Hello, dear colleagues.

For the Euro/Dollar pair, we expect the continuation of the downward movement after the breakdown of 1.0951 and the level of 1.1024 is the key support. For the Pound/Dollar pair, the price forms a potential structure for the bottom of September 20, we expect its development after the breakdown of 1.2400 and the level of 1.2495 is the key support. For the Dollar/Franc pair, the continuation of the downward movement is expected after the breakdown of 0.9835 and the level of 0.9887 is the key support. For the Dollar/Yen pair, the continuation of the downward movement is expected after the breakdown of 107.06 and the level of 107.50 is the key support. For the Euro/Yen pair, we follow the downward structure from September 18, the continuation of the downward movement is expected after the passage of the range of 117.73 – 117.51 and the level of 118.57 is the key support. For the Pound/Yen pair, subsequent targets were set against a downward structure from September 20 and the level of 134.58 is the key support for the bottom.

Forecast for September 25:

Analytical review of currency pairs on the H1 scale:

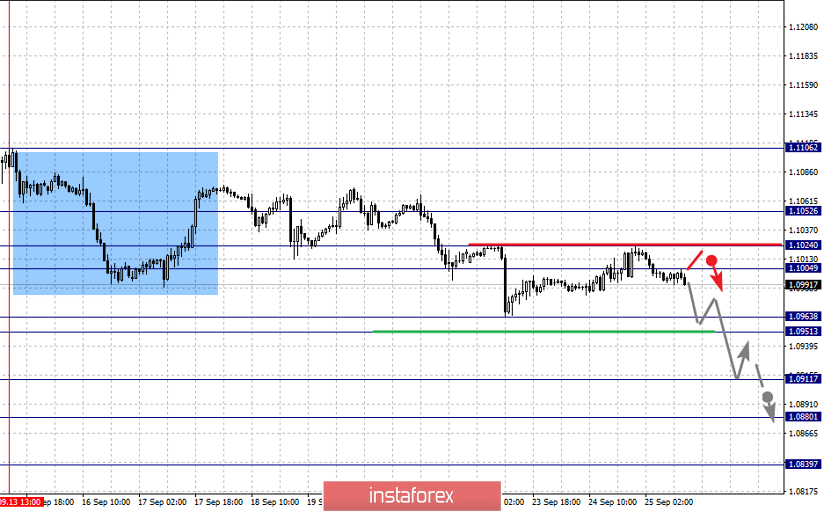

For the Euro/Dollar pair, the key levels in the H1 scale are 1.1052, 1.1024, 1.1004, 1.0963, 1.0951, 1.0911, 1.0880 and 1.0839. We continue to follow the development of the downward structure of September 13. We expect the continuation of the downward movement after the price passes the range of 1.0963 – 1.0951. In this case, the target is 1.0911 and near this level is the price consolidation. The breakdown of 1.0911 will lead to a movement to the level of 1.0880, from which we expect a pullback to the top. We consider the level of 1.0839 as a potential value for the bottom.

A short-term upward movement is possible in the area of 1.1004 – 1.1024 and the breakdown of the last value will lead to an in-depth correction. The target is 1.1052 and this level is the key support for the bottom.

The main trend is the downward structure of September 13.

Trading recommendations:

