To open long positions on GBP/USD, you need:

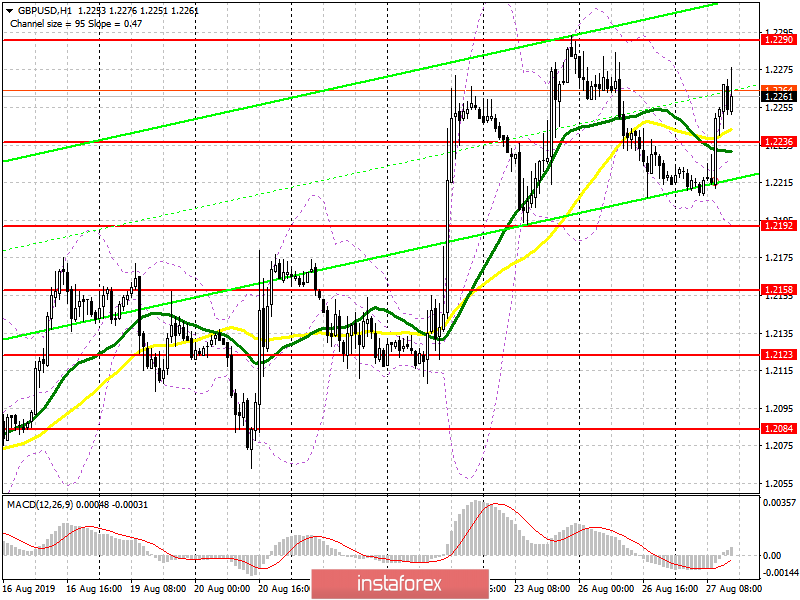

In the morning, I focused on the resistance of 1.2230, which was necessary for buyers to return to the pound to maintain the upward potential, which happened. Now, the goal is the maximum of the week in the area of 1.2290, the breakthrough of which will provide GBP/USD with a new influx of large players with the demolition of sellers stop orders, which will lead to the update of the levels of 1.2334 and 1.2387, where I recommend taking the profits. If the data on the US economy and consumer confidence will be better than economists' forecasts, it is possible to return the pound under the support of 1.2236. In this scenario, it is best to return to long positions on the rebound from the minimum of 1.2192.

To open short positions on GBP/USD, you need:

Bears will try to protect the level of 1.2290 in the afternoon, but it is better to open short positions from it only after the formation of a false breakdown, which may occur after the release of the US data. Otherwise, it is best to sell GBP/USD after updating the maximum of 1.2334. The main task of sellers for the second half of the day is a return below the support of 1.2236, which will quickly nullify all the efforts of buyers and lead to an update of the minimum of 1.2192, where I recommend taking the profits.

Signals of indicators:

Moving Averages

Trading is above 30 and 50 moving averages, but the market is still in the side channel.

Bollinger Bands

If the pair decreases, the lower limit of the indicator in the area of 1.2192 will act as support.

Description of indicators

- MA (moving average) 50 days-yellow

- MA (moving average) 30 days-green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20