The British pound managed to break above a fairly large resistance, which is a very strong bullish signal in the medium term. This happened after the House of Commons passed a bill preventing the UK from leaving the EU without a deal, as well as requiring the government to ask the European Union to postpone Brexit from October 31 to a later date in the absence of an agreement. Such news reduced the likelihood of a hard Brexit, which led to the strengthening of the British pound. It is noteworthy, but the British government, led by Boris Johnson, will not oppose the adoption of the Brexit transfer bill without a deal with the EU. The government has new thoughts on how to get the UK around this bill.

It is important to note that the House of Commons also did not support the proposal of Prime Minister Boris Johnson to hold early parliamentary elections on October 15. This is evidenced by the results of the vote, where it was not possible to gain the required number of votes. The opposition said that they would discuss the election only if Boris Johnson finds a "common language" with Brussels about the transfer of Brexit.

By the way, the Prime Minister made it clear that he intends to further advance the idea of early elections by contacting opposition leader Jeremy Corbyn with a proposal to rethink his proposal. Johnson said in an interview that he did not understand why the opposition did not support the idea of a general election, suggesting that Corbyn was simply afraid to lose them.

In any case, the political struggle that is taking place is supporting the British pound, which has returned to last week's highs. From a technical point of view, buyers need to hold the level of 1.2220 again, from which a new upward wave can be formed. The bulls may release this level for a while, allowing the pair to test a minimum of 1.2160, but it requires a rapid growth of GBPUSD, otherwise, sellers will begin to actively act in the market, able to drive the pound down to a minimum of 1.2110.

Also, the pressure on the pound may increase after the "new ideas" of the UK government to exit the EU, as long as the opposition is on the side of the opposition and retaliatory measures are required.

EURUSD

Despite the good data on the US foreign trade deficit, the European currency continued to strengthen its position yesterday afternoon, apparently receiving support from the situation that is developing with Brexit.

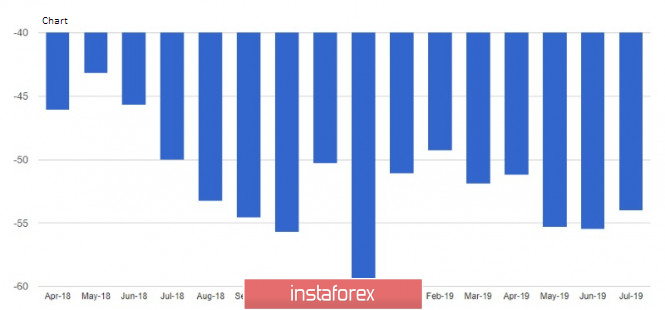

According to the data, the US foreign trade deficit in July decreased. According to the US Department of Commerce, the US foreign trade deficit in July 2019 decreased by 2.7% compared to the previous month and amounted to 53.99 billion dollars. Economists had expected the deficit to be $ 53.4 billion. The decline was due to an increase in exports of 0.6%, which was due to increased demand for consumer goods and cars.

Business conditions in the city of New York improved slightly this August after a major fall in July. According to the Institute for Supply Management (ISM), the index of current business conditions in August recovered to 50.3 points after falling to 43.5 points, indicating a decline in the activity.

Fed spokesman John Williams talked a lot yesterday about interest rates, low inflation and the situation in the economy. In his opinion, it is necessary to act appropriately to maintain economic growth, and vigilance and flexibility are key to monetary policy today. Williams also noted that the Fed is focused strictly on economic data and continues to monitor not only the economic performance in the United States but also in other countries. The US economy is in good shape amid the risks and uncertainties that are now present, but despite this, lowering rates in July was the right step. One of the key problems, according to the representative of the Fed, is low inflation, however, what will be the further actions of the Committee on Operations in the Open Market is difficult to say, since high uncertainty makes the prospects for rates unclear.

As for the technical picture of the EURUSD pair, the demand for the euro will gradually slow down, and a large resistance level of 1.1050 becomes a more difficult obstacle. Only weak fundamental data on the US labor market, the release of which is scheduled for this afternoon, will allow buyers of risky assets to continue the upward trend to the area of a maximum of 1.1090. More appropriate is purchase after a downward correction from the major support levels of 1.0970 and 1.1000.