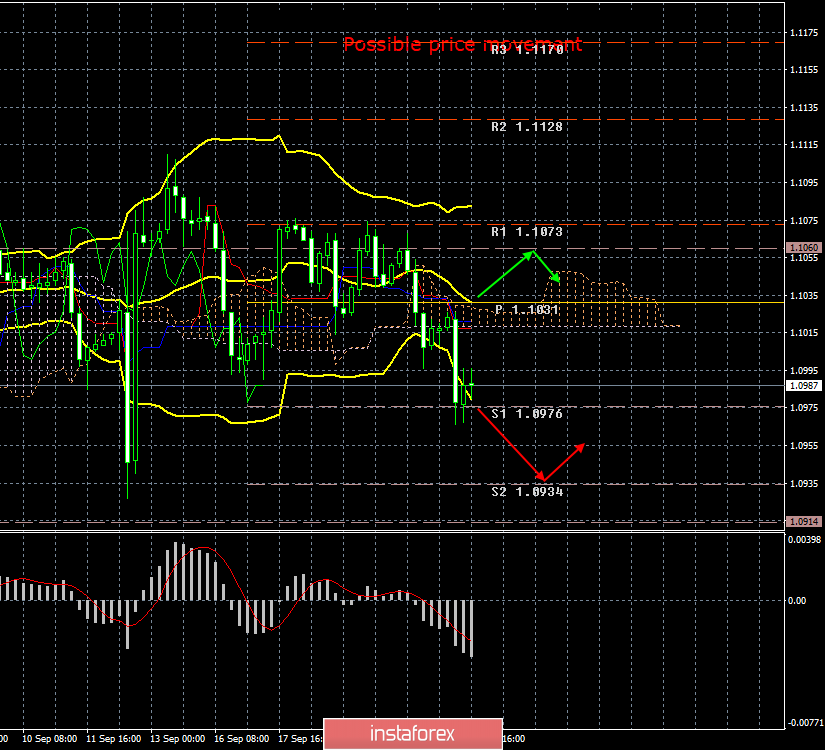

4-hour timeframe

Amplitude of the last 5 days (high-low): 94p - 85p - 62p - 51p - 72p.

Average volatility over the past 5 days: 73p (average).

The first trading day of the week for the European currency ends "smartly." For several days in a row, we wrote that the EUR/USD pair is in a flat, that traders will need good fundamental reasons for the formation of a new trend, especially if it will be a downward trend, since the pair is already trading around two-year lows. But we did not have to wait long for the fundamental foundations. Despite the fact that only preliminary values of business activity indices for September were published today, they were so inconsistent with forecasts that there was no longer any hope for the final data for September. Six out of six indices in Germany and the European Union were not just below the forecast values or values of the previous month, but simply failed. If earlier the questions were only about business activity in the manufacturing sector of both Germany and the EU, now business activity in the services sector has come close to critical values. The composite business activity index in Germany has already fallen below 50.0. In general, the euro currency sales on September 23 are quite logical, and it's good that the drop was only 45 points. Because at the US trading session, similar business activity indices for the USA were published, and all three indices turned out to be better than the values in August. All three indices were higher than 50.0, which indicates the absence of a decline in the areas of industry and services. Thus, in the afternoon, sales of the currency pair could well continue. The euro was saved from new losses only by the fact that the values in America are still not final, so it is quite possible that the final figures will be worse. Traders did not make hasty conclusions about business activity in the United States.

What does this mean for the prospects of the EUR/USD pair? As usual, nothing good. First, once again we can make sure that the steps of the ECB to ease monetary policy are not just caution and reinsurance. These are forced measures, without which the EU's economy will slide into a recession very, very quickly. Secondly, current macroeconomic indicators may become the basis for Mario Draghi and the company, at his last meeting as the head of the ECB, to make another rate cut. Of course, there is no talk of expanding the quantitative stimulus program, since they just announced its revival that will begin in November. It would be strange if the regulator would expand it before the start of the program. However, it is already clear that stimulating measures will be needed very, very serious. This bloc has not yet encountered such a problem as a trade war with America, rumors of the beginning of which have been in the air for several months. We are more and more inclined to believe that Donald Trump will unleash a trade war with the EU. A factor that may deter him from this step is the falling rating of his popularity and approval of his actions among the population. Most of the electorate is unhappy with the trade war with China, as it negatively affects the prices of consumer goods. US citizens also fear recession due to the trade wars of their president. Trump understands the mood among the population now, as well as the fact that waging a war on two fronts is very difficult. And this may restrain his impulses to introduce trade duties on imports from the European Union. This is the euro's chance. However, if macroeconomic statistics from the European Union continues to be a failure, then the absence of a trade war with the United States will not save the single European currency.

The technical picture shows that the pair is leaning towards the formation of a new downward trend. At the moment, the first support level of 1.0976 has been worked out and the drop has stopped. But overcoming this level will open the way for the bears to the levels of 1.0934 and 1.0914.

Trading recommendations:

The EUR/USD pair started a new downward movement, but today an upward correction may begin, as it was not possible to overcome the level of 1.0976 in the first attempt. Therefore, it is recommended to sell the euro if the level of 1.0976 is overcome or after the completion of the current round of correction.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicator window.