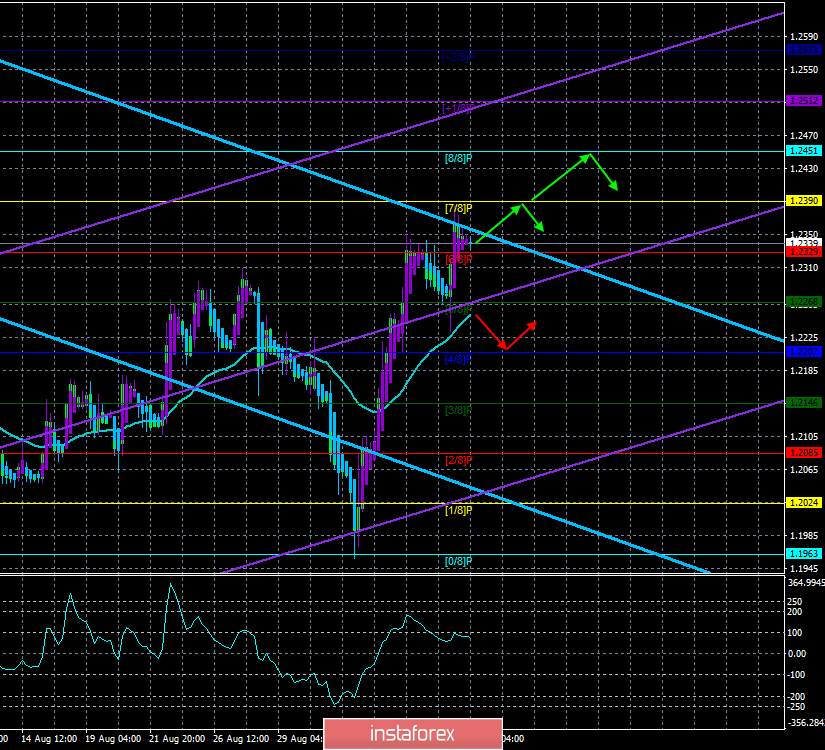

4-hour timeframe

Technical data:

The upper linear regression channel: direction – down.

The lower linear regression channel: direction – up.

The moving average (20; smoothed) – up.

CCI: 76.2286

How the pound reacts to the defeat of Boris Johnson in Parliament is seen from the chart of the pound/dollar pair. As soon as it became known that the Parliament blocked the possibility to leave the EU without a "deal" and officially requested the Prime Minister to postpone Brexit on January 31, 2020, the pound began to grow and continues to strengthen until now. Yesterday, as it is easy to guess from the headline, Boris Johnson suffered his third defeat, as most parliamentarians refused to vote for holding early elections. 293 parliamentarians supported the initiative of re-election, 46 were against. For the re-election to be adopted by the Parliament, 434 votes in favor are needed. Well, it's not just a defeat, it's a crushing defeat. Well, Parliament, with a sense of accomplishment, went on vacation until October 15.

Meanwhile, Queen Elizabeth II of Great Britain signed a law that obliges the government to postpone Brexit until January 31, 2020, unless a "deal" with Brussels is concluded by October 31 of this year. Despite this, Boris Johnson has already said that he will not ask for a delay from EU leaders. What this means is difficult to say. Johnson's trump card is clearly hidden in his sleeve, but it's hard to say what it is now. There are certain thoughts on this subject. As noted by Boris Johnson himself, if the European Union refuses to extend the term of Brexit, then he can not do anything about it and legally be clean before the laws of Great Britain, which oblige him to obey the will of Parliament and ask for an extension from the European Union. However, Johnson also believes that it is the European Union that should offer a delay, and that if there isn't such a proposal, then how can he prolong the term of Brexit? The fact that he is doing his best to avoid the transfer is not taken into account. It is obvious to everyone that Johnson is not going to negotiate a "deal" with the EU. If there were even a slim chance of that, the agreement would have already been signed. But the stumbling block remains the issue of the border regime on the border between Northern Ireland, which leaves with the UK from the EU, and Ireland, which remains part of the Alliance. The Prime Minister wants (by the way, his true motivation remains a mystery) to just quickly leave the EU and start a new chapter in the history of the British Kingdom.

The technical picture for the GBP/USD pair is very favorable. Firstly, macroeconomic statistics from the UK did not disappoint yesterday. Secondly, the British Parliament managed to stop the "destructive" Johnson's plan, at least temporarily. And the mere fact of the transfer of the "hard" Brexit to a later date gives hope that Brussels and London will still be able to disperse amicably. And supports the British currency in the foreign exchange market.

Nearest support levels:

S1 – 1.2329

S2 – 1.2268

S3 – 1.2207

Nearest resistance levels:

R1 – 1.2390

R2 – 1.2451

R3 – 1.2512

Trading recommendations:

The GBP/USD currency pair resumed its upward movement. Thus, traders are advised to continue buying the pound with targets at 1.2390 and 1.2451. It is recommended to return to sales of the British currency not earlier than fixing the pair below the moving, which is not expected in the near future.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of illustrations:

The upper linear regression channel – the blue line of the unidirectional movement.

The lower linear regression channel – the purple line of the unidirectional movement.

CCI – the blue line in the indicator regression window.

The moving average (20; smoothed) – blue line on the price chart.

Support and resistance – red horizontal lines.

Heiken Ashi is an indicator that colors bars in blue or purple.