To open long positions on GBP/USD, you need:

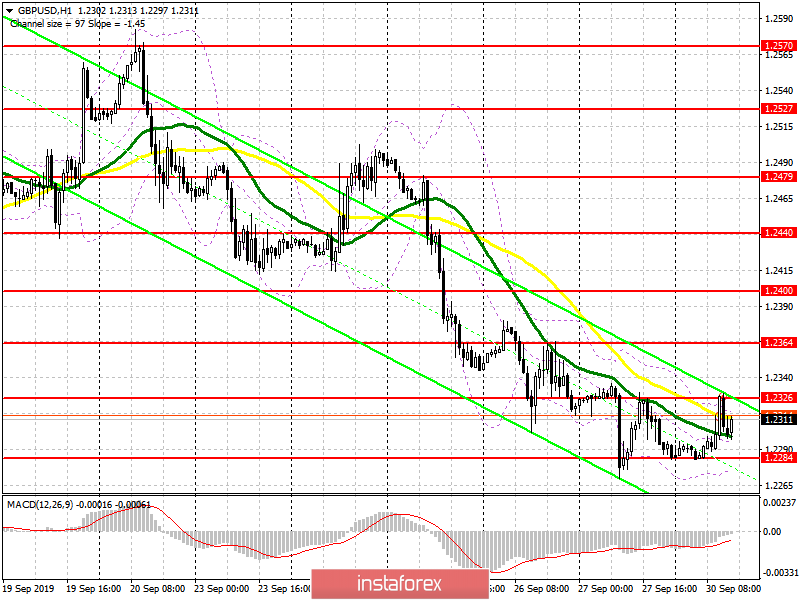

The decline in GDP, the decline in net loans and the growth of the negative balance – the result of the first half for the British pound, which ignored all these data, which may indicate the beginning of an upward correction, as there are no people willing to sell GBP/USD at the current lows. Technically, nothing has changed. Buyers of the pound made an unsuccessful attempt to break through the maximum of 1.2326, however, it was not yet possible to get beyond this range. Either the formation of another false breakdown in the support area of 1.284 or a breakthrough of the resistance at 1.2326, will lead to an upward correction of the pair to the area of a larger maximum of 1.2364, where I recommend taking the profit. If the level of 1.2284 is broken in the second half of the day, which will return to the market of large sellers, then it is best to consider new purchases in GBP/USD after updating the lows around 1.2238 and 1.2165.

To open short positions on GBP/USD, you need:

The bears managed to defend the level of 1.2323, which I paid attention to in the first half of the day. However, a larger downward correction from it was not formed even after the release of weak fundamental statistics on the state of the UK economy. Only the breakthrough of the minimum of 1.2284 can lead to a further decline in GBP/USD to the area of 1.2238, but the longer-term goal of the bears for the middle of this week will be the support of 1.2165, where I recommend fixing the profits. If the pressure on the pair weakens in the first half of the day, and the bulls take the level of 1.2326, it is best to sell the pound immediately on the rebound only after the test of the maximum of 1.2364, or even higher, from the resistance of 1.2400, as the market may begin a strong upward correction.

Signals:

Moving averages

Trading is conducted in the area of 30 and 50 daily averages, which indicates a possible growth of the market in the short term.

Bollinger Bands

In the case of a decline in the afternoon, the lower border of the indicator in the area of 1.2270 will act as support. A break of the upper border in the area of 1.2325 will only increase demand for the pound.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20