To open long positions on EURUSD, you need:

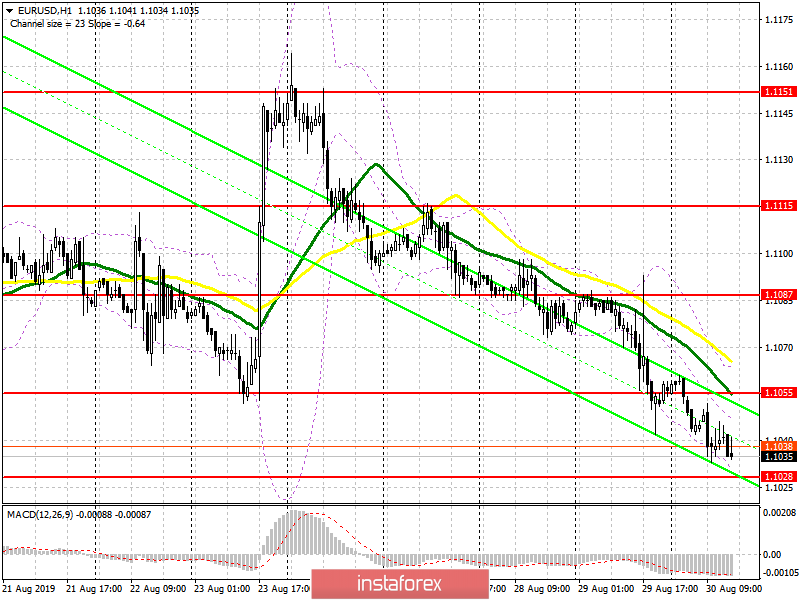

Inflation data in the eurozone coincided with economists' forecasts, which led to the continuation of the downward trend in EUR/USD. As in the morning, buyers have a few tasks that they have to deal with by the end of the week. If the pressure on the euro continues, it is best to return to long positions on a false breakdown from the large support level of 1.1028, which I spoke about in the morning. However, the more important task of buyers will be to return and consolidate above the resistance of 1.1055, which will lead to a major upward correction near the maximum of 1.1087, where I recommend fixing the profit.

To open short positions on EURUSD, you need:

The data on the US economy can help the bears, whose key task at the end of the week remains to update the low of 1.1028, where, most likely, there will be profit taking on short positions and a small rebound of the euro up. However, in the second half of the day, it is best to open new short positions after an upward correction from the level of 1.1055, on a false breakdown, or a rebound from the larger resistance of 1.1987.

Signals of indicators:

Moving Averages

Trading is below 30 and 50 moving averages, indicating a bearish market.

Bollinger Bands

In the case of euro growth, the upper limit of the indicator in the area of 1.1065 will limit the upward potential.

Description of indicators

- MA (moving average) 50 days-yellow

- MA (moving average) 30 days-green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20