The British pound continued its decline against the US dollar amid the growing probability of early general elections in the UK. Yesterday, in a televised address, the British Prime Minister once again criticized parliamentarians wanting to thwart his plans for Brexit. It's about conservatives who are skeptical about Brexit without reaching an agreement.

Johnson said lawmakers would make it impossible to hold further talks if they voted against leaving the EU without an agreement this week. The vote will take place today, and will be very important for the future situation related to Brexit and the rupture of trade relations with the EU. The Prime Minister also noted that there are no circumstances in which he would ask Brussels to postpone the date of withdrawal from the EU from October 31, and also added that he does not want to hold general elections, but will hold them if necessary.

Let me remind you that the opposition is preparing two scenarios according to which it will act. The first is to pass a vote of no confidence in the current Prime Minister Boris Johnson, and the second is to develop a law that does not allow the UK to leave the EU without any agreement on Brexit. In other words, the Laborites will try to rule out an unordered exit without an agreement, to which everything is now going. We should not forget that the Labor Party does not have as much time as it seems, since the work of Parliament will be suspended until October 14, which significantly reduces the chances that the deputies will have time to prevent a tough Brexit scenario. By next Monday, they need to develop and pass through Parliament an agreement to block the UK's exit from the EU without a deal.

As for the technical picture of the GBPUSD pair, the pound is already in the area of annual lows, for which buyers will fight so actively. Any positive news from today's vote can help the trading instrument to regain its position, which will lead to an upward correction to the resistance area of 1.2060 and 1.2110. If the results are on the side of Prime Minister Boris Johnson, the pressure on the pair will only continue, which may aggravate the situation for the pound, which is ready to break through to new local lows in the area of 1.1950 and 1.1900.

AUDUSD

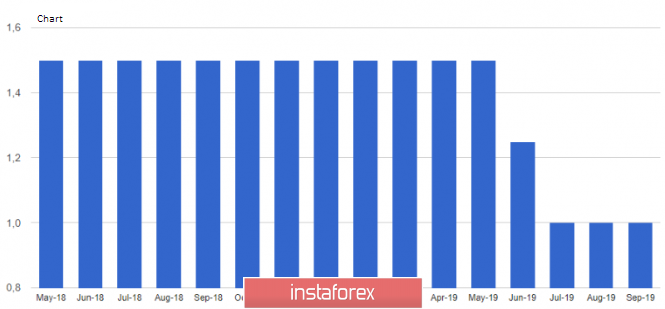

The Australian dollar initially declined, but then recovered after the Reserve Bank of Australia left the key interest rate unchanged, at 1.00%, while many expected further rate cuts. The RBA said Australia is likely to face a prolonged period of low rates, even though the growth of the Australian economy is likely to gradually accelerate. As you can see, stimulating the growth of the economy through low-interest rates and tax cuts gives its result. The regulator also noted that it is closely monitoring the situation in the labor market to assess the need for further cuts in rates. As for inflation, it is projected to remain below 2% in 2020, which keeps rates low.

The RBA also noted that the prospects for the world economy look good, but the balance of risks is shifted to the negative side, so it is expected that the world's central banks will continue to soften policy.

Today, retail sales data in Australia also came out, which fell in July, not justifying the forecasts of economists. The reduction in retail sales will harm the economy, the growth of which the Reserve Bank of Australia believes so. According to the report, sales fell by 0.1% in July from June, while economists had expected growth by 0.2%.

Australia's current account surplus in the 2nd quarter was 5.853 billion Australian dollars, while economists had expected a reduction to 1.5 billion. Net exports contributed to Australia's GDP growth in the 2nd quarter by 0.6%, and external debt increased by 2.0%.