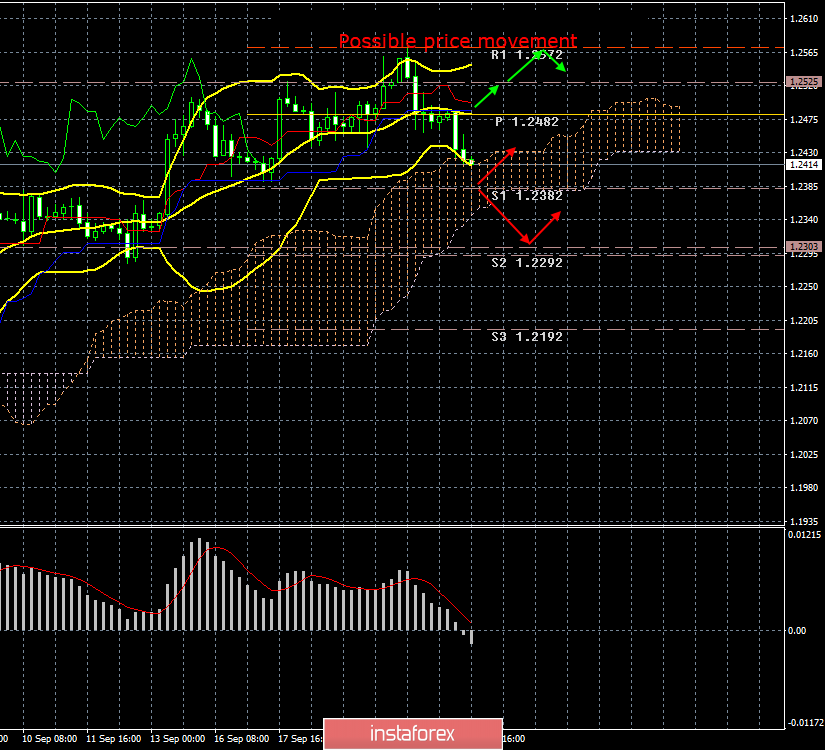

4-hour timeframe

Amplitude of the last 5 days (high-low): 104p - 134p - 73p - 122p - 124p.

Average volatility over the past 5 days: 111p (high).

Recently, amid all the statements of Boris Johnson and the leaders involved in Brexit, from the EU, two interesting questions have emerged at once. First: both sides of the negotiation process trying to agree on a "deal" or to dissuade each other in the advisability of signing it? Second: why does the rhetoric of all the actors change so often and why does it often not coincide? These two questions lead to the conclusion that there is a kind of game between the EU and Great Britain, and both sides do not know what they can come to in the end. The European Union takes the position of "no concessions and, if possible, retain Britain as part of the EU," the UK takes the position of "we don't know what we want." The prime minister wants to leave the EU and he doesn't care about the disastrous consequences of the "hard" Brexit. Parliament cannot decide how it wants to implement Brexit; Queen Elizabeth II does not take part in resolving such issues. In both ruling parties there is no unity of opinion. MPs continue to be on vacation, the Supreme Court continues to consider the case of illegal corruption of Johnson's parliament, UK citizens stock up on goods that could be in short supply if Brexit is sold without a "deal". Such chaos reigns in the United Kingdom.

The EU's chief negotiator for Brexit said today that the UK's position does not give any reason and hopes to conclude an agreement. In turn, Prime Minister Boris Johnson said that the upcoming negotiations on an agreement on Brexit in New York are unlikely to end successfully or at least with some progress. The British prime minister also notes that the parties are very far apart. Johnson said last week that the deal could still be signed, and there was tangible progress in negotiations with Jean-Claude Juncker. In a similar situation, when it seems that the leaders of the EU and the UK themselves do not know how and how it will all end and which option should be implemented at all, traders can only stock up on patience. The next deadline is scheduled not on October 31, but on October 17-18, when the EU summit will take place, during which Boris Johnson must either sign the "deal" or ask for a postponement of Brexit, as the Parliament decided. No one knows what Johnson will do. Accordingly, it makes no sense to predict anything on this issue. It remains only to respond to incoming news. Any news that reduces the chances of a "hard" Brexit is to buy the pound, any news that removes the parties from signing the "deal" and brings the disordered Brexit closer is to sell the pound.

The technical picture shows a very likely change in the direction of the trend from upward to downward. Thus, in the coming days, the downward movement may continue, especially if the nature of the news continues to be negative for the British pound. No important macroeconomic publications are planned for tomorrow in the United States or the United Kingdom, but we recommend that you continue to monitor any messages from top officials of the European Union and the United Kingdom.

Trading recommendations:

The GBP/USD currency pair has started a downward movement at the moment. Thus, small sales of the pair with targets 1.2382 and 1.2303 are now recommended. Small - because the signal to sell the "dead cross" has not yet been formed, there is only overcoming the critical line Kijun-sen. Again, it is recommended to buy the pair no earlier than when the bulls consolidate above the Kijun-sen line.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicator window.