Buy: 1.1004 Take profit: 1.1024

Buy 1.1026 Take profit: 1.1050

Sell: 1.0950 Take profit: 1.0916

Sell: 1.0908 Take profit: 1.0884

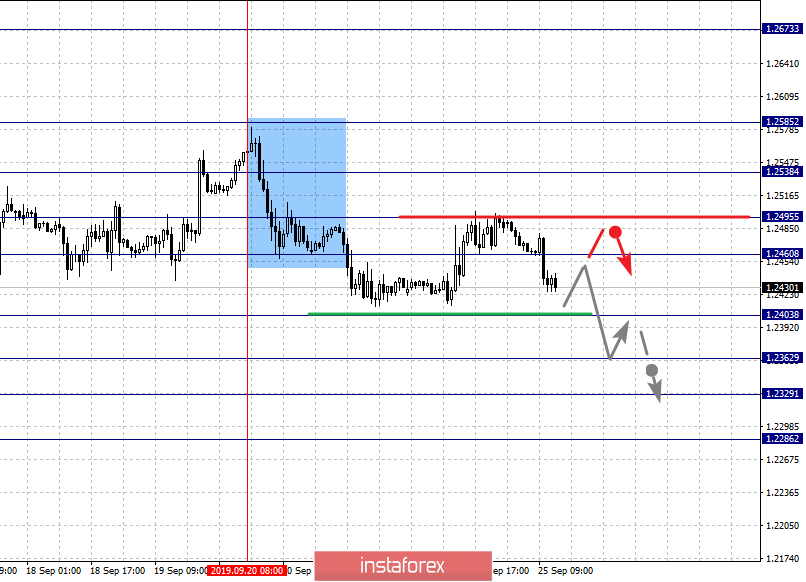

For the Pound/Dollar pair, the key levels in the H1 scale are 1.2585, 1.2538, 1.2495, 1.2460, 1.2403, 1.2362, 1.2329 and 1.2286. The price forms the potential for a downward movement from September 20. The continuation of the downward movement is expected after the breakdown of 1.2403. In this case, the target is 1.2362 and in the area of 1.2362 – 1.2329 is the price consolidation. We consider the level of 1.2286 as a potential value for the bottom, upon reaching this value, we expect a rollback to the top.

The short-term upward movement is expected in the range of 1.2460 – 1.2495 and the breakdown of the last value will lead to an in-depth correction. The target is 1.2538 and this level is the key support for the downward structure. Its passage by the price will have to develop an upward movement. In this case, the first target is 1.2585.

The main trend is the local upward structure of September 12, the formation of the potential for the bottom of September 20.

Trading recommendations:

Buy: 1.2460 Take profit: 1.2495

Buy: 1.2497 Take profit: 1.2536

Sell: 1.2403 Take profit: 1.2362

Sell: 1.2360 Take profit: 1.2330

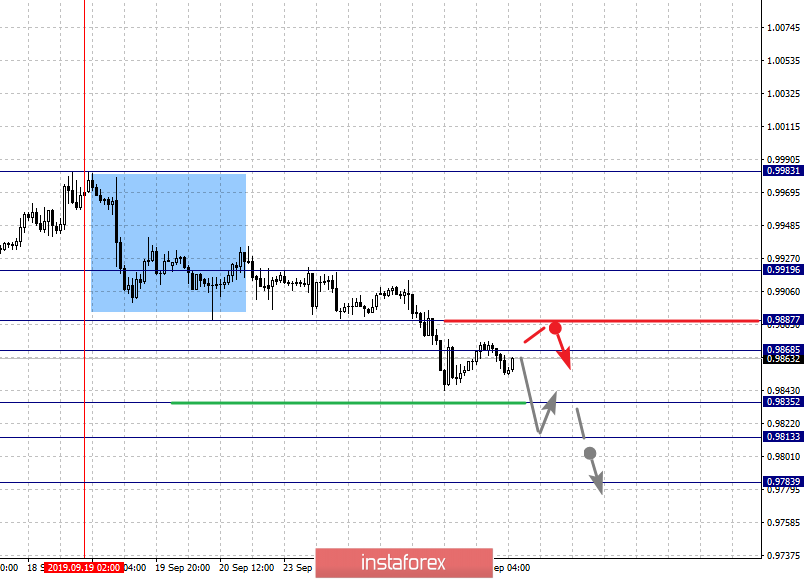

For the Dollar/Franc pair, the key levels in the H1 scale are 0.9919, 0.9887, 0.9868, 0.9835, 0.9813 and 0.9783. We follow the development of the downward cycle of September 19. We expect the continuation of the downward movement after the breakdown of 0.9835. In this case, the target is 0.9813 and near this level is the price consolidation. The breakdown of the level of 0.9813 will lead to a movement to the potential target – 0.9783, after which we expect a pullback to the top.

