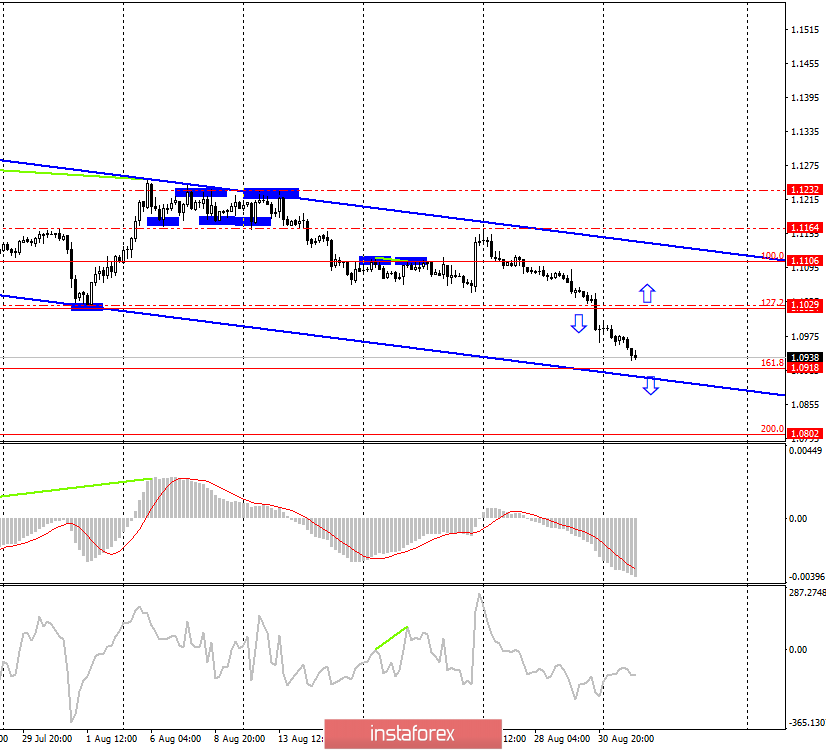

EUR/USD – 4H.

On September 4, the EUR/USD pair continues to fall on the 4-hour chart in the direction of the correctional level of 161.8% (1.0918) according to the signal received on Friday, August 30, by closing quotes below the Fibo level of 127.2% (1.1024). This signal continues to operate. At the moment, the euro/dollar pair has come close to the target level, as well as to the bottom line of the downward trend channel. Traders can expect a rebound from the level of 161.8%, but not from the channel line. Yesterday, the US dollar received support due to weak reports on business activity indices in the production sectors of Germany and the European Union. German business activity collapsed even lower than in July (43.5), European remained at 47.0. However, the numbers are irrelevant now, as anything below 50.0 is considered a downturn. Today, a similar index will be released in America and the index is expected to decline in the US industry. However, in the case of America, falling indices (Markit and ISM) will mean a slowdown, but not yet a decline. Thus, today traders are unlikely to receive information support for the sale of the US currency. A rebound from the Fibo level of 161.8% is very likely.

What to expect from the euro/dollar currency pair on Tuesday?

On September 3, I expect the euro/dollar pair to fall to the level of 1.0918 and rebound from this correction level, as the information background is unlikely to be on the side of the US dollar today. At the same time, given the rather strong desire of traders to continue selling the pair, I do not exclude the possibility of closing at a Fibo level of 161.8%, which will allow traders to expect a further drop in quotations in the direction of the next correctional level of 200.0% (1.0802). Today, the divergence is not observed in any indicator. In any case, I recommend taking profit around the level of 161.8%, in whole or in part.

The Fibo grid is built on the extremes of May 23, 2019, and June 25, 2019.

Forecast for EUR/USD and trading recommendations:

I recommend selling the pair today with the target of 1.0802 if consolidation is performed under the correction level of 161.8%. Stop-loss order above the level of 1.0918.

It is possible to buy the pair after closing above the level of 1.1029 with the target of 1.1108. In this case, the pair will remain inside the downward trend.

GBP/USD – 4H.

The show must go on. This can be described today for the British pound, the UK, and Brexit. Today, members of the UK Parliament resume after the summer holidays and in parallel, you can start to prepare for a new 5-week vacation, if for the next 6 days, they cannot cancel the decision of Boris Johnson to suspend the parliament through the court. They probably won't. But the question with Brexit remains open. Although traders do not particularly expect major changes in the route "referendum in 2016 – Brexit No Deal", there are still some chances for at least the transfer of Brexit again. Most deputies, estimated at least 400, do not support "Brexit No Deal". Accordingly, Parliament can pass any amendment or law on the impossibility of Brexit in the form in which Boris Johnson now proposes to hold it, that is, without any agreements with the EU. That is what I propose to monitor in the coming days. Jeremy Corbyn, the leader of the Labor Party, has declared war on the Prime Minister in Parliament, which will last, it seems, 6 days. Yesterday, according to the signal, fixing under the lower line of the correction channel, the pound/dollar pair resumed the process of falling in the direction of the level of 1.2014. Today, a second sell signal may form, closing below the level of 1.2014 (low of August 12), which will allow traders to expect a further drop in quotations in the direction of the next correction level of 161.8% (1.1854).

What to expect from the pound/dollar currency pair on Tuesday?

The main obstacle from the resumption of the fall of the pair, the lower line of the correction channel, is passed. Now, a lot will depend on the information background this week. If the deputies of the British parliament manage to change the situation, then the pound can grow up on the wave of optimism. If the victory remains with Boris Johnson, then I expect a fall to the Fibo level of 161.8% (1.1854). Thus, the pound both today and this week needs positive news from parliament to at least stop the fall.

The Fibo grid is based on the extremes of January 3, 2019, and March 13, 2019.

Forecast for GBP/USD and trading recommendations:

I recommend buying the pair very cautiously (or not buying at all) with a target of 1.2437 if the closing above the top line of the trend channel (downward) is performed.

I recommend selling a pair with the target of 1.1854, if a close is performed under the level of 1.2014, and I recommend that the stop-loss level be moved slightly above 1.2014.