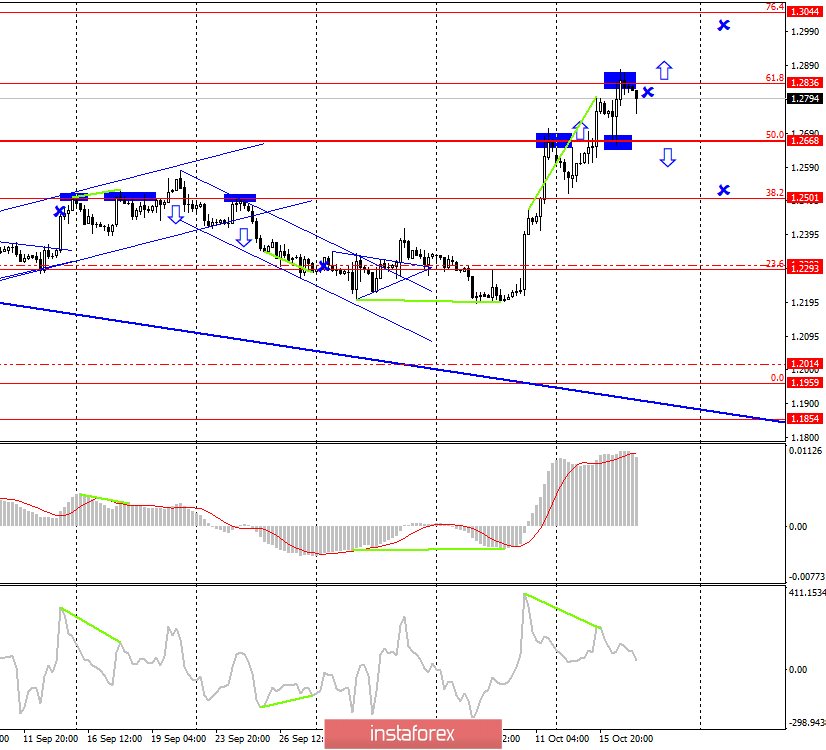

GBP/USD – 4H.

As seen on the 4-hour chart, the GBP/USD pair performed a rebound from the correction level of 50.0% (1.2668), a reversal in favor of the pound and an increase to the Fibo level of 61.8% (1.2836). At the current moment, we can say that this level was also followed by a rebound, which allows traders to count on some fall in the direction of the level of 50.0%. Closing quotes above the Fibo level of 61.8% will increase the probability of continuing growth towards the next correction level of 76.4% (1.3044). There are no new emerging divergences today.

The pound remains at the mercy of rumors. The British pound rose several days in a row based on the fact that the EU and the UK converged in negotiations. Brexit "With Deal" has already begun to loom on the horizon, however, I have already said that Johnson and the EU can agree on anything, however, if this version of the agreement is not supported by Parliament, there will be no deal. Boris Johnson has no majority in Parliament. Simply put, he cannot pass laws by the forces of his party and its allies alone, he needs the support of the opposition. And the opposition is to protect the interests of those segments of the population who do not agree with the opinion of the majority and, in particular, with the policy of Boris Johnson. That is why Jeremy Corbyn is pushing for a second referendum, and the Labor Party as a whole does not want to support the conservatives. However, the votes of the conservatives should be enough if they are supported by the Democratic Union Party. That is what Boris Johnson is counting on. However, this morning, it became known that the Unionists are not satisfied with the current agreement with the European Union. Party leader Arlene Foster said today that her party does not agree with Boris Johnson's concessions to the European Union, does not support customs rules, which are described in the new version of the agreement, and does not understand how VAT issues will be resolved. Unionists insist that the autonomous Parliament of Ireland must approve the deal with the EU, as well as all sectors of society with any political views and principles, which is written in the 1998 Belfast Agreement, which put an end to the conflicts on the island of Ireland, which Britain is afraid to provoke, if between Ireland will have a tight border, which the EU insists on. Negotiations with the Unionists continue, but it is not yet known how it will end.

It is exactly unknown and how the negotiations between the EU and Britain will end. Both sides are making progress, but this does not mean that everything will end on a positive note. At the last moment, there may be a new stumbling block, as at the time there was a problem with the border on the island of Ireland and the unacceptable presence of this border for the peoples of the island.

What to expect from the pound/dollar currency pair today?

The pound/dollar pair rebounded from the correction level of 61.8%, so I expect the pair to fall today. However, it should be noted that new messages from the EU summit of a positive nature will contribute to the birth of new demand for the pound, which may lead to a consolidation above the Fibo level of 61.8% and further growth of quotations. Retail sales in the UK in September rose by 3.1%, but this value is slightly worse than the expectations of traders. However, today and tomorrow, such economic reports will not play a special role.

The Fibo grid is based on the extremes of March 13, 2019, and September 3, 2019.

Forecast for GBP/USD and trading recommendations:

I recommend buying the pair with a target of 1.3044 if a close above the Fibo level of 61.8% is executed with the stop-loss order below the level of 1.2836.

I recommend that you consider selling the pair with the target of 1.2668 today if a rebound from the Fibo level of 61.8% is fulfilled.