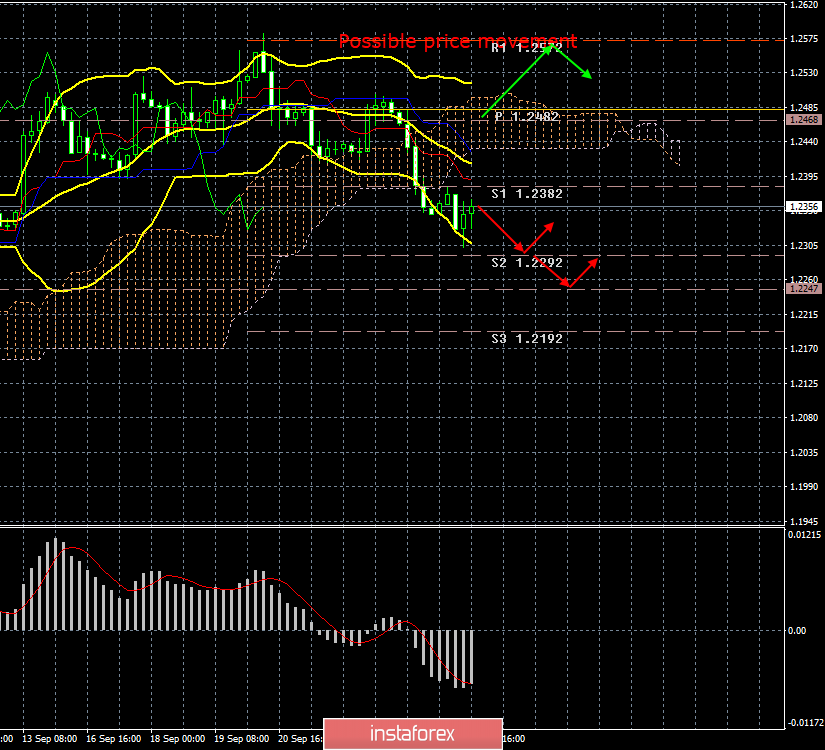

4-hour timeframe

Amplitude of the last 5 days (high-low): 122p - 124p - 78p - 88p - 150p.

Average volatility over the past 5 days: 112p (high).

All the most interesting news for the GBP/USD pair continues to come from the UK Parliament. The pound sterling, which resumed falling against the US currency on September 20, continues to decline. Today we would like to elaborate on Boris Johnson's new strategy of action, of course, if it can be called a strategy. The prime minister's latest speeches suggest that Johnson will do his best to achieve not a hard Brexit, but a Brexit "at any cost", any possible Brexit, but re-elections to Parliament. It is in this that he sees a solution to the impasse in which the British government has fallen and has been in since the first blocking of Theresa May's "deal" with the European Union. The problem is that the two "divorce" options proposed by the two prime ministers with the European Union, which had a real opportunity to be executed, did not suit the majority of the MPs. All the proposals of the prime ministers were rejected, and the country remained in the UK and since March 29, the date of Brexit is simply permanently postponed to a later date. Now the moment of the next deadline is approaching, and the Parliament has already blocked the hard Brexit, which Johnson wanted to implement. Threats of the prime minister to carry out Brexit despite the ban of Parliament did not work, as Johnson himself understands that this will be followed not just by a vote of no confidence, but also criminal proceedings. Given the cancellation of the Supreme Court prorogation of Parliament, which can be interpreted as abuse of power by Boris Johnson, now any of his unauthorized action by Parliament will be considered in court and punished to the fullest extent of the law. Johnson and the MPs understands. It is also clear to everyone that if the current composition of the Parliament can not collect the necessary number of votes to authorize Brexit, the composition needs to be changed. However, the MPs themselves are not interested in early elections. The main opposition party - the Labour Party - led by Johnson's main opponent Jeremy Corbyn, is not interested in this either. According to the Labour Party, first the government should postpone Brexit to January 31, 2020, and only then it will be possible to talk about re-elections. Otherwise, the opposition fears, the new Parliament could approve Johnson's" hard " Brexit by October 31. Well, Johnson's feint in the course of his last speech, in which he literally proposed to pass him a vote of no confidence, is the next populist step. With this proposal, he, firstly, showed that he was ready for such a step by the opposition, and secondly, it was this step of the MPs that could lead to re-election. Thus, it can already be said that until the moment when Johnson has to ask Brussels to postpone Brexit (unless, of course, Johnson does not agree to a direct violation of the law), the deputies will not declare him a vote.

Traders of the pound/dollar currency pair now have to wait for the further development of events on the Brexit topic, because now everything depends on it. Sooner or later, Boris Johnson will begin to take any action that will be closely scrutinized by market participants and depending on the nature of the pound will go up or continue to fall in price.

From a technical point of view, the pair consolidated below 1.2382, the sell signal from Ichimoku is strong, and the Bollinger bands turned down. Thus, the downward movement may continue.

Trading recommendations:

The GBP/USD currency pair is currently moving down. Thus, it is now recommended that the pound be sold with targets at 1.2292 and 1.2247. It is recommended to return to the pair's purchases no earlier than when the price consolidates above the Kijun-sen critical line.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicator window.