To open long positions on EURUSD, you need:

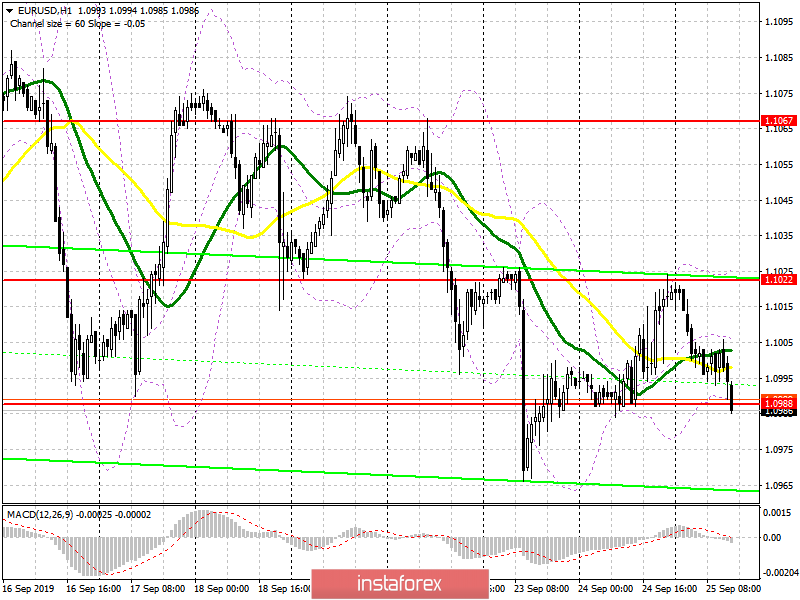

In the morning, I talked about the fact that US President Donald Trump wants to impeach, but there is no real reason for excitement yet. Against this background, the demand for safe-haven assets, which can be attributed to the US dollar, has increased, but essentially, from a technical point of view, nothing has changed. At the moment, buyers need to protect the support level of 1.0988, which was formed yesterday. Only the formation of a false breakdown there will allow us to count on another wave of growth of EUR/USD with an update of yesterday's resistance in the area of 1.1022. However, a more important task is to break through this range, which will provide the pair with a new upward wave to the maximum area of 1.1067, where I recommend taking the profit. In the scenario of a further decline in the euro and the absence of bulls at 1.0988, it is best to consider new long positions for a rebound from the support of 1.0955, or at the monthly minimum of 1.0925.

To open short positions on EURUSD, you need:

Given that no important fundamental statistics are planned for today, only statements by representatives of the European Central Bank and the Federal Reserve can lead to some surge in volatility. The bears coped with the morning task and returned the pair to the support area of 1.0988, the breakdown of which will be a clear signal to open short positions in order to further reduce the EUR/USD to the minimum area of 1.0955 and the minimum of the month – 1.0925, where I recommend taking the profit. If the bulls find the strength and hold the level of 1.0988 in the second half of the day, it is best to count on new short positions after an upward correction to the resistance area of 1.1022 or sell EUR/USD to rebound from the maximum of 1.1067.

Signals:

Moving Averages

Trading is conducted just below 30 and 50 moving averages, however, a breakout of the support of 1.0988 is necessary for the formation of a bearish trend.

Bollinger Bands

In the case of euro growth, the upper border of the indicator in the area of 1.1022 will act as resistance, from where you can open short positions immediately for a rebound.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20