To open long positions on EURUSD, you need:

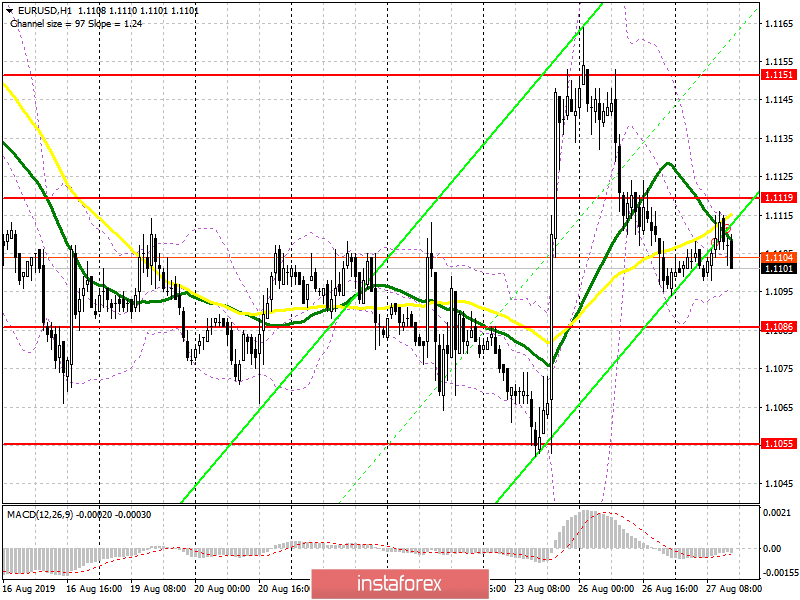

Trade remained in a narrow side channel in the first half of the day after the GDP report in Germany, which coincided with economists' expectations, decreasing by 0.1% in the 2nd quarter compared to the 1st. It is best to open long positions after the support test of 1.1086, provided that a false breakdown is formed there. If there are no active purchases in this range, I recommend postponing long positions until the minimum of 1.1055 is updated. A return to the resistance level of 1.1119 remains an equally important task for buyers, which will allow updating a maximum of 1.1151, where I recommend taking the profits. Data on the US consumer confidence indicator may lead to a surge in volatility, but the focus will still be placed on news from Italy and talks between the two parties about a coalition government.

To open short positions on EURUSD, you need:

The bears will be counting on a strong report on US consumer confidence, which will lead to a further downward movement in the pair. The formation of a false breakdown in the resistance area of 1.1119 will be an additional signal to open short positions in the euro, and the main goal will be to update the minimum of 1.1086, which sellers did not reach yesterday. Consolidation below this range will further increase the pressure and lead to a further downward trend in the support area of 1.1055, where I recommend fixing the profits. In the scenario of growth above the resistance of 1.1119 on the positive news about the formation of a coalition government in Italy, short positions can be returned immediately to the rebound from the resistance of 1.151.

Signals of indicators:

Moving Averages

Trade is carried out in the range of 30 and 50 moving average, which indicates more market uncertainty with the prospect of a further decline in the euro.

Bollinger Bands

The break of the lower limit of the indicator in the area of 1.1090 will lead to a further decrease in the euro.

Description of indicators

- MA (moving average) 50 days-yellow

- MA (moving average) 30 days-green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20