To open long positions on GBP/USD you need:

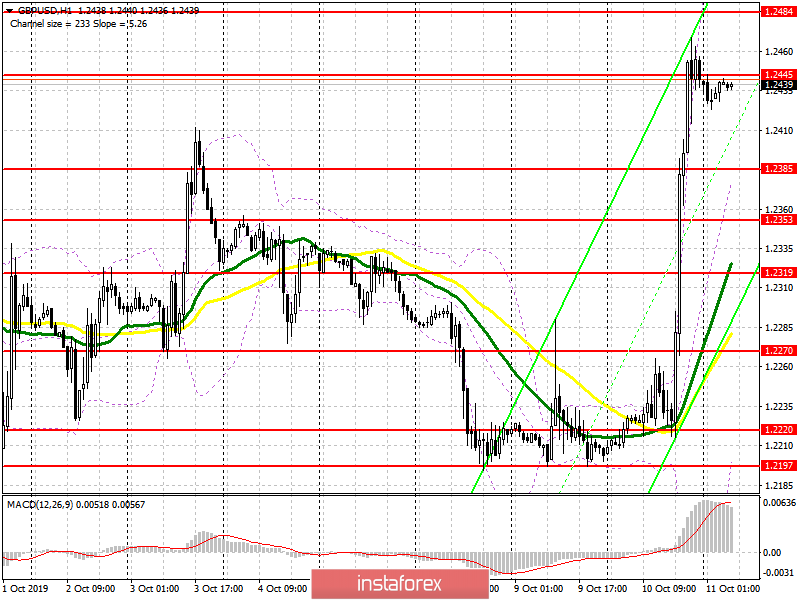

The British pound strengthened after the meeting of the two prime ministers, however, if you look at the minutes in more detail, in fact, the negotiations did not bring any result. The only thing that inspires optimism among traders is an agreement to continue negotiations on the border issue, since even yesterday the prime minister of Ireland was categorically against any meetings. Buyers need to regain the resistance of 1.2445 today, which could trigger a new wave of purchases to the highs of 1.2484 and 1.2527, where I recommend taking profits. Under the scenario of GBP/USD decline in the morning, long positions can be returned after updating the lows of 1.2385 and 1.2353.

To open short positions on GBP/USD you need:

Today, an important meeting of EU and UK representatives on the Brexit issue will take place, on which it will depend whether the pound continues to grow or the bears return to the market. The formation of a false breakdown in the resistance area of 1.2445, or a test of a new high at 1.2484, with confirmation of divergence on the MACD indicator - all this will be the first signal to open short positions in the calculation of a downward correction in the support area of 1.2385 and 1.2353, where I recommend taking profit. In the scenario of further growth of GBP/USD, after the publication of the results of the above meeting, it is best to return to short positions to rebound from the highs of 1.2527 and 1.2570.

Signals of indicators:

Moving averages

Trading is conducted above 30 and 50 moving averages, which indicates the maintenance of a bullish trend.

Bollinger bands

Under the scenario of pound decline, support will be provided by the lower boundary of the indicator in the area of 1.2385. Growth will be limited by the upper level at 1.2560.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: Fast EMA 12, Slow EMA 26, SMA 9

- Bollinger Bands 20