A short-term upward movement is possible in the area of 0.9868 – 0.9887 and the breakdown of the last value will lead to an in-depth correction. The target is 0.9919 and this level is the key support for the downward structure from September 19.

The main trend is the downward cycle of September 19.

Trading recommendations:

Buy: 0.9868 Take profit: 0.9885

Buy: 0.9890 Take profit: 0.9919

Sell: 0.9835 Take profit: 0.9815

Sell: 0.9811 Take profit: 0.9785

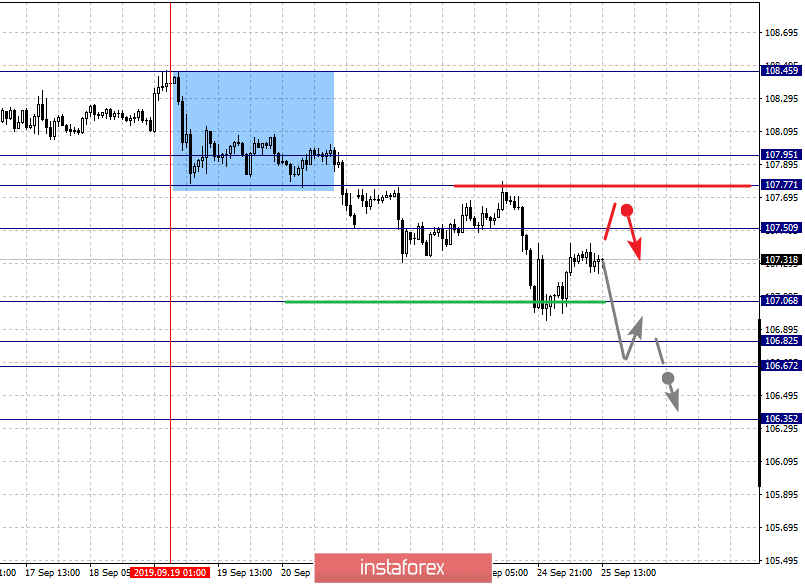

For the Dollar/Yen pair, the key levels in the H1 scale are 107.95, 107.77, 107.50, 107.06, 106.82, 106.67 and 106.35. We follow the development of the downward structure of September 19. The continuation of the downward movement is expected after the breakdown of 107.06. In this case, the target – 106.82 and in the area of 106.82 – 106.67 is the short-term downward movement and consolidation. We consider the level of 106.35 as a potential value for the bottom, upon reaching this level, we expect a rollback to the top.

Going into a correction is expected after the breakdown of 107.50. In this case, the target is 107.77 and the level of 107.95 is the key support for the downward cycle. We expect the initial conditions for the upward movement to be formed.

The main trend is the downward structure from September 19.

Trading recommendations:

Buy: 107.05 Take profit: 106.82

Buy: 106.65 Take profit: 106.37

Sell: 107.50 Take profit: 107.70

Sell: 107.78 Take profit: 107.95

For the Canadian dollar/Dollar pair, the key levels in the H1 scale are 1.3379, 1.3343, 1.3326, 1.3297, 1.3260, 1.3235, 1.3198 and 1.3172. We continue to monitor the development of the upward structure from September 10. At the moment, the price is in a correction. The continuation of the upward movement is expected after the breakdown of 1.3297. The target is 1.3326 and in the area of 1.3326 – 1.3343 is the consolidation. We consider the level of 1.3379 as a potential value for the top, upon reaching this level, we expect a rollback to the bottom.

The short-term downward movement, as well as consolidation, are possible in the area of 1.3260 – 1.3235 and the breakdown of the last value will lead to an in-depth correction. The target is 1.3198 and this level is the key support for the top. Its breakdown will have a downward structure. In this case, the potential target – 1.3172.

