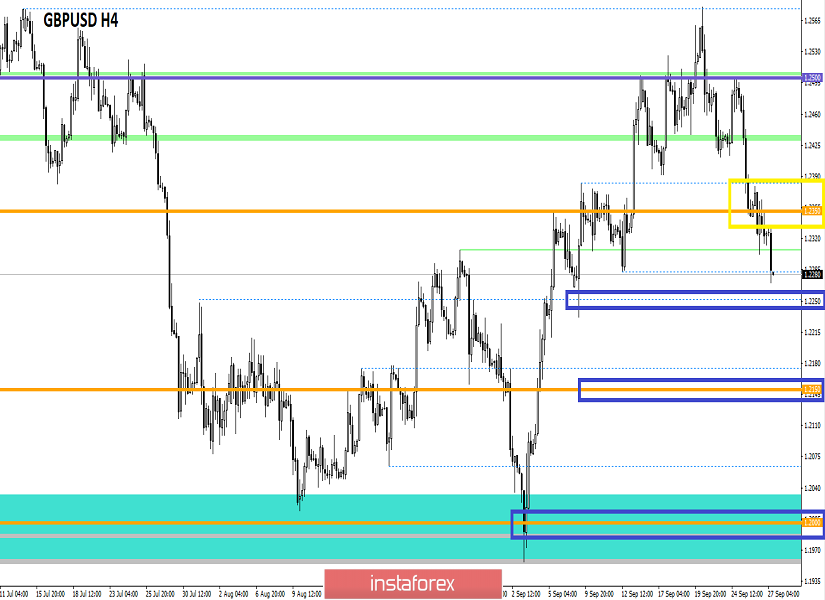

The pound/dollar currency pair showed a low volatility of 77 points over the last trading day, but this fluctuation was enough to focus below the level of 1.2350. From technical analysis, we see that the process of fixing the price below 1.2350 was in full swing, where the amplitude of the oscillation had a range of 1.2300/1.2380. Is this platform a regrouping of trading forces after the breakthrough from the level of 1.2500? Yes, very likely, since a stop/rollback was necessary in this case.

As discussed in the previous review, speculators are delighted with the past fluctuations, so, the main profit from the move to 1.2500 (1.2400) – 1.2350 was recorded yesterday, in the first half of the day. After that, the process of monitoring the behavior of quotes began, just in the phase of fixing the price relative to the level of 1.2350. The task was to identify a breakdown or a rebound relative to the level of 1.2350, where sellers seemed to have trump cards, who nevertheless saw the potential for further decline, and the point of 1.2325 became a reference point. The primary prospect, in this case, was located at around 1.2300, where the quote reached 1.2302, but after that, it slowed down the fluctuation just around the Pacific-Asian trading session.

Considering the trading chart in general terms (day period), we see that the theory of recovery of the initial downward trend has almost passed into the stage of implementation in terms of producing 48% relative to the elongated correction. Of course, it is too early to talk about a full resumption of the downward trend, as the support point of 1.1957 is still more than 300 points, but progress is already being felt.

The news background of the previous day had data on the GDP of the United States for the second quarter, where the rate of economic growth was confirmed in terms of slowing from 2.7% to 2.3%. The US dollar, in turn, retained its leading position in terms of growth, as compared with the British currency, things are much better in the States.

While the news background pokes fun at the not-so-successful Prime Minister Boris Johnson, the consequences of Brexit continue to hit business in Britain. So, Jaguar Land Rover announced its intention to suspend production in the UK because of Brexit. In this case, we are talking about the suspension of four factories in Britain in the first week of November to mitigate the consequences of a failure in the supply of components after the country's exit from the EU. Let me remind you that in August, automakers such as Toyota and BMW (Mini) announced stopping production of cars at British factories on October 31 and November 1 for the same reason.

This morning, the pound was no longer set, a speech will be made by a member of the Bank of England Monetary Policy Committee, Michael Saunders, who said that regardless of Brexit's outcome, whether hard or by agreement, the UK needs to cut its key rate. Naturally, the pound could not resist such positive news and continued to decline in the form of a local impulse candle (08:00 London time). In terms of news flow, in the afternoon, we are waiting for data on orders for durable goods in the United States, where they are predicted to decrease by 0.1%, which may put local pressure on the US dollar.

The upcoming trading week in terms of the economic calendar expects to be no less interesting. So, since Monday, we have a stream of statistical data, which will publish an estimate of GDP (Q2) of the UK, after which we have packages of indices and, of course, NonFarm data, which will not be ignored by speculators.

