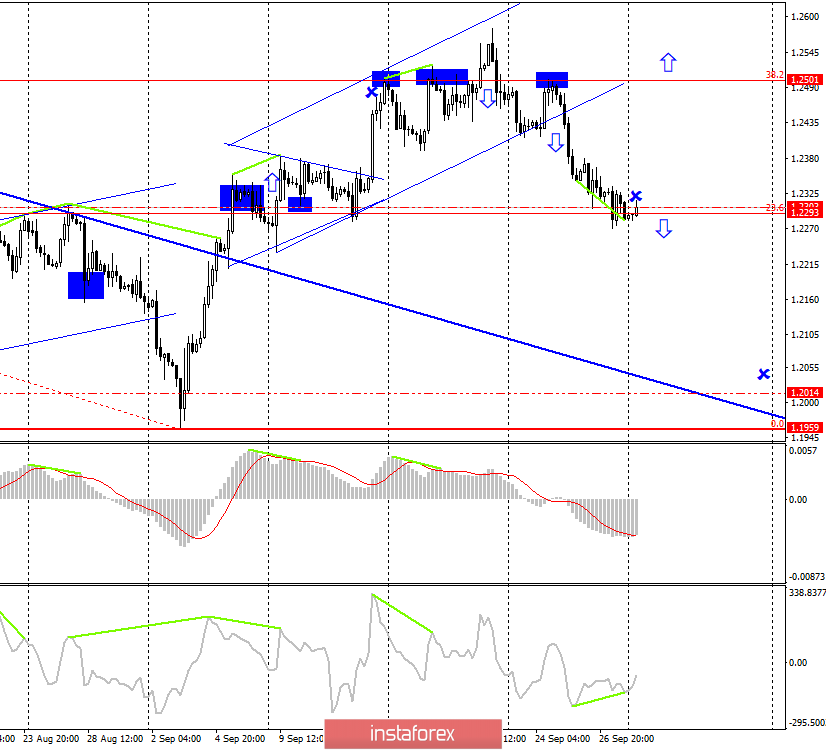

GBP/USD – 4H.

As seen on the 4-hour chart, the GBP/USD pair performed a fall to the corrective level of 23.6% (1.2293), an attempt to close below this level, which ended unsuccessfully. A weak and corrective bullish divergence was formed at the CCI indicator, which allows traders to expect some growth of quotations in the direction of the correction level of 38.2% (1.2501). However, most likely, the growth will be small. The closing of the pound/dollar pair under the Fibo level of 23.6% will increase the probability of continuing the fall towards the level of 1.2014.

Now, about the information background. I already discussed in a previous article what options for implementing Brexit are possible if we talk about Boris Johnson as the Prime Minister of Great Britain. Recently, however, there have been many rumors about a possible vote of no confidence in the Prime Minister and the impeachment of the Prime Minister. In general, the chair under the prime minister is swinging openly, and Labor leader Jeremy Corbyn is ready to take Johnson's place, albeit temporarily, just to prevent Brexit's implementation of "No Deal". I believe that a vote of no confidence will not be announced until October 31 – exactly when it becomes known what awaits the UK in the coming months. Either Johnson implements Brexit in some way or a new postponement of the exit dates. It is after October 31 that Parliament can start a war to remove the Prime Minister from his post. At the same time, talk of impeachment will be possible. Now, it will be necessary to resolve the issue with Brussels, either an agreement or the transfer of Brexit, it is unlikely that Parliament will go to the removal of Johnson. And it is not so simple and not so fast as it would be desirable to deputies.

So far, Boris Johnson can only be blamed for deliberately misleading Queen Elizabeth II. Nothing more. Boris Johnson says he still implements Brexit with or without a deal, contrary to the will of the Parliament, but has not yet implemented anything. Therefore, there is nothing to judge him for. Regarding the illegal suspension of the Parliament, the Prime Minister has the right to take such a step. And the fact that the Court found the prorogation illegal, so he recognized it because of the reasons for the prorogation itself. When the country is at a distance of 2 months from a possible exit from the European Union, deputies cannot be sent on vacation, as they are deprived of the opportunity to influence Brexit and the actions of the government. It turns out that the Court made such a decision only in the circumstances. If Brexit weren't, then the prosecution would be recognized as legal.

Well, the key fact is that never in the history of Great Britain has the Parliament "dismissed" the Prime Minister. On the other hand, dismissal may not be necessary. In such cases, the Prime Minister himself resigns from his post. So it was with Theresa May, for example. However, will this be the case with Boris Johnson?

What to expect from the pound/dollar currency pair today?

The pound/dollar pair continues the process of falling. Today, traders have the right to expect consolidation under the correction level of 23.6% (1.2293) and further fall of the pound/dollar pair towards the level of 1.2014. The information background will remain generally negative for the pound but today's news about GDP for the second quarter supported this currency. Still, a rollback to the top is now possible.

The Fibo grid is based on the extremes of March 13, 2019, and September 3, 2019.

Forecast for GBP/USD and trading recommendations:

I do not recommend buying the pair soon, as the pair can now perform a maximum rollback to the top.

I recommend considering the new sales of the pair with a target of 1.2014 if a close is performed under the level of 23.6%, with the stop-loss above the level of 1.2308.