To open long positions on GBP/USD, you need:

The pound fell on data on the construction sector, wherein September this year there was an even greater reduction in the activity. However, the bulls took advantage of this moment and tried to return to the market. For a larger upward correction, buyers of the pound need a breakout and consolidation above the resistance of 1.2263, which will lead to an update of the highs in the area of 1.2327, where I recommend taking the profit. If the US labor market data is better than economists' forecasts, the pressure on the pair may return. In this scenario, it is best to open new long positions from the week's low at 1.2207, subject to the formation of a false breakdown there or buy the pound to rebound from the level of 1.2165.

To open short positions on GBP/USD, you need:

Bears need to keep the pair below the resistance of 1.2263, and good data from ADP will serve as an additional signal to open short positions to update and break the low of this week at 1.2207. Only such a scenario will push GBP/USD to the area of new support levels of 1.2165 and 1.2112, where I recommend taking the profit. If the US labor market data leads to a breakout of the resistance at 1.2263, then it is best to return to short positions in the pair after updating the maximum at 1.2327 or rebounding from the larger level at 1.2364.

Indicator signals:

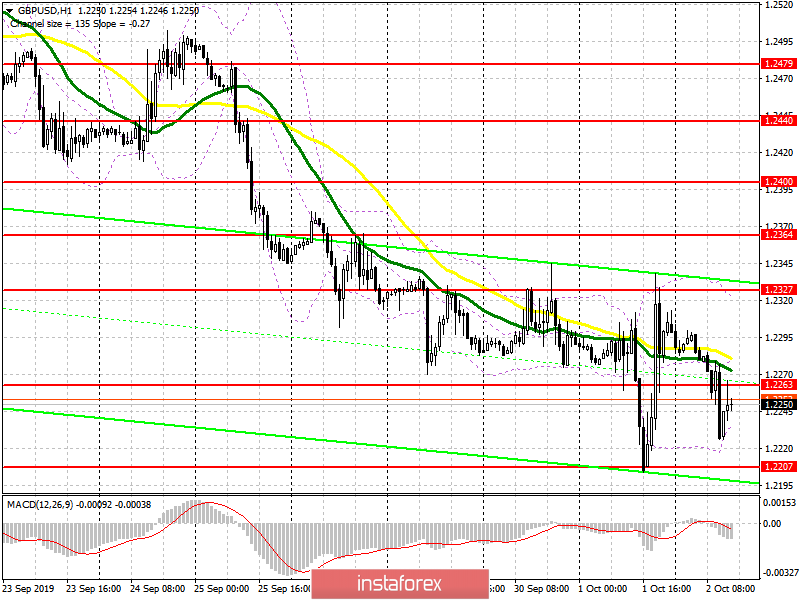

Moving Averages

Trading is conducted below 30 and 50 daily averages, which indicates a further decline in the market.

Bollinger Bands

In the scenario of growth of the pound, you can count on sales immediately on the rebound after the test of the upper limit of the indicator in the area of 1.2327.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20