The foreign exchange markets still characterized by low investor activity last week amid the continuing uncertainty of the prospects for a trade war between the United States and China, despite the informational stuff from Donald Trump about the resumption of negotiations with the Chinese side, as well as confirmation of this fact from Beijing.

On September 1, Washington and Beijing introduced previously announced trade duties. The states raised duties on Chinese imports in the amount of 112 billion dollars and after this, China almost immediately increased the rate of duties on US imports by 75 billion dollars. In addition, Washington is also expected to increase customs duties by 15% by the end of this year on goods from the "heavenly places" with a total value of $ 160 billion.

In general observation of everything that happens, we can say that the hopes of the markets to possibly alienate the fact of a large-scale trade war did not come true. As we pointed out earlier, it seems that before the parties make a mutual compromise, they will test their strength economic "weapons" on the enemy, and only then, weakening in the mutual struggle, they will go to each other to meet. As it seems to us, this will not happen soon.

In the foreign exchange market last week, the only noticeable event was the collapse of the single European currency against the Japanese yen and the US dollar. The drop at the moment was more than 1%. What caused this unexpected fall?

The reason for this was the commentary of some representatives of the ECB namely, Sabine Lautenschlager, Elizabeth Holtzman, and Olli Rehn, who made it clear that there are serious contradictions in the European regulator in the views on the future of incentive measures. ECB board member Lautenschlager and Austrian new head Holtzman said they still doubt the need for incentive measures. At the same time, their colleague, Rehn, said in his commentary that the ECB is ready for decisive measures to support the European economy amid a decline in economic activity, which, by the way, is already noted. In fact, he made it clear that incentive measures would be taken.

Investors in this situation are frightened by the lack of a unified view in the bank on solving economic problems in the region, which caused the euro to collapse.

Assessing the overall picture in the markets, we believe that this will locally support the demand for protective assets, including the US dollar. Regarding the prospects for the dynamics of the euro, we expect a continued local decline, especially when paired with the US dollar.

Forecast of the day:

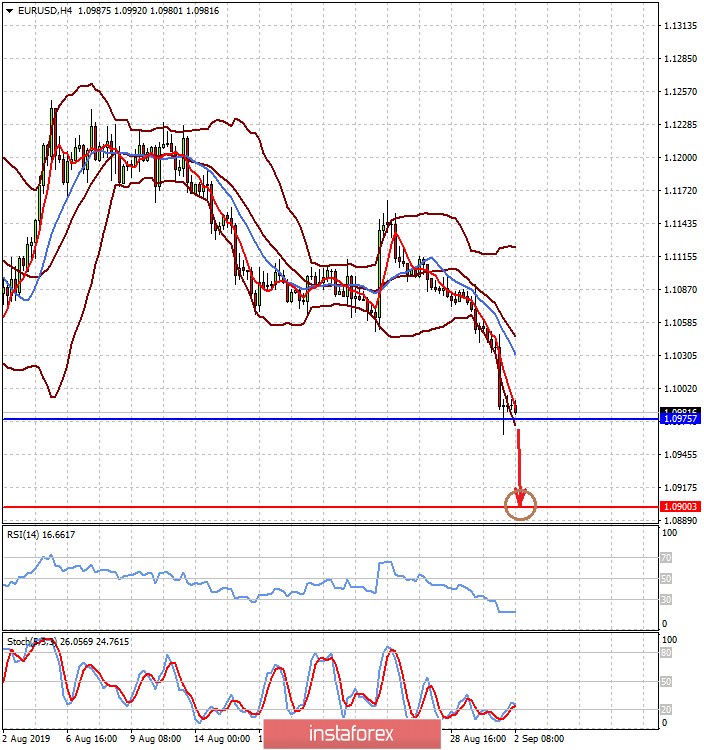

The EUR/USD pair has every chance to continue to fall in the wake of the growth of pessimism in the markets and discord in the ECB regarding the prospects of monetary policy. A pair falling below 1.0975 may continue to fall to 1.0900.

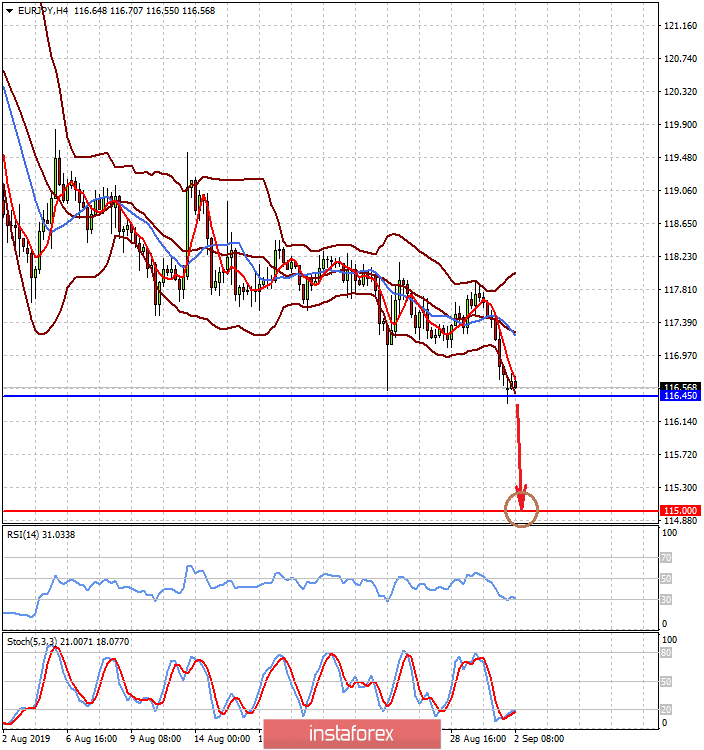

The EUR/JPY pair also has prospects for a fall on the wave of the above reasons. We believe that its decline below the level of 116.45 will lead to its fall to 115.00.