The foreign exchange market froze after China took a protective measure against US attacks on its economy at the beginning of the week – significantly lowered the rate of the national currency to the levels of a decade ago.

This event, in our view, is a serious signal indicating that trade relations between Washington and Beijing, burdened by the political pressure of the former, are unlikely to be resolved in the near foreseeable future. We believe that the Chinese response was directed specifically at President D. Trump to prevent him from winning the presidential election that had already begun.

Everything indicates that Beijing, as they say, does not want to quarrel with the States, which are the most serious trading partner. He was quite satisfied with the relationship that had developed over the years, which allowed the country not only to accumulate financial and intellectual resources but also to develop actively, which ultimately led to the second place in the world economy after the United States. But with the arrival of the forty-fifth President, the situation changed radically, which became the basis for the trade conflict.

It seems that the Chinese will try to sit out, watching the presidential race in the States, trying to maximize the damage to Trump. But there is another risk for them. This, we believe, is a high probability of an agreement by the end of this year or early next year, because the President will need a positive external background to win the presidential race, which will be a large-scale new trade agreement with China. But so far, most likely, we should expect an increase in tension and an increase in rates on both sides in this difficult game.

But back to the situation on the foreign exchange market. In our view, the American economy is a few steps away from the onset of the recession. Markets understand this, which is manifested in a virtually vertical drop in the yields of US Treasury government bonds. Thus, the yield of the benchmark of 10-year treasuries reached the values of September 2016 and at the moment, it has been steadily keeping below the psychological level of 2.0% for several days now.

It should also be noted that our earlier view that the escalation of the US-China crisis will force the Fed to resume lowering interest rates seems to find support. In just the last few days, investors estimate the next decline in interest rates at the September meeting of the Federal Reserve, according to the dynamics of futures on federal funds rates, at 78.8%.

The continued tension will likely force the US Central Bank to go for it only once, and possibly three more rate cuts before the end of this year. In this situation, of course, the dollar will be under strong pressure, not only for gold and safe-haven currencies but even with the euro, which over the past 10 years has been perceived as the antithesis of the US currency.

Forecast of the day:

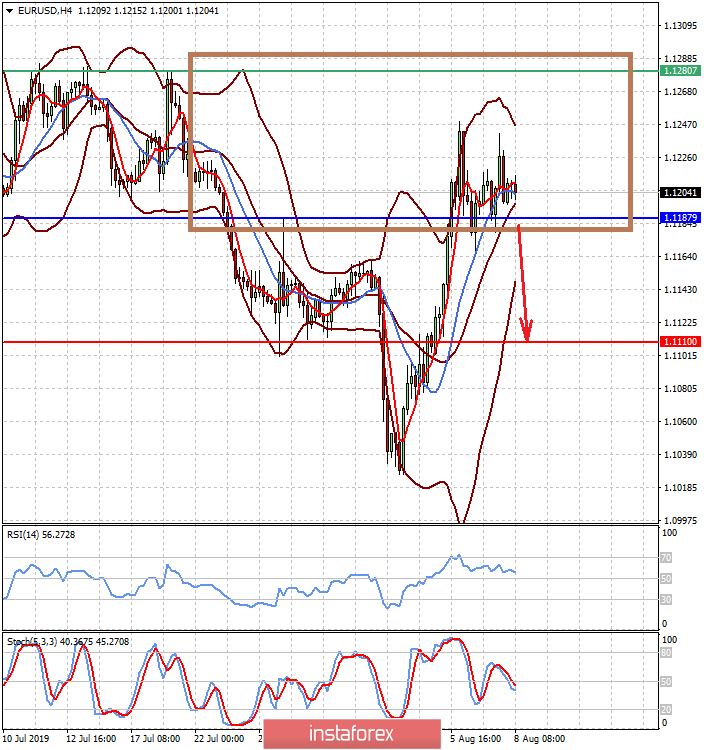

The EURUSD pair is consolidating above the level of 1.1185. It may remain in the range of 1.1185-1.1280 until the end of this week in anticipation of the latest economic data from the United States. But if it falls below 1.1185, it may fall to the level of 1.1110.

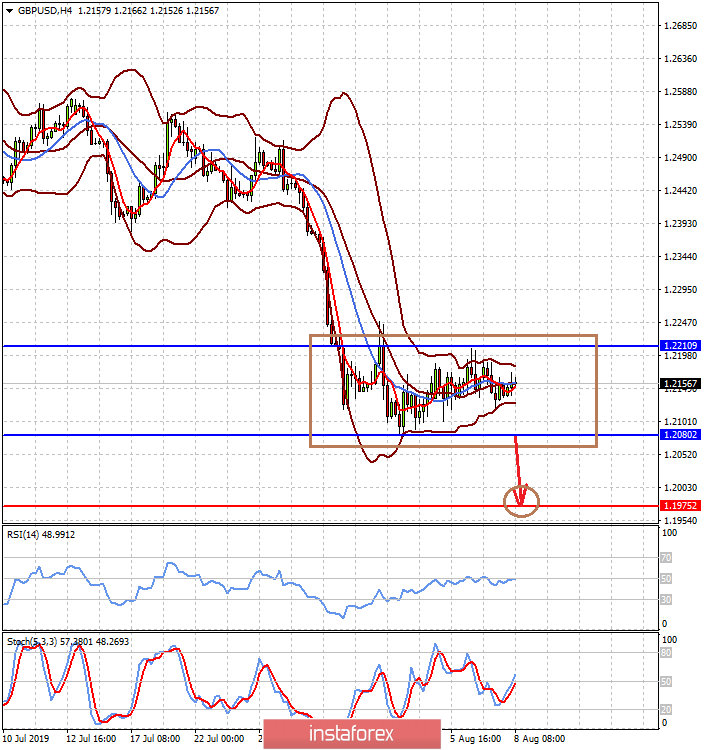

The GBPUSD pair is also consolidating in the range of 1.2080-1.2210. If tomorrow's UK GDP data is weaker than forecast, the pair could fall to 1.1975.