GBP/USD

Analysis:

Changes occurred in the current upward wave of July 30. The potential of the counter decline from September 13 exceeded the level of the rollback of the last section. Either a full correction or the first part of the downward wave is formed. The price rebounded from the upper border of the potential reversal zone. The price rise that began yesterday has a reversal potential.

Forecast:

Today, a downward pullback is expected on the pound chart, which balances the previous growth. The bearish rate is likely until the end of the day. The completion of the correction and a return to price growth can be expected tomorrow.

Potential reversal zones

Resistance:

- 1.2320/1.2350

Support:

- 1.2250/1.2220

Recommendations:

The best tactic today is to stay out of the market. Intraday supporters may sell the pound briefly. In the area of the support zone, it is recommended to monitor the signals of your vehicle for the purchase of the instrument.

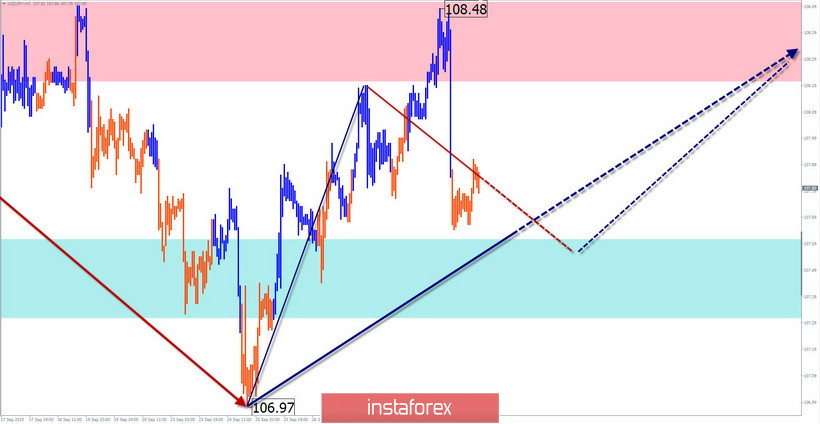

USD/JPY

Analysis:

The short-term trend of the Japanese yen sets the algorithm of the upward wave of August 25. A week ago, it started the final part (C). Yesterday, the price rolled back down from the intermediate resistance, forming a correction.

Forecast:

The price decline is expected to be completed in the coming sessions. Reversal within the boundaries of the settlement support. The beginning of price growth is possible at the end of the current day.

Potential reversal zones

Resistance:

- 108.20/108.50.

Support:

- 107.60/107.30

Recommendations:

For yen sales, the expected downside potential is small. It is recommended to refrain from trading at the time of decline and to look for signals to buy the pair at its end.

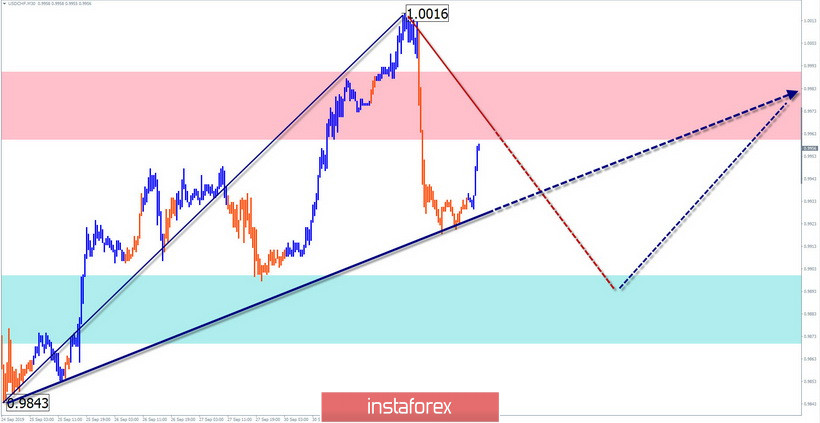

USD/CHF

Analysis:

On the franc chart, a stretched plane has been developing since the end of June. The structure of the entire wave is not complete, so the bullish trend will continue. Its last section reached the intermediate resistance level, from which the price yesterday rolled back down.

Forecast:

The started decline has all the chances to last today. The morning pullback up may be replaced by a decrease in the next session. The lower limit of the expected daily move shows the support zones.

Potential reversal zones

Resistance:

- 0.9960/0. 9990

Support:

- 0.9900/0. 9870

Recommendations:

The optimal strategy for today is to refuse to trade at the time of decline. Intraday traders can make short-term sales of the pair.

Explanations: In the simplified wave analysis (UVA), the waves consist of 3 parts (A-B-C). The last unfinished wave is analyzed. The solid background of the arrows shows the formed structure, dotted – the expected movement.

Attention: The wave algorithm does not take into account the length of time the tool moves!