Donald Trump is expanding his markets again. On Monday, the stock exchanges are growing steadily after Trump announced the possibility of introducing a postponement of tariff increases for China. Since China is ready to return to the negotiating table, he added.

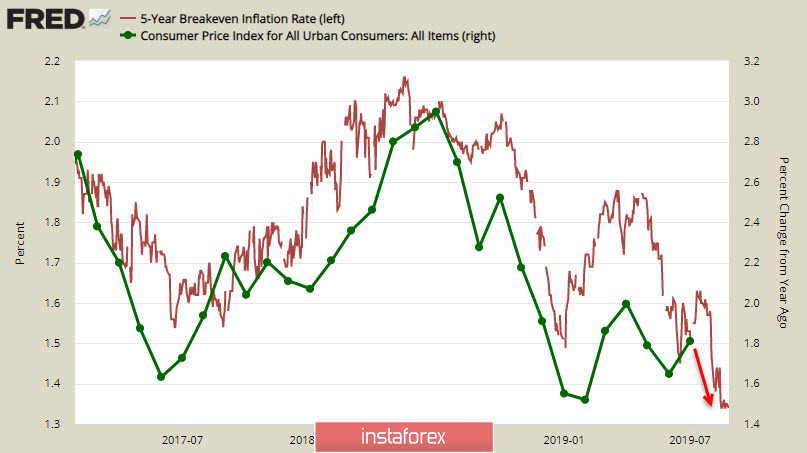

Nevertheless, it is the states that need the delay because the dollar with high speed loses its main advantage - higher inflation expectations than in the eurozone and, especially, in Japan. We can already see the third wave of falling 5-year bond yields TIPS in 2019, which indicates a growing business confidence that US consumer demand will begin to decline in the very near future. Even before the recession, it's already a hand to fall.

Most likely, the dynamics of TIPS bonds is quite expected for the financial authorities, despite public assurances of the strength of the American economy since it indicates that the business does not see prospects for growth in consumer demand and inflation, and therefore it is preparing for reduction. In any case, the Congressional Budget Committee (NWO) reports that higher tariffs increase domestic prices, analyzing the economic consequences of raising tariff rates since January 2018. Thereby, it reduces the purchasing power and increasing the cost of investing in a business and as a result, this leads to a decrease in real US GDP by 0.3% per year.

Of course, the NEA rightly notes that reciprocal tariffs from US trading partners reduce US exports, which reduces productivity. As a result, trade barriers lead to both a drop in real production and real household income, which means tax collection will drop. This trend can be traced to the decline in TIPS bond yields, which means it increases the likelihood of two more Fed rate cuts this year and the actual recognition of the approach of the recession.

EUR/USD pair

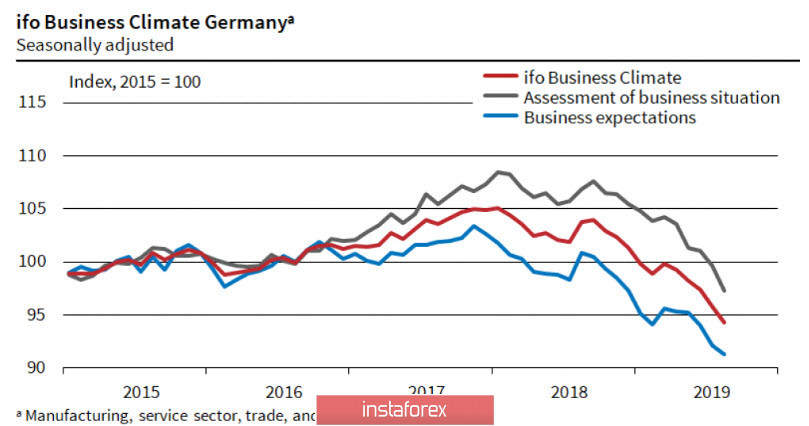

The Ifo business climate index fell from 95.8p to 94.3p in August, which was the lowest level since November 2012. The pessimism of company executives is growing, and there are more signs of a recession. The graph speaks for itself and it is difficult to see the positive where it does not exist.

For manufacturing companies, the situation looks even worse than the economy as a whole. The last time this level of pessimism was observed in 2009 as trade also went to negative territory, mainly due to wholesale sales. Only the construction sector is more or less stable.

On Friday, inflation data will be published in August with neutral expectations but, as rightly noted in Nordea-Bank, Central banks do not understand the nature of inflation. In any case, established monetary policies aimed at achieving the target (usually 2%) fail everywhere. Accordingly, the lower the inflation, the more likely it is that the ECB will present in September the broadest possible easing package. Also on Friday, the data on the base us deflator PCE for July will be released and with a high probability, the direction of the EUR/USD pair will aim in the direction where the difference in inflation expectations will show. While the spread in these expectations is in favor of the dollar, the Euro remains under pressure. However, the rapid decline in the yield of 5-year bonds Tips to a 3-year low indicates that in the US inflation is unlikely to meet expectations.

The increase in uncertainty gives the euro a chance for a respite, but in any case, the EUR/USD decline stops at least until Friday. With high probability, the euro will trade in a wide range between 1.1065 and 1.1145. The direction of exit from which will be prompted by Friday data.

GBP/USD pair

On Friday, the pound updated the local maximum of 1.2270, as we expected. However, the momentum has become noticeably weaker at the moment. The lack of macroeconomic news, except for report on consumer and mortgage lending in July from the Bank of England on Friday, and the market's fatigue from conflicting political statements increase the likelihood of going into the lateral range of 1.2190 - 1.2290. This time, an attempt to update the maximum will most likely be unsuccessful.