The aggravation of the US-China trade conflict, as well as the growth of disagreements along with weak economic statistics, all this led to the weakening of the US dollar, as many traders and investors again started talking about the continuation of a series of interest rate cuts in the US in the autumn of this year.

As noted above, Xi and Trump continue to exchange unflattering statements about each other. Yesterday, the escalation of the trade conflict took a new turn. First of all, the White House's indignation caused yesterday's sharp weakening of the yuan against the US dollar. On this account, the American President immediately spoke, saying that the fall of the yuan is a manipulation of the Chinese currency, and this is a serious violation, which in time will greatly weaken China.

Let me remind you that last week Donald Trump accused China that it does not comply with the agreement and does not buy agricultural machinery and products in the United States. China said yesterday that Chinese authorities are unable to buy agricultural products from the United States due to uncompetitive prices, completely denying all the accusations of the US.

It should be noted that the stronger the trade conflict between the United States and China, the more investors will grow confident that the Fed will go to another reduction in interest rates. If after the rate decrease last week, the probability of the next decline was estimated at only 20%, then yesterday, according to the Fed's futures quotes, investors estimated this probability at more than 40%.

There are also concerns about the third decline before the end of this year, while the probability of at least two rate cuts before the end of the year is estimated at about 75%.

Yesterday's data on the weaker growth of activity in the US services sector confirm the slowdown in the economy.

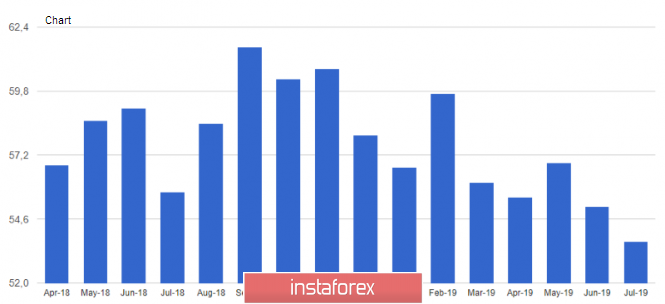

According to the report of the Institute of supply management, activity in the service sector grew slowly in July. The ISM-calculated PMI purchasing managers index for the US non-manufacturing sector fell to 53.7 points in July from 55.1 points in June. Economists had expected the index to rise to 55.7 points. Let me remind you that the values above 50 points indicate an increase in activity. It is worth noting that the sharp slowdown in the production sector is gradually spreading to the service sector, which is a bad signal for the economy. The subindex of business activity in July fell sharply, to 53.1 points from 58.2 points in June.

But according to IHS Markit, the PMI index for the US service sector in July rose slightly, amounting to 53.0 points against 51.5 points in June. The growth was due to the increase in employment.

As noted above, yesterday's speeches by Fed representatives only confirmed traders' concerns about the further easing of monetary policy in the United States. During the interview, member of the Board of Governors of the Federal Reserve System Leil Brainard said that the Fed continues to monitor the situation in the markets and seeks to extend the period of economic growth in the United States. She also insisted on achieving the target annual inflation rate of 2.0%, noting the weak growth rate. In her opinion, this will require greater support for the economy.

As for the technical picture of the EURUSD pair, the sharp growth of risky assets slowed down in the area of a large resistance of 1.1250, which I previously drew attention to in my reviews. At the moment, it is best to look for new long positions in the trading instrument after updating the support of 1.1170 or from the minimum of 1.1140, where the lower limit of the ascending channel will pass. The trend to the north will clearly continue to form, and the breakout of the range of 1.1110-1.1170 is clearly a bullish signal for the market. The target of buyers of risky assets will be highs in the area of 1.1290 and 1.1340.