To open long positions on EURUSD, you need:

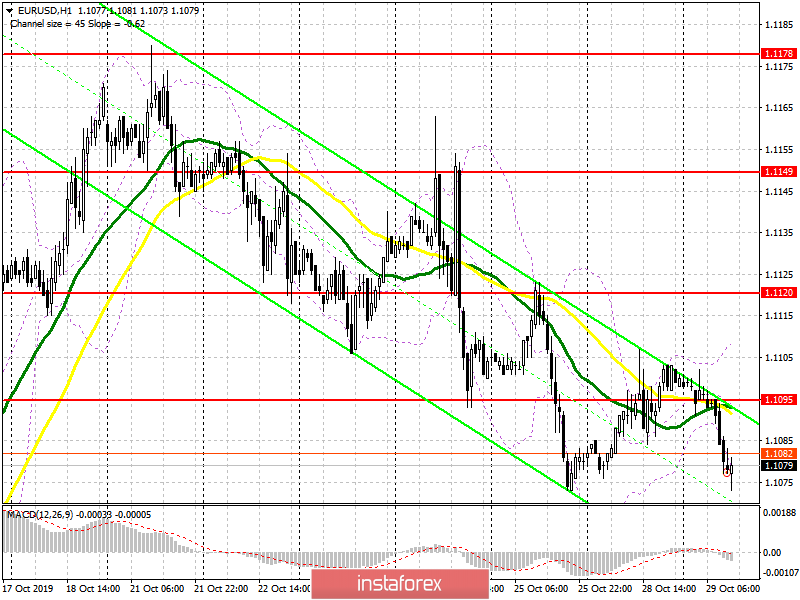

Sellers continue to push the euro down, and activity from buyers is not visible. The focus is shifted to tomorrow's Fed meeting, at which the leadership can take a "technical pause" in lowering interest rates, which will further support the US dollar. From a technical point of view, nothing has changed. At the moment, the task of buyers is to return to the level of 1.1095, and only under this condition can we expect a larger upward correction in the area of the highs of 1.1120 and 1.1149, where I recommend taking the profits. If the pressure on the euro continues, and this may happen after good data on consumer confidence in the US, it is best to consider new long positions after a false breakdown in the support area of 1.1066 or buy for a rebound from the minimum of 1.1026.

To open short positions on EURUSD, you need:

Sellers coped with the task for the first half of the day and returned the pair under the resistance of 1.1095. At the moment, while trading is below this level, the pressure on the EUR/USD will continue, and the data on the consumer confidence index may lead to an even greater sell-off with the update of the weekly low of 1.1066. However, the main target of the bears remains support in the area of 1.1026 and 1.0994, where I recommend taking the profits. If the bulls regain the resistance of 1.1095, it is best to return to short positions to rebound from the highs of 1.1120 and 1.1149. An unsuccessful consolidation above 1.1095 will be an additional sell signal.

Indicator signals:

Moving Averages

Trading is conducted below 30 and 50 moving averages, which indicates the predominance of sellers in the market.

Bollinger Bands

The upper limit of the indicator in the area of 1.1110 acts as a resistance.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20