The euro reacted with a decline in data on the business climate in Germany, which deteriorated in August this year, indicating the continued weak economic growth. In addition, a fall in sentiment can lead to a technical recession. The main problem for Germany remains a sharp slowdown in the manufacturing sector, which is directly related to the weak global economy, as well as the threat of a chaotic exit of Great Britain from the EU. The deterioration of trade relations between the US and China is also a "headache" for Germany.

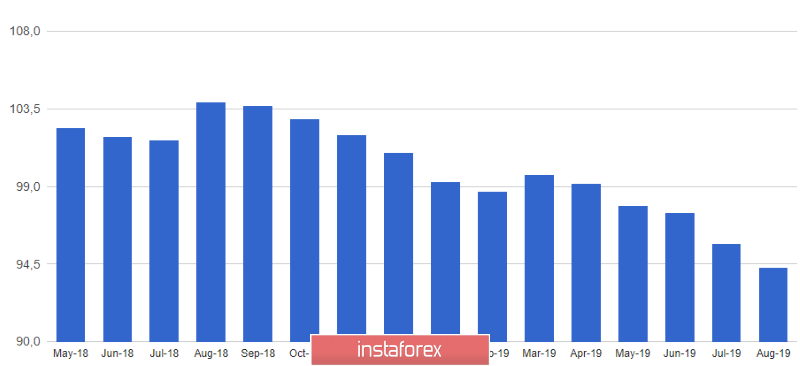

The Ifo Institute's report indicated that the German Business Climate Index dropped to 94.3 points in August from 95.8 points in July this year. Economists had expected the index to reach 95.1 points in August.

It should also be noted that the index of company expectations in Germany in August also fell to the lowest in over the past 10 years and amounted to 91.3 points against 92.1 points in July. Ifo said the concerns of company executives are directly related to a slowdown in economic growth, as well as a decrease in satisfaction with current conditions. Pessimism regarding the situation in the coming months also intensified.

Today there was talk that China could resort to easing monetary policy and another intervention in the foreign exchange market. This will help stimulate a slowing GDP amid yet another deepening trade conflict with the United States. In the coming quarters, the People's Bank of China is expected to lower the lending rate of commercial banks by 0.75 percentage points.

Let me remind you that since September, China has been introducing reciprocal trade duties on a number of American goods, which outraged the US president at the end of last week, who hastened to declare that the Chinese government was robbing the United States.

As for the technical picture, the euro has undergone a slight correction after growth at the end of last week and is now in the support area of 1.1110. A break of this level will hit a number of stop orders of the "Friday" bulls and will pull down the trading instrument even lower - in the region of a low of 1.1080. If bulls rehabilitate today in the afternoon, then the next goal will again be the resistance of 1.1160, which it was not possible to overcome at the beginning of the week.

The British pound, as expected, continues to decline gradually against the US dollar, as investors, after the meetings of the British prime minister with EU leaders, begin to wonder whether the EU's position has really changed. Boris Johnson will need to come up with something unrealistic about the Irish border to convince the bloc leaders to make a number of changes to the current Brexit agreement.

Most likely, after the pound has risen last week, pessimism will again gradually increase, which will allow large players to continue building short positions on the pound as a result of the next failed plan of the new British Prime Minister, as it has already happened with Theresa May's proposals.