4-hour timeframe

Technical data:

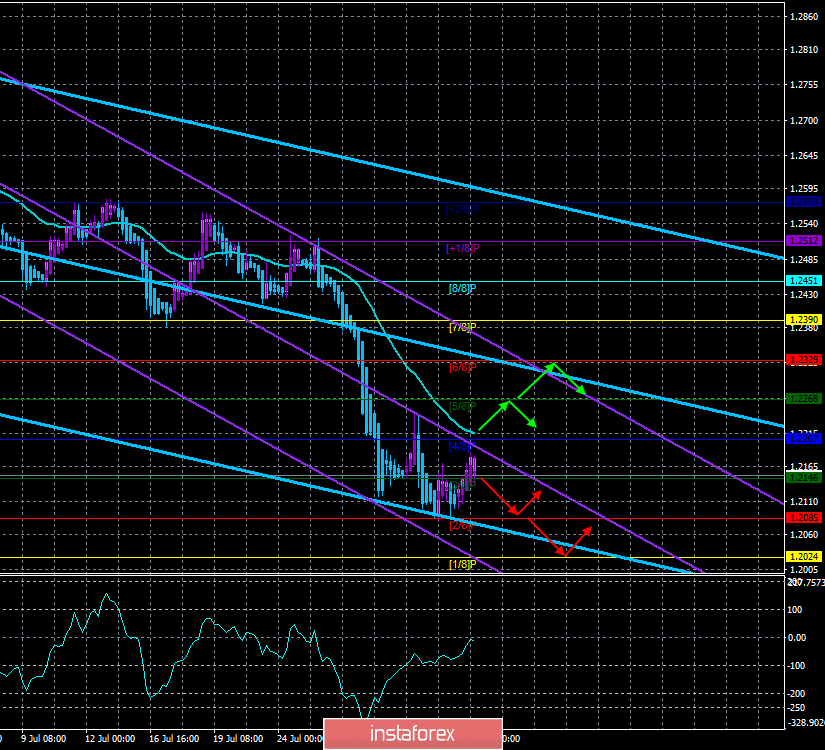

The upper linear regression channel: direction – down.

The lower linear regression channel: direction – down.

The moving average (20; smoothed) – down.

CCI: -8.7654

So, the UK has officially announced the need for the European Union to give Michel Barnier a mandate to change the current agreement on Brexit. Otherwise, there will be a "hard" scenario of the Kingdom's exit from the jurisdiction of Brussels. What does it look like after the UK announced spending of 100 million pounds? On advertising and informing the public about the "hard" option of "divorce" from the EU, after Boris Johnson once again said that the UK will leave the EU on October 31 in any case, and after the British Parliament "hedged" and adopted an amendment prohibiting Johnson to carry out the country's exit from the alliance independently? That's right, bluff and blackmail. From our point of view, Johnson understands that the Parliament will not approve his initiative to leave the European Union at any cost. So in the relevant vote, this option will be rejected. And in this case, it is necessary to ask for a new delay from the European Union and to appoint new parliamentary elections, the result of which for the Conservative Party, firstly, is not obvious, and secondly, it can be weak, since the credibility of the ruling party has long been weakened for the same Brexit. And as a result, the Prime Minister is trying by all means to create the appearance that the UK will really come out of the EU on October 31 and that it will be unprofitable for the European Union. However, the EU has a more advantageous position, as the damage to its economy from Brexit will be less. Brussels understands this and is in no hurry to make additional concessions and new negotiations. Boris Johnson will achieve his tactic to publicly state that he tried to sign a new deal with the EU, but the leaders of the bloc have not taken this step, so there's just no other option than to leave the UK without any agreements. The pound sterling began to adjust, but this correction is very weak.

Nearest support levels:

S1 – 1.2146

S2 – 1.2085

S3 – 1.2024

Nearest resistance levels:

R1 – 1.2207

R2 – 1.2268

R3 – 1.2329

Trading recommendations:

The GBP/USD pair began to adjust for the purpose of moving, so now it is still recommended to consider the sale of the pound sterling with the goals of 1.2085 and 1.2024, but after the reversal of the Heiken Ashi indicator down.

It will be possible to buy the pound/dollar pair with the targets of 1.2268 and 1.2329 not earlier than fixing the price above the moving average line. In this case, the bulls will have a chance to form an upward trend.

In addition to the technical picture should also take into account the fundamental data and the time of their release.

Explanation of illustrations:

The upper linear regression channel – the blue line of the unidirectional movement.

The lower linear regression channel – the purple line of the unidirectional movement.

CCI – the blue line in the indicator regression window.

The moving average (20; smoothed) is the blue line on the price chart.

Murray levels – multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.