To open long positions on GBP/USD, you need:

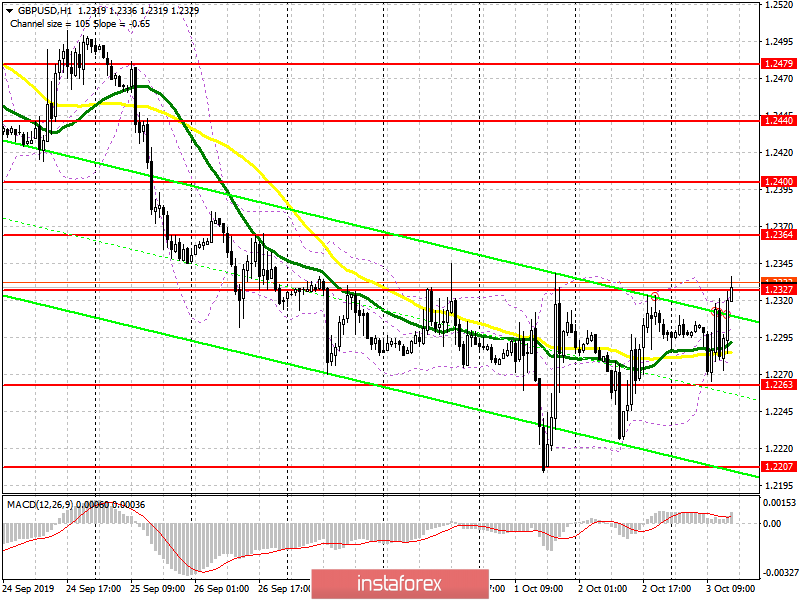

Yesterday's proposal for Brexit from the UK government leaves hope for the growth of the pound, as even a weak report on the index of activity in the service sector, which fell below 50 points, did not lead to a sharp sell-off of the pair, which is a very strong bullish signal. At the moment, bulls are trying to break through above the resistance of 1.2327, above which there is several sellers' stop orders. Their demolition will lead to a larger upward correction in the area of highs 1.2364 and 1.2400, where I recommend fixing the profit. In the correction of the pound, which may occur after the release of reports on the composite PMI index of the USA, it is better to return to long positions on a false breakdown from the support of 1.2263 or buy immediately on a rebound from a minimum of 1.2207.

To open short positions on GBP/USD, you need:

Sellers are trying to protect the resistance level of 1.2327, but it is unlikely to do so since even the terrible report on the service sector did not lead to a major sell-off of the pair. Most likely, the bears will release the level of 1.2327 and move a little higher, to the resistance area of 1.2364, where you can see short positions only if there is a false breakdown, or larger sellers will show themselves at the maximum of 1.2400. The main goal will be to return and consolidate below the support of 1.2263, which will necessarily lead to a decrease in GBP/USD to the area of the month's minimum of 1.2207, where I recommend fixing the profits.

Indicator signals:

Moving Averages

Trading is above the 30 and 50 daily averages, indicating a high probability of an upward correction.

Bollinger Bands

In the scenario of the pound decline, you can expect to buy immediately on the rebound after the test of the lower limit of the indicator in the area of 1.2263.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20