The most interesting events displayed below:

On Monday, September 30th

Great Britain 09:30 London time – GDP y/y Q2: Prev 1.2%

Great Britain 09:30 London time – Number of approved mortgages (August): Prev 67.31K – Forecast 66.17K

Great Britain 09:30 London time – Volume of mortgage lending (August): Prev 4.61V – Forecast 3.70V

On Tuesday, October 1st

Great Britain 09:30 London time – The index of business activity in the manufacturing sector Markit (September): Prev 47.4

USA 15:00 London time – ISM index of business activity in the manufacturing sector (September): Prev 49.1 – Forecast 50.4

On Wednesday, October 2nd

USA 15:00 London time – Change in the number of employees in the non-agricultural sector from ADP (September): Prev 195K– Forecast 153K

On Thursday, October 3rd

Great Britain 09:30 London time – Composite PMI (September): Prev 50.2

Great Britain 09:30 London time – Index of business activity in the services sector (September): Prev 50.6 – Forecast 51.0

USA 15:00 London time – ISM business activity index for services sector (September): Prev 56.4 – Forecast 55.8

On Friday, October 4th

USA 13:30 London time – The number of new jobs created outside the agricultural sector (September): Prev 130K – Forecast 162K

Further development

Analyzing the current trading chart, we see a local speculative surge due to the speech of Michael Saunders, after which a partial recovery effect, which fully reflects the speculative process. The very same movement in terms of recovery is developing in the right format, overcoming the periodical coordinates of 1.2300. In turn, speculators continue to feast, previously open trades in the area of 1.2325 is already profitable, where the background of the jump was a partial commit.

It is likely to assume that the surge caused by the information background, temporarily stalled in the area of current values, where it is necessary to observe the behavior of quotes and how sellers are willing to go further in terms of decline. Thus, the outcome of the current day can be in two scenarios: Firstly, the hype subsides and we again return to the level of 1.2350, where we already observe the behavior of the quotes, in terms of the next gulf of short positions; the second scenario displays the opposite picture, that is, relative to the current points, a stop is formed, where, as a result, sellers come back, which are fixed below 1.2270, which makes it possible to resume the downward move towards 1.2200 – 1.2150.

Based on the above information, we concretize trading recommendations:

- Buy positions, if they are considered, then in the form of speculative operations in the direction of 1.2350. I consider this approach risky, so it's better not to rush and wait until the price fixation is higher than 1.2380, which will be focused on the move in terms of maintaining an oblong correction.

- Sell positions are considered in terms of continuing the downward trend in terms of restoring the trend, wherein the case of fixing the price below 1.2270, you can expect a move to 1.2200 – 1.2150.

Technical analysis

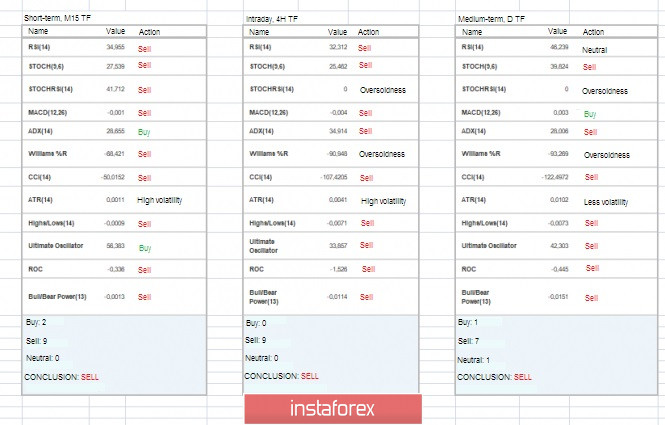

Analyzing a different sector of timeframes (TF), we see that the process of restoring quotes turned all the indicators in the downward direction, where we see an almost unanimous decision. As you know, in the case of the first scenario, the indicators on the minute and intraday intervals will turn in the opposite direction.

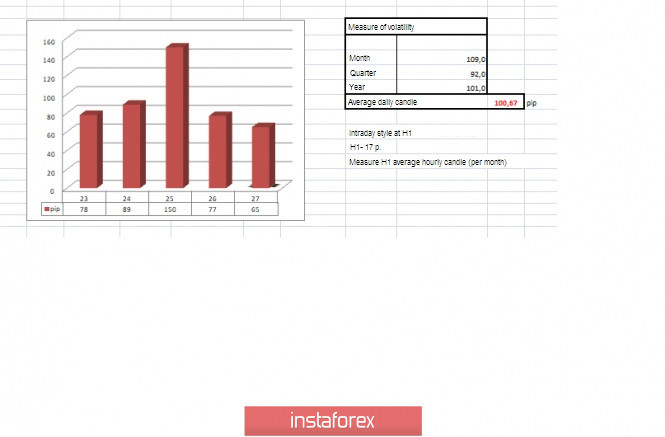

Volatility per week / Measurement of volatility: Month; Quarter; Year

Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year.

(September 27 was built taking into account the time of publication of the article)

The volatility of the current time is 65 points, which is not bad for this period. It is likely to assume that volatility can still grow, but in the case of a slowdown and a proper background, we will be limited to 80-100 points.

Key level

Resistance zones: 1.2350**; 1.2500**; 1.2620; 1.2770**; 1.2880 (1.2865-1.2880)**.

Support zones: 1.2150**; 1.2000***; 1.1700; 1.1475**.

* Periodic level

** Range level

*** The article is based on the principle of conducting transactions, with daily adjustments.