To open long positions on GBP/USD, you need:

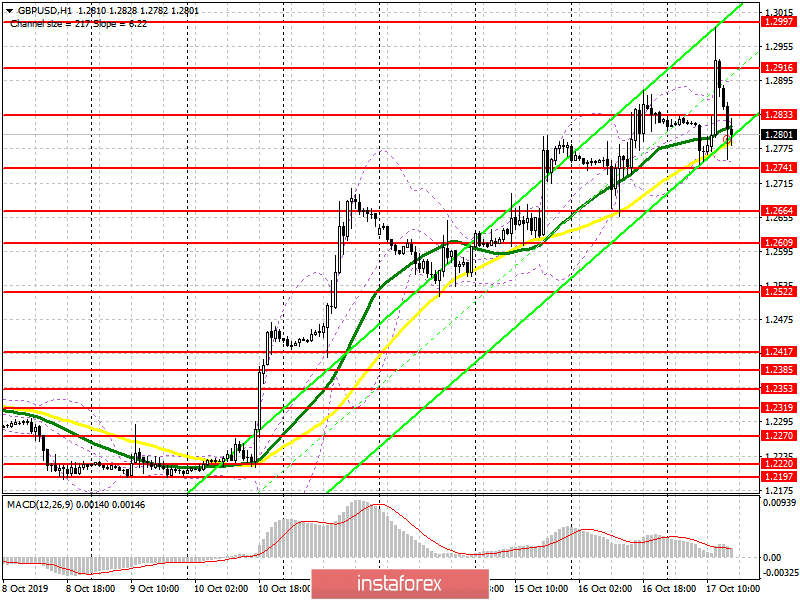

The British pound soared to new highs, from which in the morning I recommended selling the pair. This happened after the expected news that at the EU summit, the leaders of the countries approved the proposed Brexit agreement by Boris Johnson. However, as we can see on the chart, the continuation of the bullish scenario did not happen, and the GBP/USD pair returned to the opening levels of the day. Bulls need to act again. The only consolidation above the resistance of 1.2833 will lead to a re-growth of the pound in the area of 1.2916, and then to a new monthly maximum in the area of 1.2997, where I recommend taking the profits. Pressure on the pound may return after news from the DUP party. In the scenario of the pair's decline, it is best to return to long positions on a false breakdown from the support of 1.2741 or buy immediately on a rebound from the minimum of 1.2664.

To open short positions on GBP/USD, you need:

The next word is for the UK Parliament. Any negative reaction could lead to a major sell-off of the pound. The formation of a false breakdown and an unsuccessful consolidation above the resistance of 1.2833 will lead to the continuation of a downward correction in the pair, which will aim at the lows of 1.2741 and 1.2664, where I recommend taking the profits. With growth above the resistance of 1.2833, short positions can be returned from the level of 1.2916 and sell GBP/USD to rebound from the maximum of 1.2997.

Indicator signals:

Moving Averages

Trading is conducted around 30 and 50 daily averages, which indicates the possible formation of a downward correction in the pair.

Bollinger Bands

If the pound rises, the upper limit of the indicator around 1.2890 will act as a resistance.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20