To open long positions on GBP/USD, you need:

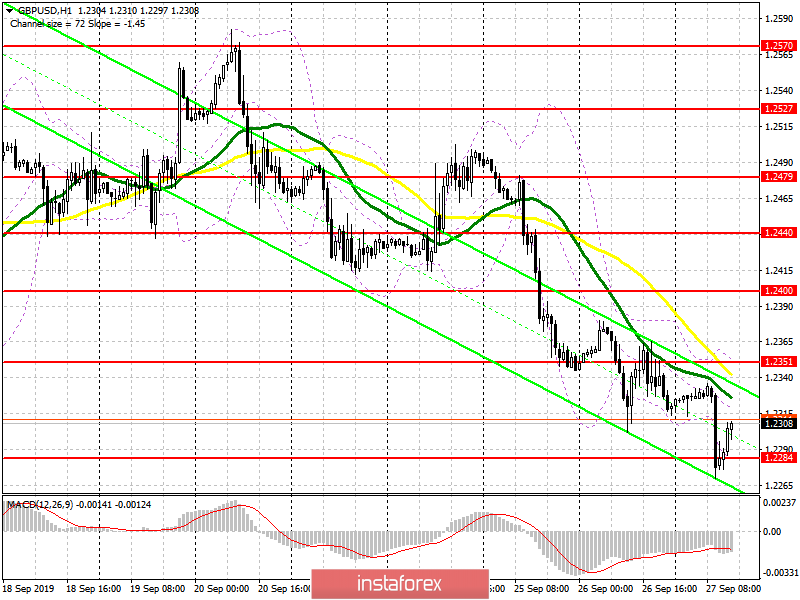

In the first half of the day, the update of a large support in the area of 1.2284, which I drew attention to in my morning review, led to a return to the buyers market, and a large surge in volume at this level indicated the exit of speculative sellers of the pound by the end of the week. At the moment, the task of the bulls remains the test level of 1.2351, where I recommend fixing the profit. In the scenario of GBP/USD decline in the second half of the day after the US data, it is best to consider new long positions from the new monthly low of 1.2238, as bulls are unlikely to try to hold the support of 1.2284 again.

To open short positions on GBP/USD, you need:

The bears have completed all the tasks for this week and retreated after the test minimum of 1.2284, which I paid attention to in the morning. At the moment, it is best to count on short positions in the pair after the formation of a false breakdown in the resistance area of 1.2351 or sell immediately for a rebound from the maximum of 1.2400. The main movement will be based on data on the spending and income of Americans, which is a leading indicator of the future state of the economy. If sellers manage to break below the level of 1.2284 in the second half of the day, the downward trend is likely to be limited only in the support area of 1.2238.

Signals:

Moving Averages

Trading is below 30 and 50 daily averages, which indicates a bearish trend.

Bollinger Bands

The resistance is the average border of the indicator around 1.2315, a breakthrough of which will lead to larger growth of the pound.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20