To open long positions on EURUSD, you need:

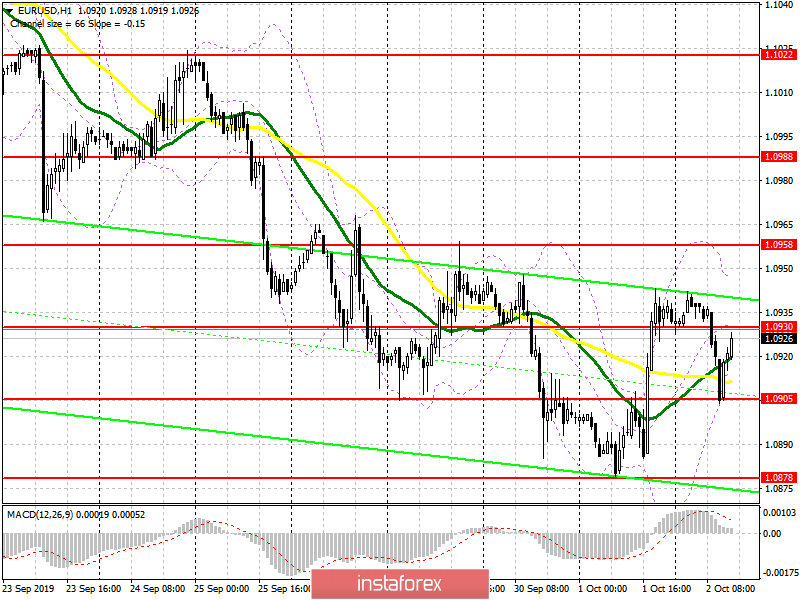

The absence of important fundamental statistics allowed the sellers of the euro to break below the level of 1.0930, however, the bulls returned to the market from the support of 1.0905, from which I recommended buying in the morning review. At the moment, the more important task will be to break through and consolidate above the resistance of 1.0930, which will only strengthen the demand for the euro and lead to an update of this week's maximum in the area of 1.0958, where I recommend taking the profit. However, under the scenario of the release of good statistics on the American labor market, the release of which is scheduled for the afternoon, a second wave of EUR/USD decline is possible. In this case, it is best to consider new purchases on a rebound from a minimum of 1.0878.

To open short positions on EURUSD, you need:

The bears coped with the morning task and broke below the support level of 1.0930, updating the minimum of 1.0905, where the profit was fixed. At the moment, short positions in EUR/USD are best calculated after the release of a weak report from ADP, as well as under the condition of forming a false breakdown in the resistance area of 1.0930. The main task of sellers will be to return and consolidate below the support of 1.0905, which will increase the pressure on the euro and lead the pair to the lows of the week in the area of 1.0878, where I recommend taking the profit. In the case of EUR/USD growth above the resistance of 1.0930, short positions can be considered immediately on the rebound from the resistance of 1.0958.

Indicator signals:

Moving Averages

Trading is just above 30 and 50 moving averages, indicating an attempt to return to the market of euro buyers.

Bollinger Bands

With further growth of EUR/USD, the upward trend will be limited to the upper limit of the indicator 1.0950.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20