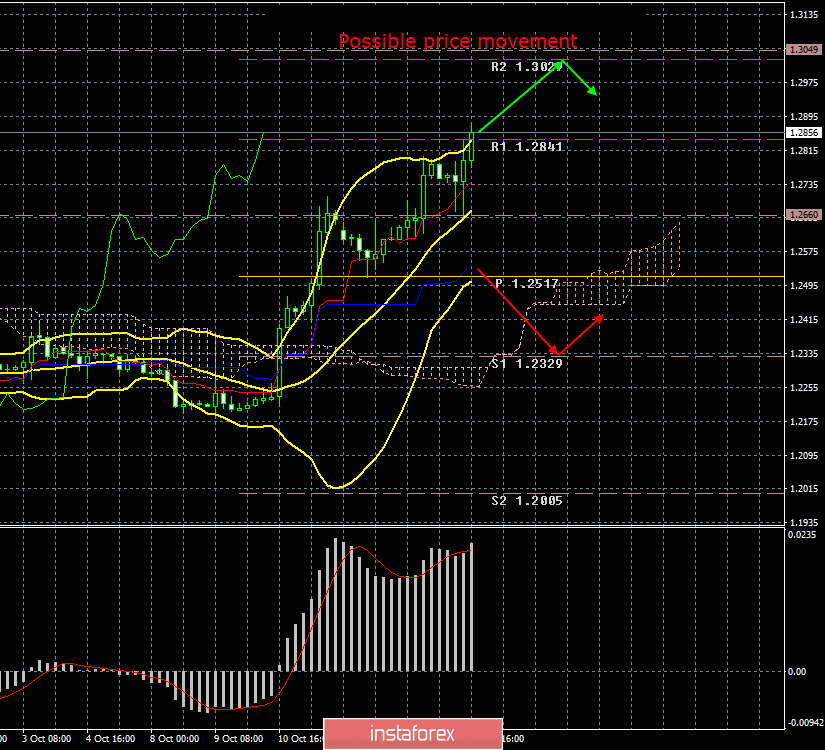

4-hour timeframe

Amplitude of the last 5 days (high-low): 93p - 264p - 298p - 134p - 198p.

Average volatility over the past 5 days: 197p (high).

The pound sterling paired with the US currency continues a strong upward movement, as well as breaking all volatility records. The average volatility over the past five days is already almost 200 points. Nearly all of these 200 points of steam usually goes only one way, up. The September inflation report was published in the UK today, which showed that experts' forecasts about accelerating inflation to 1.8% y/y did not come true. The consumer price index remained at around 1.7% y/y, and in monthly terms a low price increase of 0.1% was recorded. But what does it matter if traders received a new batch of comments from top officials of the European Union that a Brexit deal could be concluded before the end of the week? Whenever we hear such a wording, I want to add "maybe not concluded". However, participants in the foreign exchange market do not take the second part of this phrase into account, so the pound continues to grow.

Today, President of the European Council Donald Tusk said that "theoretically, the fate of Brexit can be decided within 7-8 hours." What this means is unknown. Either the parties have to agree on a couple of issues, and the deal between Brussels and London is almost a settled matter. Either the European Union is still waiting for some kind of concession from London, but it may not wait for it. Unclear. However, most of the traders regarded Tusk's words as a signal that the parties were close to signing an agreement, so new purchases of the British currency followed. Donald Tusk also added that the main provisions of the document have already been agreed and, theoretically, the deal can be signed on October 17, that is, on the first day of the EU summit. However, Tusk also notes that "everything is possible with our British colleagues," clearly hinting at possible surprises from Boris Johnson.

The Prime Minister of Ireland Leo Varadkar also spoke today. He said that he had a conversation with Boris Johnson over the phone and believes that there really is progress in the negotiations. "There are still a few issues that need to be addressed," adds Varadkar. The prime minister of Ireland also hopes that these issues will be resolved today in order to ratify the agreement with the European Union tomorrow, and on Saturday to allow the British Parliament to consider it and vote.

At the same time, sources in Brussels say that there are still many unresolved issues, and negotiations continue almost around the clock. As usual, the rhetoric of Johnson and the EU is different. The only question is whether the parties will ultimately be able to come to an agreement. Actually, we can find out about this tomorrow, when the EU summit begins and information begins to flow from it.

All the action will end on Saturday, when the British Parliament will meet in any case, since it will either have to vote for Boris Johnson's "deal" with the European Union, or decide whether the "divorce" is postponed until January 31, 2020. In any case, before the end of the week it will become clear what awaits Britain in the next few months, and possibly years.

The technical picture remains unchanged - a strong upward movement. At the moment, the first resistance level of 1.2841 has been worked out, however, the upward movement can easily continue if tomorrow the deal on Brexit is ratified.

Trading recommendations:

The GBP/USD currency pair continues to move up. Thus, we recommend now continuing to trade on the rise, especially for those who are already in long positions, with the target of 1.3029. But the opening of new purchases, from our point of view, involves high risks. Sales of the pair are now not relevant at all.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicator window.