To open long positions on EURUSD, you need:

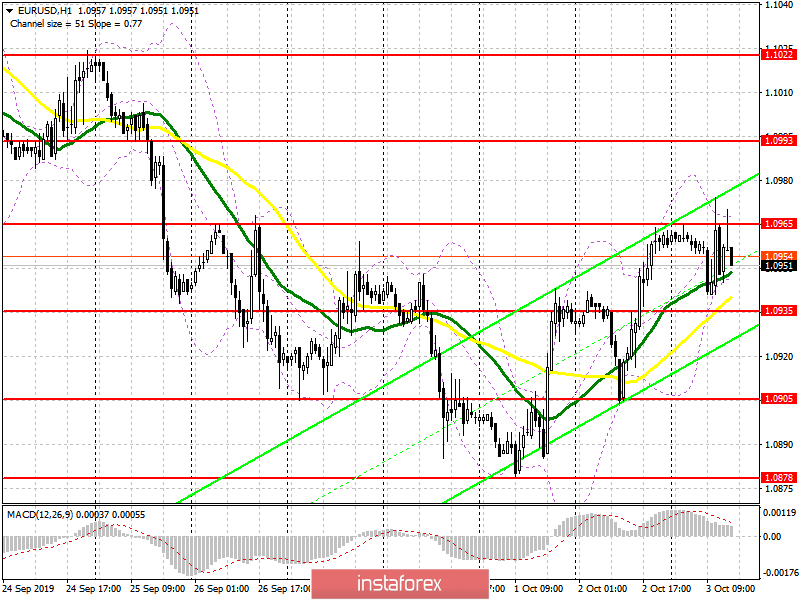

The euro continues to experience problems with growth above the level of 1.0965 after the release of weak data, which indicated a slowdown in the growth of activity in the services sector of the eurozone, as well as a decline in producer prices. However, bad reports did not lead to a sharp decrease in EUR/USD, leaving the technical picture unchanged compared to the morning forecast. Only a weak report on the activity of the US non-manufacturing sector will lead to a repeated resistance test of 1.0965, and the breakdown of this level will resume the upward trend, the goal of which remains the highs of 1.0993 and 1.1022, where I recommend taking the profit. In a good data scenario, it is best to return to long positions in EUR/USD on a false breakdown from the level of 1.0935 or buy on a rebound from yesterday's large support of 1.0905.

To open short positions on EURUSD, you need:

The bears coped with the morning task and did not allow the bulls to get above the resistance of 1.0965, forming a false breakdown. While trading is below this range, the sellers' target will be the test of the minimum of 1.0935, the breakdown of which will quickly return EUR/USD to the area of yesterday's support of 1.0905, where I recommend taking the profit. If the data on the activity of the non-productive sector is worse than the forecasts, the bulls can regain the resistance of 1.0965. In this scenario, it is best to return to short positions from the resistance of 1.0993 or sell for a rebound from a larger high of 1.1022.

Indicator signals:

Moving Averages

Trading is just above 30 and 50 moving averages, indicating an attempt to return to the market of euro buyers.

Bollinger Bands

A break of the upper border of the indicator in the area of 1.0965 will lead to a larger wave of euro growth.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20