The main trend is the upward structure of September 10, the stage of correction.

Trading recommendations:

Buy: 1.3299 Take profit: 1.3226

Buy: 1.3344 Take profit: 1.3378

Sell: 1.3260 Take profit: 1.3237

Sell: 1.3233 Take profit: 1.3200

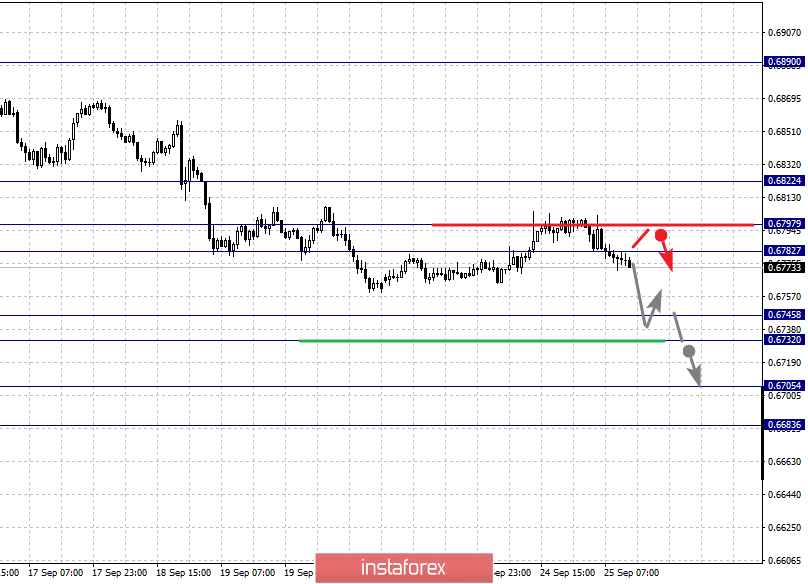

For the Australian dollar/Dollar pair, the key levels in the H1 scale are 0.6822, 0.6797, 0.6782, 0.6745, 0.6732, 0.6705 and 0.6683. We follow the development of the downward cycle from September 13. At the moment, the price is in a correction. We expect the continuation of the downward movement after the breakdown of 0.6760. In this case, the first target is 0.6745. The short-term downward movement is possible in the range of 0.6745 – 0.6732 and the breakdown of the last value should be accompanied by a pronounced downward movement. The target is 0.6705 and near this value is the consolidation. We consider the level of 0.6683 as a potential value for the bottom, at which we expect to go into correction.

The short-term upward movement is possible in the area of 0.6782 – 0.6797 and the breakdown of the last value will lead to a prolonged correction. The potential target is 0.6822 and this level is the key support for the downward structure.

The main trend is the downward cycle of September 13, the stage of correction.

Trading recommendations:

