On Monday, the mood of investors in the financial markets clearly changed in a positive direction under the influence of two events. The first is a definite statement by US President D. Trump that a new trade agreement between the United States and China will be signed at the summit in Chile on November 16-17, while the second news is about the postponement of the resolution of the issue of Britain's exit from the EU in January next year.

If the second message, despite the postponement of the end of Brexit without any end, had practically no effect on the markets, then the certainty that appeared in the outcome of the US-Chinese negotiation process had a noticeable positive effect. In the financial markets, demand for risky assets increased, primarily stocks of companies, while protective instruments, on the contrary, were under pressure.

Moreover, yields on American Treasuries continued to climb, while supporting the US dollar. After a sharp increase on Friday, gold quotes turned down and corrected, returning to a narrow price range that had been formed over the past three weeks. The Swiss franc and Japanese yen also resumed their earlier decline against the dollar. The DXY dollar index, in turn, is getting support.

Another important reason for the appreciation of the American currency is the growing expectations in the markets that the Fed, having lowered its key interest rate by 0.25% following a meeting on Wednesday, may announce a technical pause in order to observe the emerging situation in the US economy.

Now, what else, in our opinion, needs to be paid attention to? This is the likely coincidence of the expectation of a trade agreement between Washington and Beijing and a possible pause in the process of reducing rates by the Federal Reserve. Either these forecasts are mere coincidence, or they come from very informed sources. So, what will become the basis for such a view? We will learn a little later, but we also must admit that there is a certain logic in this, since in many ways the reason for the deceleration of the US economy was the declaration by D. Trump of a trade war, primarily with China.

Assessing the likely development of events, we believe that markets have already taken into account the reduction in interest rates in the United States and the decision on a technical pause could lead to an increase in the dollar exchange rate with a subsequent weakening demand for gold and other protective assets.

Forecast of the day:

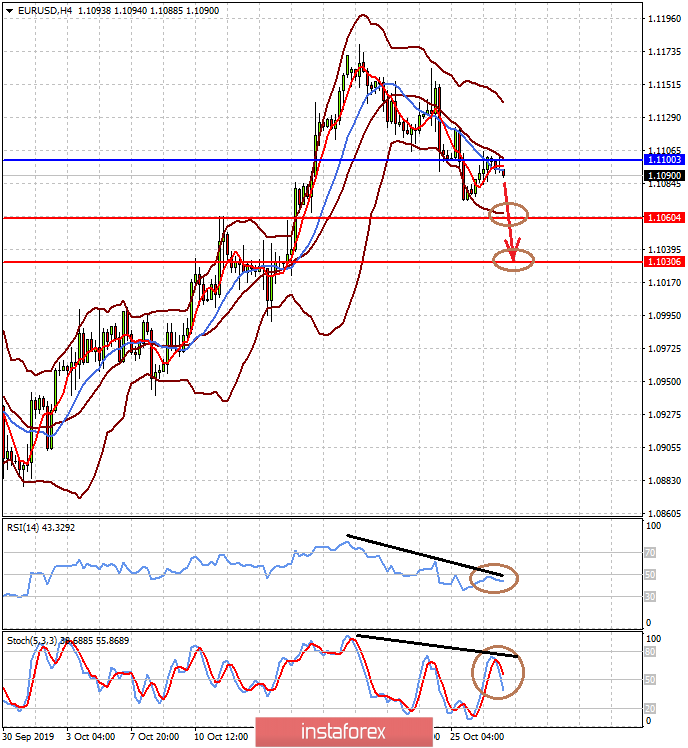

The EUR/USD pair is turning down below the level of 1.1100. If it does not overcome it, it is likely that the price will continue to fall first to 1.1060 and then to 1.1030.

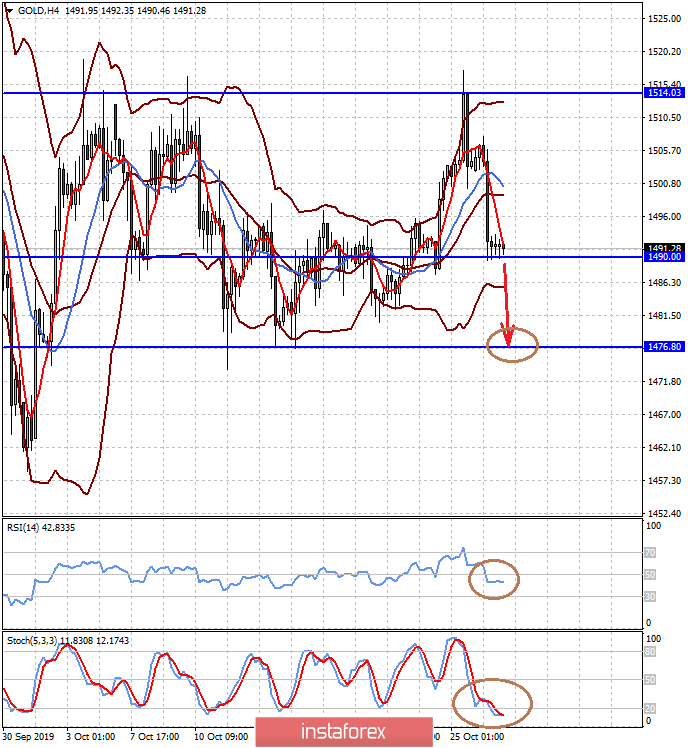

Gold on the spot "sat down" at the level of 1490.00. If it overcomes it, it will lead to the resumption of the fall in prices to 1476.80.