The "skirmish" of the ECB representatives at the end of August on the need for the introduction of large-scale stimulus measures by the ECB led to an increase in the yield of German and American government bonds, considered the most reliable in the financial markets.

Recall that a surprise for the markets was a confrontation between representatives of the European regulator. Some of them, for example, S. Lautenschlager, expressed doubts about the need for incentive measures, and on the contrary, the head of the Central Bank of Finland, O. Rehn, announced the need for their introduction already September. On this wave, the single currency rate went uphill and the yields on government bonds of economically strong countries of the eurozone members turned up.

The yield on the American treasuries did not remain as they say after testing the level of 1.430% this morning around 1.632%. We can explain this behavior only by a shift in expectations towards the fact that the Fed can also limit itself to only one decrease in the interest rate this year by 0.25%.

Such a likely scenario will put pressure on demand for risky assets and first of all, stocks of companies may stimulate the resumption of local strengthening of the US dollar in our opinion. True, if indeed the ECB will only limit itself to lowering the deposit interest rate by 0.10% to 0.50% and not take broad incentive measures, we should expect continued appreciation of the euro paired with the dollar.Again, it should be recognized that this growth will be local in nature since the ratio of interest rates of the ECB and the Fed will obviously not play in favor of the single European currency.

Today, inflation values were published in China, which in consumer prices maintained an annual growth rate of 2.8% and jumped to 0.7% from 0.4% in monthly prices. On this wave, the Chinese stock market was trading in the red, and the yuan began to increase against the US dollar.

Assessing the overall picture in the markets, we note that one of the outcomes of the trade war is the revival of inflationary pressures, which could become a threat to incentive measures both in Europe and in the States with China. Ultimately, this will hinder the support of global economic growth, which will further decline, threatening the risks of a new recession.

Forecast of the day:

The GBP/USD pair continues to rally in the wake of the decision of the British Parliament to resume negotiations with the EU on Brexit with a wish to postpone it. This idea was supported by Queen Elizabeth II. From a technical point of view, the pair rose above 1.2330, and if it fixes above it, it is likely to continue growing locally to 1.2460.

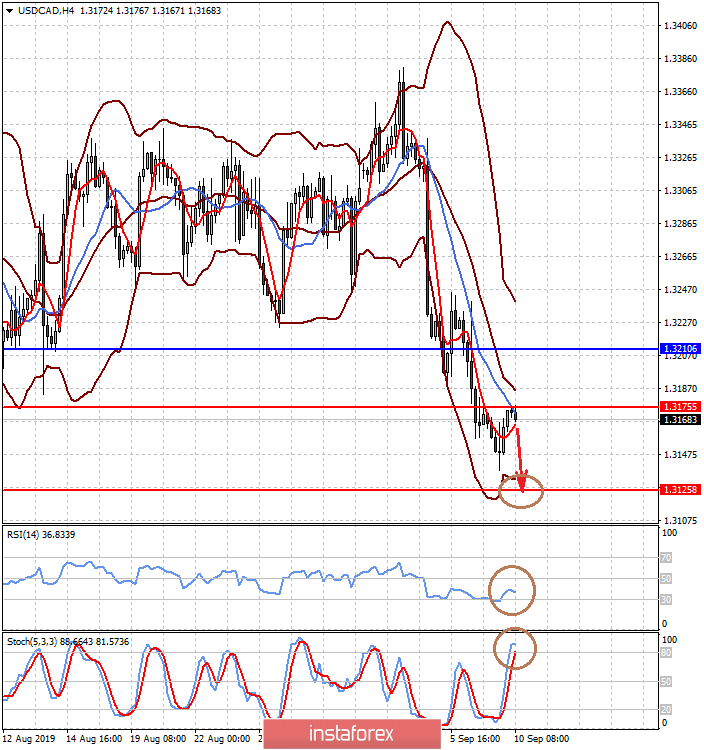

The USD/CAD pair remains under pressure in the wake of rising crude oil prices. Our pair forecast remains the same. We believe that after a local bounce up to 1.3175 and holding the price below this level, there is a high probability of a resumption of its fall to 1.3125.