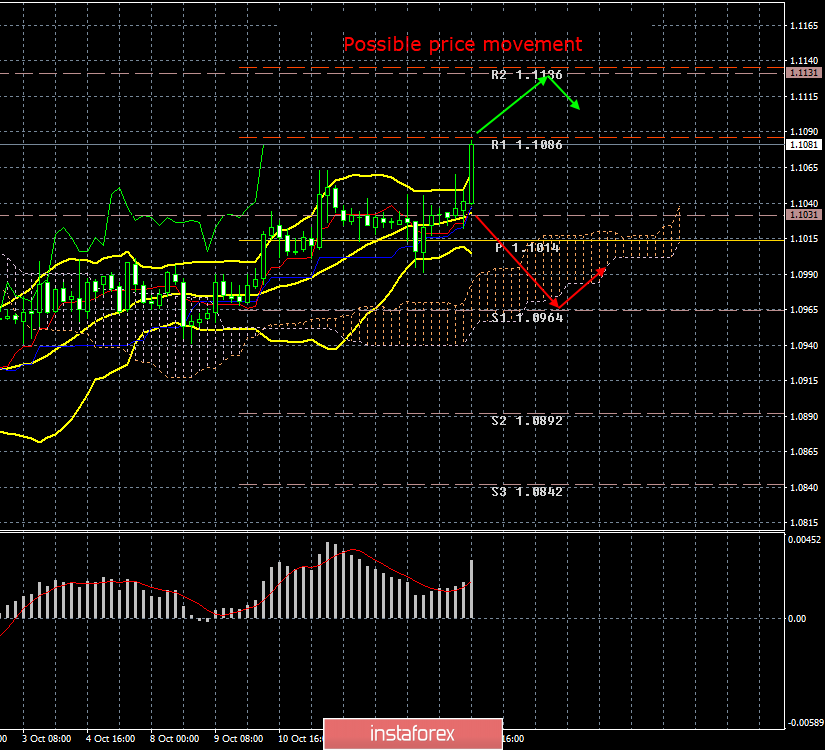

4-hour timeframe

Amplitude of the last 5 days (high-low): 37p - 64p - 62p - 30p - 55p.

Average volatility over the past 5 days: 50p (average).

The EUR/USD currency pair continued its upward movement on October 16 in accordance with the upward trend of recent weeks. At first glance, it may seem that the strengthening of the euro currency today is not logical, but it is not. During the third trading day of the week, two macroeconomic reports were published. We had high hopes on the first of them – the consumer price index in the European Union for September. Hopes associated with the fact that traders wake up after days of stomping in one place. The fact that inflation in the EU can continue to slow down could be assumed, since there are no grounds for any other assumptions. Experts expected that in September the consumer price index will remain the same, but in reality inflation continued to decline and amounted to 0.8% y/y. From our point of view, this is already of critical importance. If earlier the head of the ECB, Mario Draghi, regularly noted that inflation supposedly is far from the target levels, then now there is somehow little sense in focusing attention on it. It was after such figures that we expected the euro to complete its ascending tread. However, in practice, traders did not respond to the inflation report. This fact seems to reveal a lot to us. It seems that market participants are so accustomed to weak macroeconomic statistics from Europe that they ceased to respond to it. This is a very positive factor for the euro, since now only the negative from the United States will be perceived by the market. A portion of disappointing news was also received at the other side today. Retail sales, which were expected with an increase of 0.3% in September, actually decreased by 0.3%. Excluding car sales, a decrease of 0.1% was recorded with a forecast of + 0.2% m/m. Since the discrepancy between the forecast and the real value was very large, traders rushed to sell the US dollar, which led to a new rise in the euro.

What next? Firstly, we focus on the upward trend, which can no longer be called short-term. Secondly, ignoring the inflation report may mean that most of the traders are no longer configured to sell the euro. Thirdly, if the Federal Reserve will reduce the key rate at the end of the month, this could provide serious support for the euro. Unfortunately, such a take-off and good prospects for the euro can easily be offset by the European Central Bank, if that, in turn, also goes for an even greater reduction in the key rate, which is already negative. In addition, the European Union, like the United States, does not need an expensive national currency, especially on the verge of a trade war with America, so the ECB can "work" to ensure that the euro does not show a strong strengthening in the foreign exchange market.

Thus, at the moment, we note that the upward trend continues. The euro/dollar is often adjusted, but is confidently moving up, as all technical indicators signal. There will be no important news tomorrow, except for the report on industrial production in the US, so a new pullback of the pair is possible. Moreover, the first resistance level of 1.1086 is perfectly worked out and a rebound from it will also show the beginning of a round of corrective movement.

Trading recommendations:

The EUR/USD pair resumed the upward movement. Thus, it is now recommended to trade for an increase in general, however, not overcoming the first target 1.1086 may trigger a round of downward correction. If tomorrow the US industrial production report fails, it will be a new growth factor for the euro.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicator window.