Buy: 0.6760 Take profit: 0.6745

Buy: 0.6782 Take profit: 0.6795

Sell: 0.6745 Take profit: 0.6734

Sell: 0.6730 Take profit: 0.6707

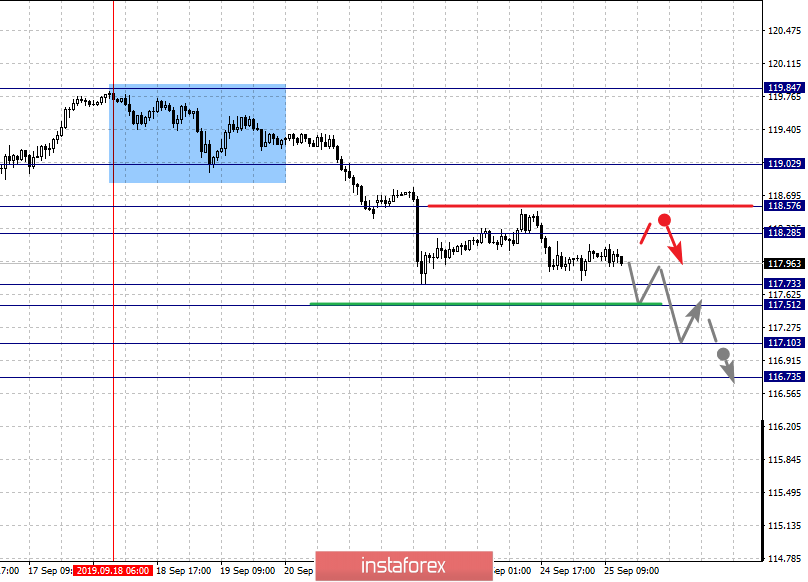

For the Euro/Yen pair, the key levels in the H1 scale are 119.02, 118.57, 118.28, 117.73, 117.51, 117.10 and 116.73. We follow the development of the downward structure of September 18. We expect the continuation of the downward movement after the price passes the range of 117.73 – 117.51. In this case, the target is 117.10. We consider the level of 116.73 as a potential value for the bottom, upon reaching this value, we expect a rollback to the top.

The short-term upward movement is possible in the range of 118.28 – 118.57 and the breakdown of the last value will lead to an in-depth movement. The target is 119.02 and this level is the key support for the downward structure.

The main trend is the downward structure of September 18.

Trading recommendations:

Buy: 118.28 Take profit: 118.55

Buy: 118.60 Take profit: 119.00

Sell: 117.50 Take profit: 117.10

Sell: 117.08 Take profit: 116.73

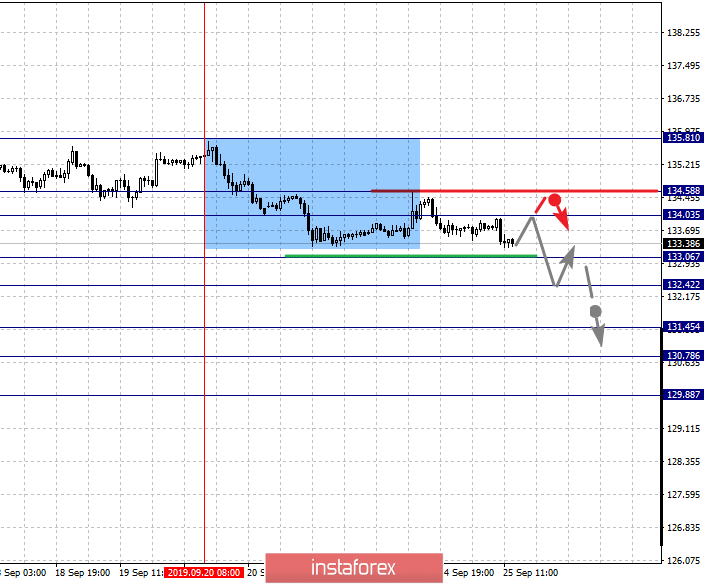

For the Pound/Yen pair, the key levels in the H1 scale are 135.81, 134.58, 134.03, 133.06, 132.42, 131.45, 130.78 and 129.88. We determined the next goals from the downward structure on September 20. The short-term downward movement is expected after the breakdown of 133.06. The target is 132.42 and the breakdown of which, in turn, should be accompanied by a pronounced downward movement. In this case, the target is 131.45 and in the area of 131.45 – 130.78 is the consolidation. We consider the level of 129.88 as a potential value for the downward movement, upon reaching this level, we expect a rollback to the top.

The short-term upward movement is possible in the area of 134.03 – 134.58 and the breakdown of the last value will have to form an upward structure. In this case, the potential target – 135.81.

The main trend is the formation of a downward structure from September 20.

Trading recommendations:

Buy: 134.03 Take profit: 134.55

Buy: 134.60 Take profit: 135.80

Sell: 133.04 Take profit: 132.44

Sell: 132.40 Take profit: 131.45