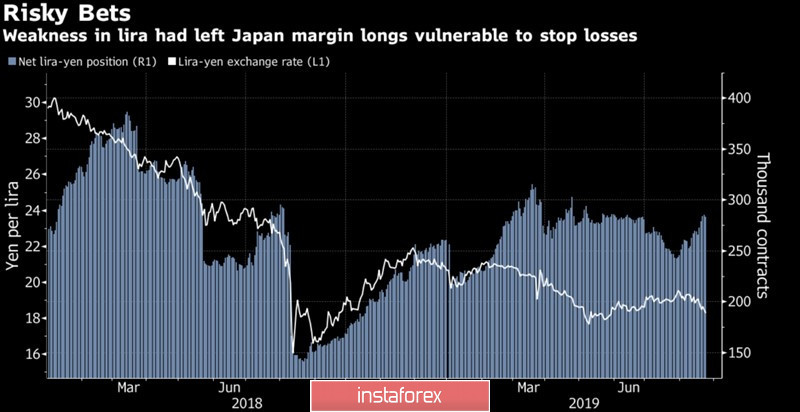

The escalation of trade wars and another flash accident on the forex market made it possible for the Japanese yen to update a three-year high against the US dollar. The currency of the Land of the Rising Sun is used as the main funding currency in the framework of carry trade strategies, and the fact that at the end of August the net longs on the Turkish lira reached their highest values from mid-June could not but cause concern. Where it is thin, it breaks. At the same witching hour (late US and Asian forex sessions), as at the beginning of 2019, a major player stirred up the hive: one serious bid - and TRY/JPY collapsed, pulling down all the other currency pairs associated with the yen.

Dynamics of TRY/JPY and speculative positions

Flash crashes tend to repeat from time to time, but it is unlikely that anyone would have expected that so little time has passed since the January events. Moreover, the yen and its drivers for growth abound. On the increase in tariffs for $75 billion U.S. imports by Beijing from 5% to 10%, Donald Trump responded with the same coin: duties were increased from 25% to 30% on $250 billion worth of Chinese imports, $300 billion – from 10% to 15%. Someone, after the president's words that there was another solution, might have thought he was getting excited, but the White House said that he regrets that he did not raise the tariff even further. America will do without China!

The fire of the trade war continues to burn, and the demand for safe haven assets is growing with it. Stock markets are falling, and Donald Trump blames the Fed for this. After Jerome Powell's speech in Jackson Hole, during which the chairman of the Federal Reserve did not signal aggressive monetary expansion, the US president called him an enemy. Who is the greater enemy, Powell or Xi Jinping? Finance Minister Steve Mnuchin was even forced to make excuses about this, saying that the owner of the White House spoke figuratively.

Markets reacted to the escalation of the trade war not only with the collapse of the S&P 500 and the yield of 10-year US Treasury bonds to a three-year low. The yuan fell to an 11-year low, and the yen, franc and gold were again purchased like hotcakes. If the German business climate index from the IFO continues to fall, signaling a recession in the German economy, European inflation will remain as sluggish as before, and US durable goods orders will disappoint, the downward course of USD/JPY and EUR/JPY will most likely will continue.

The market is already wondering where the Bank of Japan's patience lies. The rebound from the level of 105 yen per dollar seemed to be a currency intervention to many. In late August, the pair again felt this mark and again sprung up. Perhaps the BoJ is not going to wait for it to fall to 100?

Technically, the 5-0 pattern was clearly implemented on the daily USD/JPY chart. After reaching a target of 161.8% according to the AB = CD model, an upward rebound occurred twice, which increases the risks of forming a "Double Base". To continue the downward course, bears need to rewrite the August low.