To open long positions on EURUSD, you need:

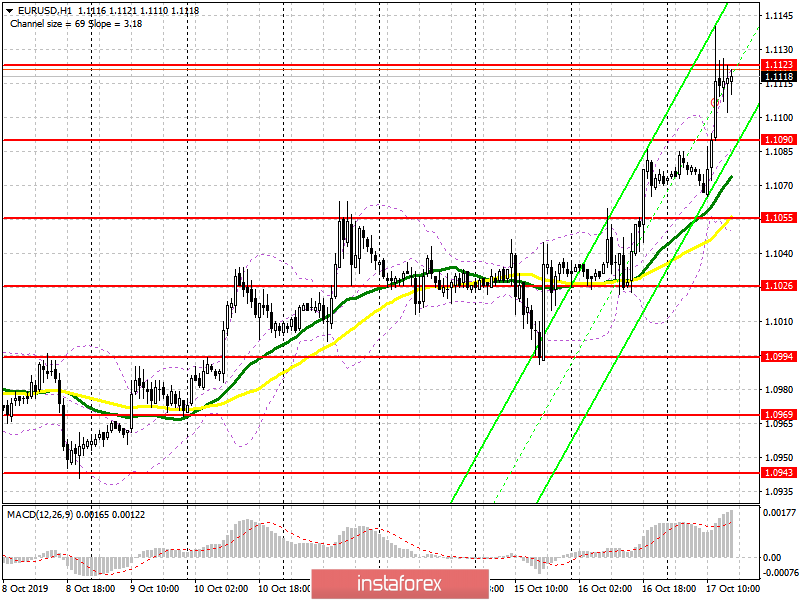

The Brexit plan proposed by Boris Johnson was approved by the EU today at the very beginning of the summit, which led to a sharp increase in the European currency. At the moment, the goal of the bulls is the resistance of 1.1123, a breakthrough of which will provide the pair with new forces that can reach EUR/USD to the highs of 1.1151 and 1.1189, where I recommend taking the profits. Under the scenario of the euro declined in the afternoon, since EU approval for the Brexit deal is still small, I recommend returning to long positions on a false breakdown from the support of 1.1090 or on a rebound from a larger low of 1.1055.

To open short positions on EURUSD, you need:

Pressure on the US dollar remains, as throughout the week there has been the talk of lowering US interest rates. In the afternoon, sellers will wait for the formation of a false breakdown in the resistance area of 1.123. Only under this condition, it is possible to open short positions, counting on the update of the support in the area of 1.1090. However, the further target of the bears will be at least 1.1055, where I recommend fixing the profits. In the scenario of further growth above the resistance of 1.11123, it is best to open short positions in the pair from the maximum of 1.1151, in case of a false breakdown, or on a rebound from 1.1189.

Indicator signals:

Moving Averages

Trading is above the 30 and 50 moving averages, which indicates the continuation of the bullish market.

Bollinger Bands

In the scenario of a pair decline, you can buy immediately on the rebound from the lower border of the indicator in the area of 1.1055.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20