It seems that the growth rate of retail sales in Europe slowed down from 2.8% to 2.2%, which amid low inflation, can hardly be called good news. But the single European currency was still able to seriously strengthen its position. The fact is that you need to take a closer look at the statistics themselves, and then it becomes clear that they turned out to be very good. In particular, they expected a slowdown in retail sales growth to 2.0%, and not to 2.2%. Moreover, the previous data was revised upwards, from 2.6% to 2.8%. In other words, the state of affairs in the European services sector is not so depressing.

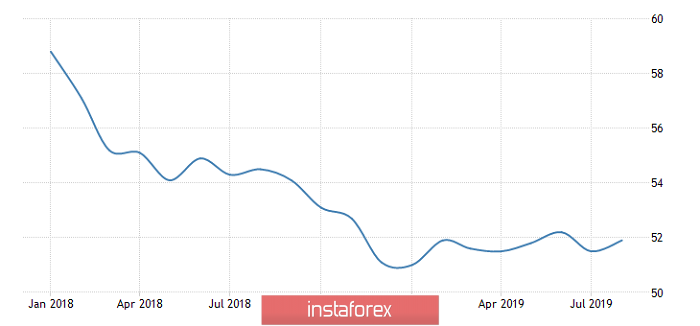

Confirmation of this thesis is the final data on business activity indices, which showed a slightly better result than preliminary estimates. Thus, the index of business activity in the service sector rose from 53.2 to 53.4, and to 53.5. The composite business activity index rose from 51.5 to 51.9, while they expected growth to 51.8. So in fact, the single European currency had many reasons for growth.

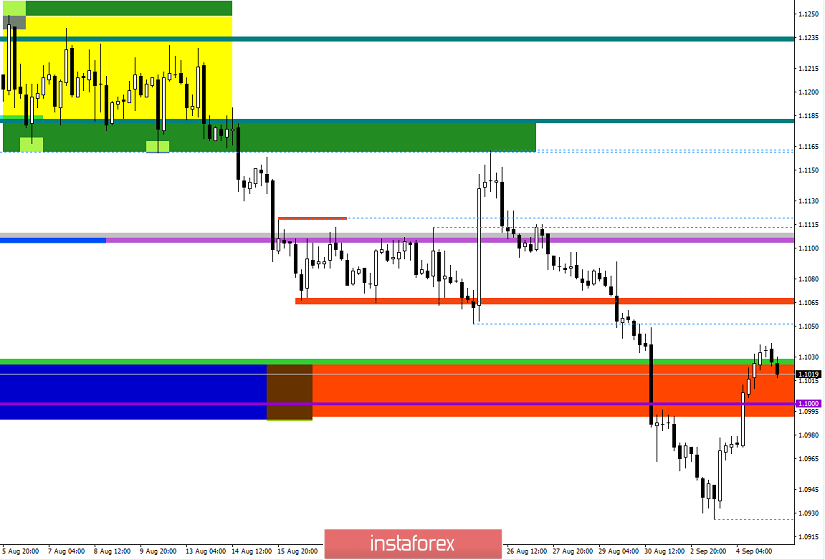

European Service Business Activity Index:

Composite index of business activity in Europe:

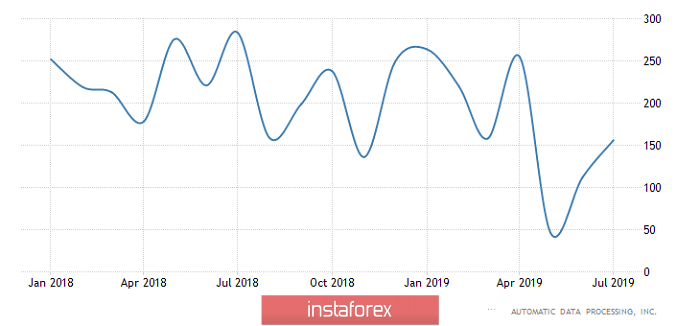

Today, the attention of market participants will shift to ADP data on employment, which precede the publication of the report of the United States Department of Labor. And if we look at forecasts, it turns out that employment growth is expected to decrease from 156 thousand to 149 thousand. That is, a decline of 7 thousand. In theory, this should be perceived as a negative factor for the dollar. However, do not forget that the single European currency's growth from yesterday was partly due not only to macroeconomic data, but also to the overall overbought dollar. So the growth potential of the single European currency is somewhat limited. Moreover, the decrease in employment growth is rather insignificant, especially if you recall that in the previous month there was an increase of as much as 44 thousand. But in any case, as soon as the data are published, then within the first minutes, the single European currency will go up. But only at the expense of emotions, and then, common sense will prevail again.

Employment Change in the United States:

The EUR/USD pair moved into a clear corrective movement after feeling support in the 2017 value range. The overheating factor of the US dollar played a small role in the formation of the current fluctuation. The return of the price above the psychological level of 1.1000 indicates a clear desire to close previously opened short positions and as a fact we see our correction. Considering everything that happens in general terms, we see that having fluctuation, over the past two days, did not make fatal changes in the composition of the trend, it was, and remains in a downward direction, only its clock part has changed, which is completely normal.

It is likely to assume that the return of prices within 1.1000 is a real scenario for the coming hours. After that, we follow the incoming statistics from the US, as I wrote above, where there may be a local rebound, but the overall picture is still in the form of an amplitude of 1.0990/1.1040.

Concretizing all of the above into trading signals:

• We consider long positions in terms of the further formation of the correction move, where in case the price is consolidated above 1.1040, we can expect a move to 1.1080.

• We consider short positions in terms of a temporary recovery in the direction of 1.1000. A deeper decline should be considered after a clear consolidation of the price below the psychological mark of 1.1000, while maintaining the inertial course.

From the point of view of a comprehensive indicator analysis, we see that the indicators on the minute intervals signal a decrease, just confirm the theory of a temporary return to the level of 1.1000. Hour intervals on the contrary, consider climbing, but this one is understandable, they are fixated on the corrective course. Long-term sites and keep a downward interest following the main trend.