Judging by the dynamics of defensive instruments, traders are less and less trusting the words of politicians, preferring more significant fundamental factors. Even the high-profile statements of Donald Trump, designed to reassure investors, do not inspire confidence in market participants - the "safe haven" currencies are still in demand and are in no hurry to depreciate against the dollar.

The fact is that the growth of anti-risk sentiment in the market was due to completely "tangible" events, not words. China quite unexpectedly decided to retaliate against the United States by announcing an increase in duties on the 5,000th list of US goods. The market clearly did not expect such a turn, since Trump recently showed a "goodwill gesture", delaying the introduction of additional tariffs on imports of Chinese goods until December 15 (instead of September 1). Outwardly, the situation resembled another "thaw" in relations between the United States and China, especially in light of ongoing preparations for the next round of negotiations, which was supposed to take place in mid-September.

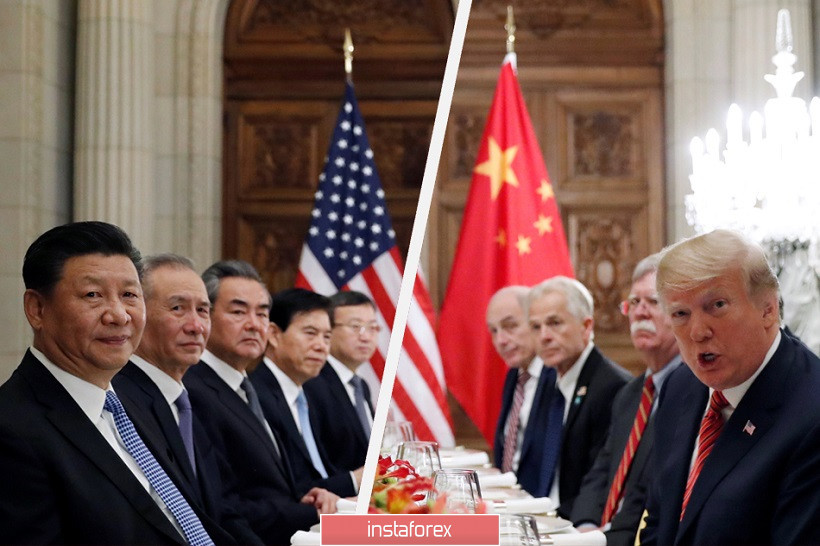

But as it turned out, Beijing was just waiting for a convenient moment to declare countermeasures. Trump reacted instantly by "throwing" another 5% on the previously announced duties - that is, duties on $300 billion worth of goods will increase from 10% to 15%, and duties on $250 billion worth of goods will increase from 25% to 30% . Simultaneously with this statement, the US president added that he had two "productive" telephone conversations with the Chinese side. According to him, Chinese authorities have "serious intentions" that could lead to a deal. Trump refused to answer the question of whether he spoke directly with Chinese President Xi Jinping, but at the same time he spoke extremely positively about the Chinese leader several times, and even called him "a great leader."

Risk appetite did not return to the market despite such unctuous comments by the US president. The US currency slowed down in almost all pairs, defensive tools lost some price - but in general, there is still a certain wariness on the market. Figuratively speaking, traders are listening to Trump, but at the same time looking at the USD/CNY rate: the yuan continues to become cheaper along with the dollar, updating price highs almost daily (today the pair has reached 7.169). Given the "specifics of the exchange rate formation" of this pair, it can be assumed that Beijing is far from certain about the effectiveness of the next negotiations. Indeed, this is not the first time Trump has demonstrated such behavior: at first he initiates negotiations with optimism (or agrees to them), but then turns around 180 degrees, simultaneously accusing the Chinese of intransigence and other "sins."

The current situation can be used when trading the USD/JPY pair. The Japanese currency is completely withdrawn from its "internal" fundamental factors - for example, the yen completely ignored the latest release of inflation data in Japan. The status of a defensive asset allows the Japanese currency to be a kind of weathervane for US-Chinese trade relations. Furthermore, the fact that the yen is paired with the dollar now continues to be traded within the 105th figure, says a lot - above all, about the continuing anti-risk sentiment in the foreign exchange market. In fact, we are seeing a correctional pullback after reaching a three-year price low (104.46). This correction was provoked not only by cautious optimism regarding the prospects for trade negotiations. US macroeconomic reports also played a role.

In particular, the indicator of consumer confidence in the US today came out better than expected. Analysts expected a decline of this indicator to 129.3, but it only slightly fell to 135.1 points (the index reached 135.8 points in July). The Fed manufacturing index also contributed to the growth, which rose today to one point with a forecast reduction to -2 points. These reports helped the dollar stay afloat, despite the continued decline in the yield of 10-year Treasuries (the indicator again fell to around 1,501).

In my opinion, the prevailing fundamental picture allows USD/JPY traders to open short positions in the pair. If trade negotiations between China and the United States will not be appointed in the near future, then the yen will again gain momentum. It is also worth remembering that in addition to the global trade conflict, there are other reasons for the growth of anti-risk sentiments - for example, the political crisis in Italy and Brexit. Thus, the USD/JPY pair retains the potential to retest the support level of 104.90, which corresponds to the lower line of the Bollinger Bands indicator on the daily chart.