Her Majesty, Queen of Great Britain, Elizabeth II, signed a bill prohibiting Brexit without a divorce agreement nevertheless, as well as obliging the government to obtain a reprieve from Brussels until January 31. True, she did this not in the morning but after waiting for a theatrical pause, thereby tickling everyone's nerves. Apparently, she decided to do more important things first; for example, walking a dog or feeding swans. Having wiped perspiration from the forehead, the parliamentarians immediately set about doing what they liked in recent days to ruin Boris Johnson's plans. The House of Commons rejected all the proposals of the Prime Minister, the most important of which was a request for early elections, which he planned to hold on October 15. The parliamentarians rightly reasoned that until the Cabinet of Ministers received another postponement from Brussels, there is no point in calling early elections since Boris Johnson has something to do even without campaigning. Then, with a clear conscience, the parliament went on an extraordinary vacation arranged by Boris Johnson. All of this should have led to a serious increase in the pound, the hero of our time still left the last word for himself and swore on his blood that a deal with the European Union would be concluded as early as October 18. I don't know what kind of emotions were overwhelming people at that very moment in Brussels, Paris, and Berlin since it is unlikely that Boris Johnson meant that Britain would agree to the existing conditions of the European Union. They do not intend to offer others which have been repeatedly stated. So it's very obvious that Boris Johnson does not intend to give up without a fight, and he is determined to fulfill his promise to withdraw the United Kingdom from the European Union no later than October 31. So, you should expect unexpected steps and surprises from him. However, this means a sudden increase in the uncertainty that investors of all stripes are so afraid of. So, the words of Boris Johnson stopped the growth of the pound.

It is obvious that the political circus with horses attracts spectator interest so much that no one paid any attention to macroeconomic statistics, which turned out to be unexpectedly good. The fact is that the decline in industrial production in the UK accelerated from -0.6% not to -1.1%, but to -0.9%. Although, perhaps for the better, no one paid attention to such grandiose achievements of British industry and the economy.

Industrial Production (UK):

Although sooner or later, reality will make itself felt and it will no longer be possible to dismiss it as if it were not significant or of little interest. Moreover, the idea that British politicians gave us led to the obvious overbought not only of the pound, but also of the single European currency. So the market needs at least a local correction. Ideally, she needs at least some formal reason, which may be today's data on the UK labor market and yes, all indicators should remain unchanged. All except one - the average wage excluding bonuse. The growth rate of which may slow down from 3.9% to 3.8% and of course, the reason is so-so. But recalling the situation with industry and others, this may be quite enough.

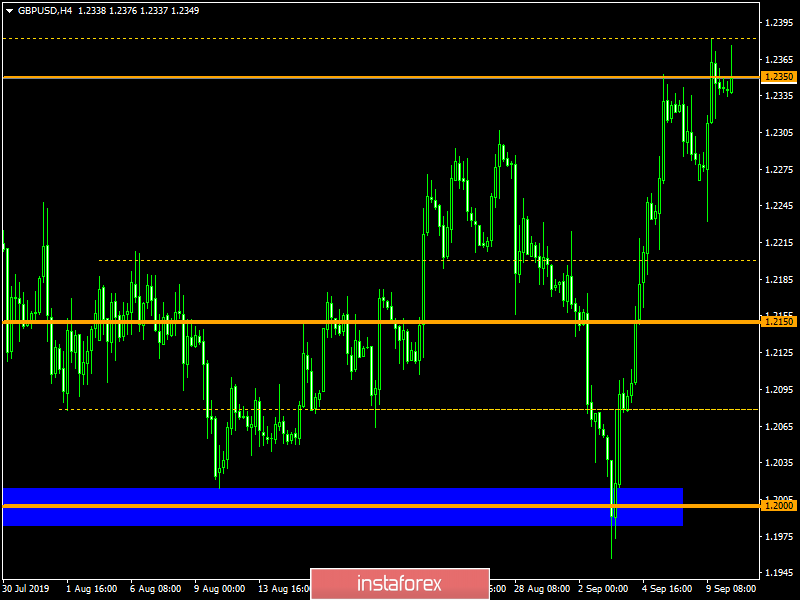

The Pound/Dollar currency pair again jumped towards the range of 1.2350, where the breakdown attempt was unconditional, but after which the process of slowdown took place. It is likely that a temporary amplitude fluctuation within 1.2330/1.1280, where the boundaries should be carefully analyzed for breakdown.

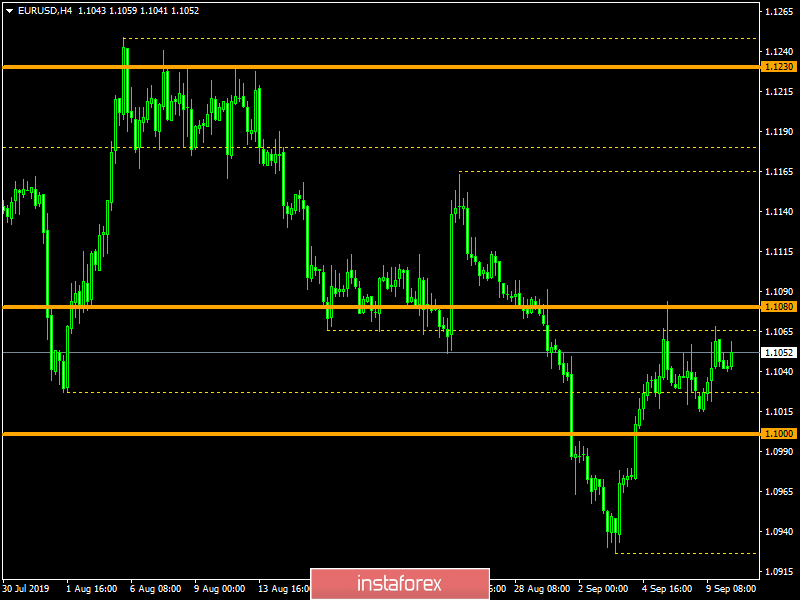

The Euro/Dollar currency pair returned to the level of 1.1060 and actually closing the recent correction. It is likely to assume a temporary compression of the amplitude concentrating within the boundaries of 1.1030/1.1070. In turn, the resistance level remains in the region of 1.1080, where the quote had previously arrived.