An unexpected surge in anti-risk sentiment in the foreign exchange market provided weak support for the euro-dollar pair. Against the background of a general weakening of the US currency, the pair impulsively reached a one-week high of 1.1164, however, it quickly retreated to the bottom of the 11th figure.

This is not the first failure of EUR/USD bulls in the last few days: for example, on Friday, when Fed head Jerome Powell voiced enough "dovish" rhetoric, the price could not gain a foothold above the resistance level of 1.1150 (the middle line of the Bollinger Bands on the daily chart, coinciding with the Tenkan-sen line). Therefore, today's price pullback was, by and large, inevitable - and even the escalation of the US-Chinese trade war could not help the pair's buyers to maintain their advantage. European currency problems like anchors hold back the pair's growth, despite the greenback's uncertain position.

The whole array of euro problems can be divided into two parts: firstly, these are weak macroeconomic reports (which portend an aggressive easing of the ECB's monetary policy) and political battles in Italy (which, in turn, portend early Parliamentary elections). In particular, today the euro-dollar pair reacted negatively to the dynamics of the German indicator of the business environment from IFO. This indicator is a good addition to the already published reports from ZEW and PMI. It is worth recalling that the block of macroeconomic statistics published this week greatly increased the likelihood of large-scale actions by the ECB to mitigate monetary policy.

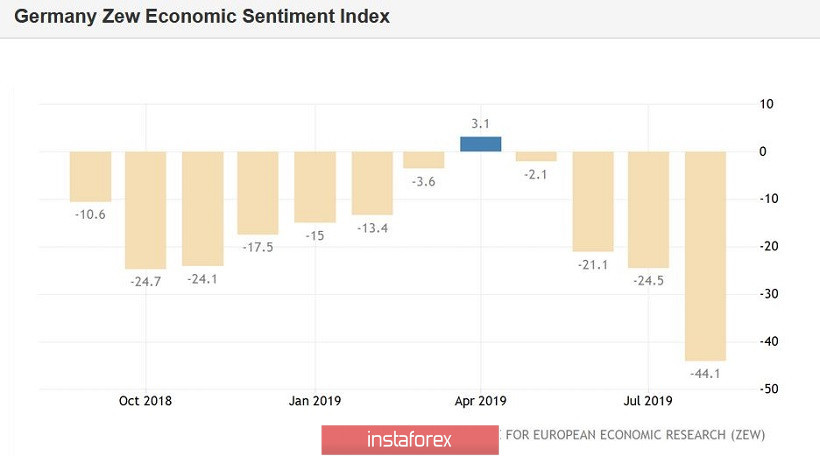

ZEW indices of Germany and the eurozone came out not only in the "red zone", but also updated multi-year lows. The German index crashed to -44 points while forecasting a decline to -27 points. The pan-European indicator showed similar dynamics, dropping to -43 points while forecasting a decline to -21 points. The indicator has fallen to its lowest levels since 2010, reflecting the pessimism of the European business environment. The reasons for this dynamic are due to the escalation of the trade war between the United States and China, the prospects for a "hard" Brexit, and again, the Italian political crisis.

Following the ZEW indices, the German economic growth indicator for the second quarter of this year was published. For the first time since the third quarter of 2018, German GDP fell into the negative region (-0.2%). After that, the market started talking about the risks of a technical recession in this country, which is the "locomotive" of the European economy. The August data from the IFO today only confirmed the negative trends. The indicator continued to decline over the past five months and today, it reached 94.3 points with a forecast of weak growth to 95.1 points. This is the lowest result for the last 7 years (to be more precise, since November 2012).

The weak figures from the IFO only aggravated the fundamental picture for the euro amid a worsening political crisis in Italy. Let me remind you that the Italian president set the "deadline", which expires tomorrow, August 27. Before this time, MPs must form a new government - otherwise the head of state promised to dissolve the Parliament and call for early elections. Today, a day before the allotted time expires, information appeared that Italian parties "5 Star Movement" and the Democratic Party could not agree on a candidate for the post of head of government of the new Parliamentary majority. Five Star leaders insist on continuing Conte's premiership, while Democrats insist on an alternative candidate. If the parties do not come to an agreement (and the likelihood of this is quite high), Parliamentary elections will be held in Italy again. Given the current rating of the League, it can be assumed that in this case, the next prime minister will be Matteo Salvini, who recently only strengthens anti-European rhetoric. In other words, the European currency will be under great pressure if the Italian political crisis continues.

But the US currency began to gradually restore its position after a serious decline against the backdrop of an escalation of the trade war. First, the parties quickly backtracked, at least according to the American president. According to Trump, representatives of China "expressed their readiness to continue consultations with the United States on trade issues, and Washington welcomes this step." Beijing did not confirm, but did not refute this statement. And although the yuan continues to become cheaper (at the moment, the USD/CNY pair has broken the 7.150 mark), the dollar slowed down its decline throughout the market, and even increased the pressure along with the euro.

The US currency received indirect support from macroeconomic statistics. The release of data on orders for durable goods was better than expected. So, the total volume of orders rose to 2.1% after rising 1.8% in June. This is the strongest indicator growth rate since last August. Let me remind you that not so long ago, dollar bulls were pleased with data on retail sales in the United States. The total figure rose to 0.7% - this is the best result since March of this year. Excluding auto sales, the indicator jumped to 1.3%, and excluding auto and fuel sales, it rose to 0.9%, demonstrating consistent growth for the third month in a row.

Thus, the dollar lies between the "sword and the hard place" - on the one hand, good macroeconomic reports, on the other hand, the risk of further escalation of the trade war. However, despite the greenback's uncertain position, bulls of the EUR/USD pair cannot turn the situation in their favor. The "anchors" of the European currency hold the pair in the price range between 1.1040 (the lower line of the Bollinger Bands indicator on the daily chart) and 1.1160 (local price low). The further movement vector of the pair will depend on Rome, Beijing and Washington. In any case, macroeconomic statistics will soon play a secondary (auxiliary) role.