To open long positions on GBP/USD, you need:

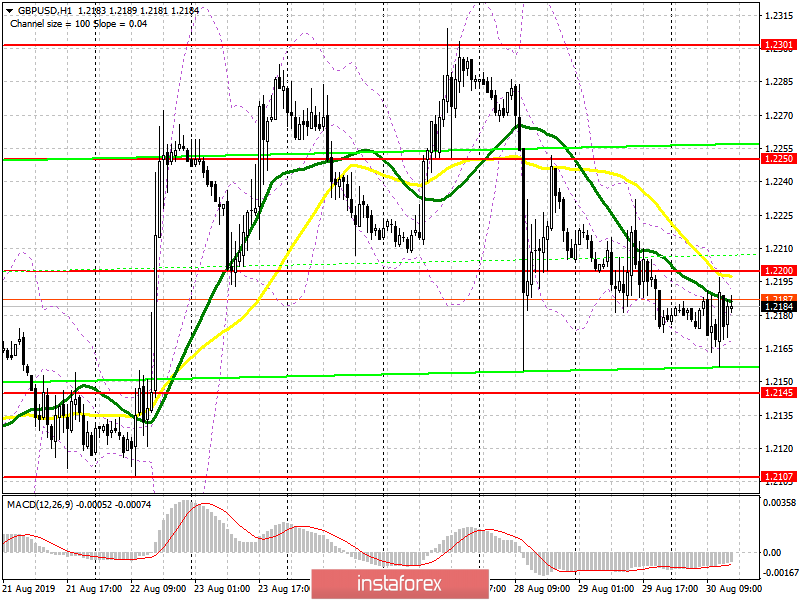

The tense situation around Brexit and the opposition's attempt to pass through parliament a law that does not allow the UK to leave the EU without an agreement paused major actions by major players who prefer to wait for the results of the confrontation between Boris Johnson and his opponents. From a technical point of view, nothing has changed compared to the morning forecast. To return to the market, buyers need a breakthrough of the level of 1.2200, which will lead to a larger upward correction to the important resistance area of 1.2250, where I recommend taking the profits. If the bears continue to push the pound down, I recommend opening long positions immediately after the formation of a false breakdown in the support area of 1.2145 or a rebound from the low of 1.2107. However, the update of 1.2107 will indicate a complete reversal of the upward trend, so strong growth from this range can hardly be expected.

To open short positions on GBP/USD, you need:

The main task of the pound sellers is to maintain the level of 1.2200, and the formation of a false breakdown on it in the afternoon will be a direct signal to open short positions in the hope of updating weekly lows in the areas of 1.2145 and 1.2107, where I recommend taking the profits. In the scenario of a return and consolidation above the resistance of 1.200, it is best to consider new short positions on the rebound from the larger high of 1.2250, which is a serious problem for buyers of the pound.

Signals of indicators:

Moving Averages

Trading is below 30 and 50 moving averages, indicating a return to the seller's market.

Bollinger Bands

Volatility is reduced, which does not give signals to enter the market.

Description of indicators

- MA (moving average) 50 days-yellow

- MA (moving average) 30 days-green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20