Trump's tweets only added uncertainty to the markets. We expect a local drop in the USD/JPY pair and the resumption of growth in gold quotes.

After Monday, US President D. Trump announced that China wants to resume negotiations on mutual trade with the United States. Investors grabbed the news as a saving straw and started to buy cheaper assets.

Once again, Trump turned the mood in the financial markets like a professional newsmaker, throwing a sweet pill to investors in the form of news that he had been phoned from China over the weekend and offered to return to the negotiating table on the issue of mutual trade between the countries. However, interestingly, the official Beijing in the person of Foreign Ministry spokesman Geng Shuang did not confirm the information about a telephone conversation of someone from the Chinese side with Trump.

This news cooled the positive mood of investors as the market began to doubt whether the American president really talked with the Chinese side or just his fantasies. Moreover, we note that there are indeed grounds for such thoughts. Trump very often obviously bluffed, telling this or that news, in order to provide the direction necessary for his policy in the local financial market. And on Monday, after his message, the refutation of China made the markets once again show restraint.

Trump news put pressure on defensive assets. Quotations of gold, the Japanese yen, and the Swiss franc declined slightly while the American treasuries yields grew. But today, the opposite picture is noted. Prices of safe-haven financial instruments began to rise.

In general, observing what is happening, one can describe the situation uncertain in its prospects, which leads to the factor of high volatility in all segments of the financial market without exception. Assessing the likely development of the situation, we note that if Donald Trump's words regarding the resumption of the negotiation process with the Chinese side on trade are not confirmed, this may become the basis for a new wave of sales in the markets. This may ultimately stimulate the demand for safe-haven assets and lead to a local strengthening of the dollar.

Forecast of the day:

The USD/JPY pair after a local bounce up is still trading above the strong support level of 105.00-05 in the wake of a growing demand for defensive assets. We believe that the pair will continue to decline to 104.00, which will increase after breaking the level of 105.05.

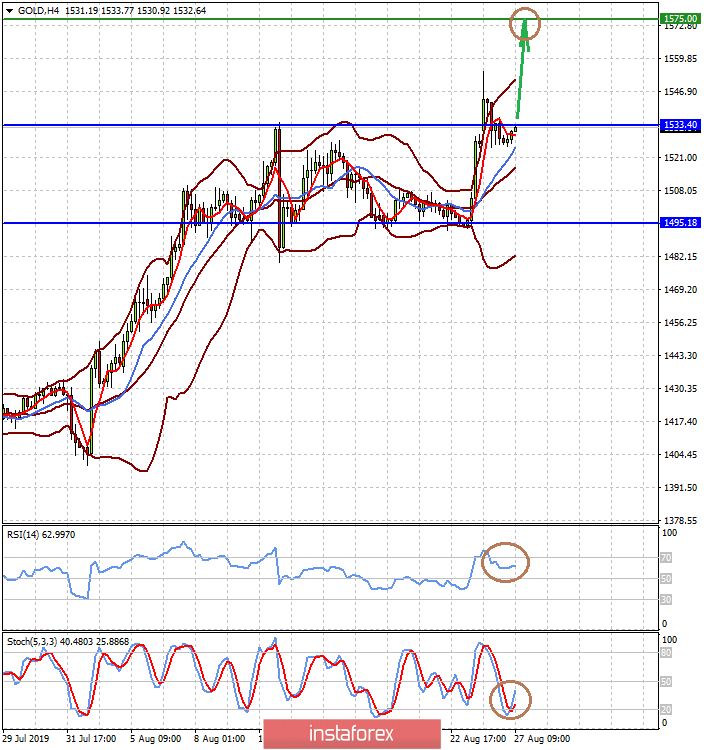

The price of gold is turning upward after a slight correction. If the price overcomes the level of 1533.40, we believe that it will continue to grow to 1575.00.