Confidence that the Fed has launched a new expansion program has contributed to positive growth and demand for risky assets, but the Fed's current actions are still apart from what the markets call "quantitative expansion." The Fed is so far limited to buying bills, which leads to an increase in the balance sheet, but so far, there is no connection with the growth of bank reserves, which was typical during previous expansions.

The expectation for the Fed meeting tomorrow suggest that the rate will be reduced by 0.25%. Shortly before the meeting, preliminary data on GDP for the 3rd quarter will be published. The expectations are negative, which is not surprising against the background of current trends. The Federal Reserve Bank of Dallas, Kansas and Chicago reported a drop in regional industrial indices, the consumer confidence index from the University of Michigan came out slightly worse than expected, and the report on durable goods orders was noticeably worse than forecasts.

On the other hand, the rate reduction has already been taken into account by the market, so the dollar as a whole is trading neutrally. Volatility, in turn, will remain reduced until the publication of the results of the meeting and the press conference of J. Powell.

NZD/USD

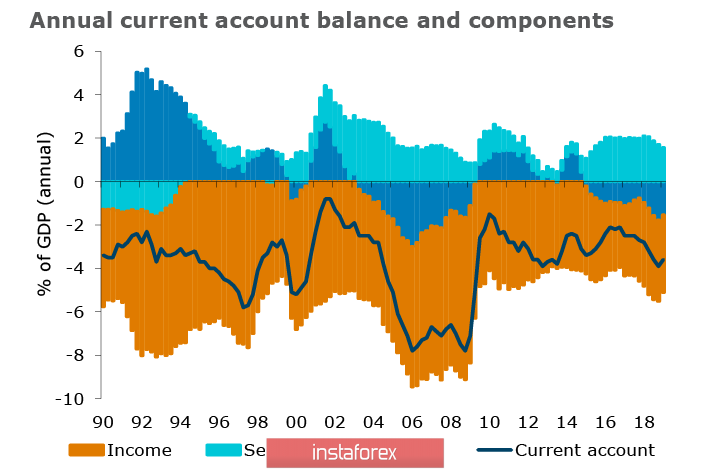

The growth of the Kiwi has stopped and the rollback is associated with a loss of risk appetite. The main reason is another increase in uncertainty on the trade agreement between the USA and China, and another delay in Brexit brought its share of the negative. As for internal economic factors, they can be characterized in one word - "stability". The foreign trade report came out in line with expectations. The current account deficit is kept within acceptable limits and has no upward trend, despite the growing deficit in trade in goods.

The main risk factors include a record level of household debt, which potentially threatens the sustainability of demand and the services sector, but in general, the situation is no worse than the G10 countries. Risk factors also include a slowdown in GDP growth, which will undoubtedly affect the labor market, that is, unemployment may resume its growth in the very near future.

Moreover, Banks active in New Zealand hold close views on the upcoming actions of the RBNZ and expect three rate cuts in November, February and May, after which the key rate will decline to 0.25%. These steps will revitalize the economy and at the same time reduce the risk of strengthening the Kiwi.

Before tomorrow's meeting of the Fed, volatility will decline, while the Kiwi will remain neutral with a slight margin of negativity. The probability of leaving below 0.6333 is high, but the chances of a decline to the support of 0.6290 / 6300 are noticeably weaker. Resistance is 0.6400 / 10. With attempts to grow, you can sell with the stated goals.

AUD/USD

There are still no solid reasons for the growth of the Australian economy. A recent PMI report from Commonwealth Bank showed that production has been at lows since April, business confidence has weakened, and hiring has slowed.

There is also a slight increase in activity in the service sector and the volume of new orders declined for the first time in 3.5 years. Companies are cutting back on investment, and consumers are cutting down on spending. Australia is slowing at the same time as global PMIs are declining, but key indicators are still in a growth zone.

Therefore, the Australian currency will remain in a wide range of 0.6808 - 0.6882 in the next day. The direction of exit from which will depend entirely on the outcome of the Fed meeting and on what kind of shade the comments will take. There are no internal drivers and the Australian currency is unlikely to resume decline, as indicated by the positive CFTC report on the dynamics of operations with the Australian currency.