The euro-dollar pair again entered the ninth figure today, reacting to extremely weak PMI data in the manufacturing sector in Germany. Similar indices of Italy, France and the entire eurozone also appeared in the red zone, not significantly reaching the forecast values. But, despite the downward impulse, the EUR/USD bears could not overcome the resistance level of 1.0950. Having pushed off from the bottom line of the Bollinger Bands indicator (on the daily chart), the pair again got bogged down in a flat. Even the "dovish" rhetoric of the head of the ECB, Mario Draghi, who spoke today in the European Parliament, could not support the bears - while maintaining a weak state, the pair still did not dare to break through the price barrier.

On the one hand, the head of the European Central Bank did not say anything new today - many of his theses have already been voiced following the results of the September meeting. On the other hand, he extremely negatively assessed the prospects for economic growth in Europe and allowed the continuation of monetary easing. In particular, he said that key European indicators slowed down "more than expected", and this is mainly due to the influence of external fundamental factors (ie, the trade war). Draghi also added that the dynamics of the most important indicators imply that the EU economy will not recover in the near future - and the manufacturing sector is particularly alarming in this context (the ECB president made a statement after the release of PMI data). In addition, Draghi again focused on the extremely weak growth in core inflation and the export sector. Summing up the above, the head of the central bank repeated his already familiar phrase that monetary policy should be "accommodative for a long period". As for further possible solutions, here Draghi said a vague, but quite unambiguous phrase that "We stand ready to adjust all of our instruments, as appropriate, to ensure that inflation moves towards our aim in a sustained manner,".

In other words, the head of the European Central Bank did not surprise traders with any new "revelations", although his rhetoric was extremely mild. Assuming further easing of monetary policy, he put pressure on the euro, although, on the other hand, a different position could not be expected from him. Firstly, he leaves his post in a month, so any long-term forecasts in his mouth would have sounded inappropriate. Secondly, the head of the ECB throughout his cadence always left a gap for a possible maneuver.

Nevertheless, the very fact that the head of the ECB voiced readiness for further actions unpleasantly surprised many traders, because of which the pair showed a downward direction all day. After the September meeting, most analysts expressed confidence that by the end of the year the regulator is unlikely to decide on the next steps in this direction. The decision to resume QE was too hard for them.

But after the corresponding remark by Draghi, one can no longer be certain that the central bank will maintain a wait-and-see attitude "against all odds". It is worth noting here that macroeconomic reports today showed a very weak result, as if confirming Draghi's words. Germany's manufacturing PMI fell to a record low of 41 points. In the eurozone as a whole, the index was also lower than forecast, recording a slowdown in production. Industrial PMI has been declining for almost the entire year, and since February it has been below the key level of 50 points, indicating a decline in industry. Similar dynamics were recorded in France and Italy. The PMI in the service sector also ended up in the red zone, complementing the overall negative picture.

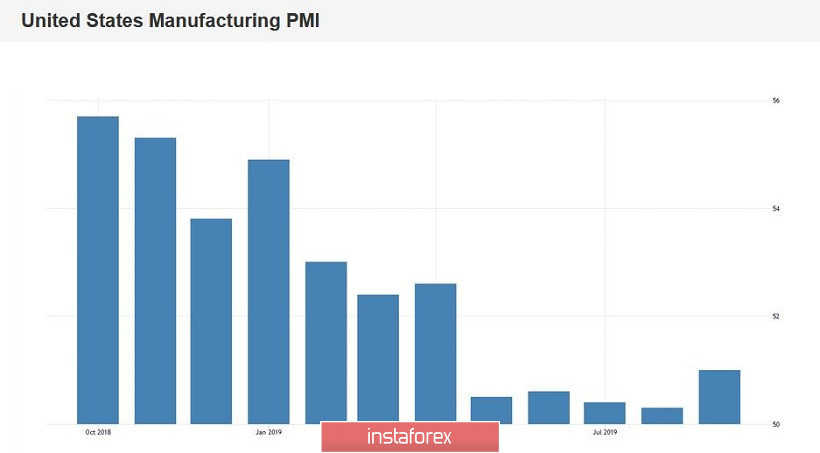

On the contrary, the US index of business activity in the manufacturing sector showed a positive trend. For the first time since May of this year, the indicator moved away from the boundaries of 50 points, exceeding forecast values. This factor provided additional support to the dollar, which is growing mainly on optimism regarding the resolution of the trade war. Last Friday, Washington temporarily exempted more than 400 Chinese goods from duties, and this reversal to Beijing was another step towards de-escalating the conflict. Prior to this, China resumed purchases of American agricultural products. And although now there is only a preparatory process for the meeting "at a high level", such steps demonstrate the intentions of the parties to come to a compromise. Moreover, according to the American press, this time Donald Trump will take a softer position in the negotiations, because on the eve of the presidential campaign he needs a victory over China, albeit of a nominal nature. These are just rumors, but such a scenario is likely, given the fact that Democrat Joe Biden is still 7-9% ahead of Trump.

Thus, the fundamental background for the EUR/USD pair today has formed against the European currency, while the dollar is confidently afloat. The prospects for easing the monetary policy of the ECB have again loomed on the horizon, and European macroeconomic reports continue to disappoint investors. While US indicators provide background support for the dollar, which is waiting for the next round of talks between the US and China (in early October).

But for the development of the downward trend, the bears need to overcome and gain a foothold below the 1.0950 mark (the lower line of the Bollinger Bands indicator on the daily chart). Since the end of August, sellers have several times made similar attempts, but in vain. But for the bulls of the pair, the task is more complicated - for the development of a large-scale correction, they need to break the upper line of the above indicator on the same timeframe, which corresponds to the price of 1.1100.