To open long positions on GBP/USD, you need:

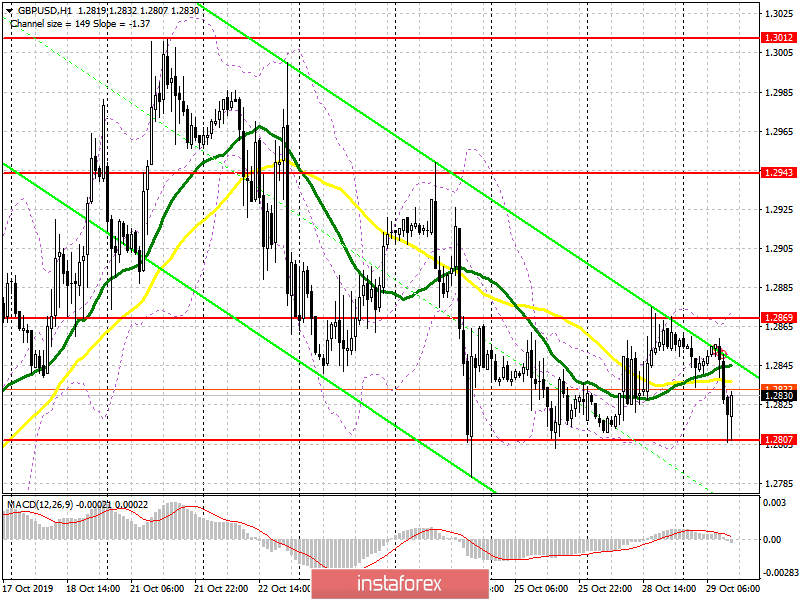

From a technical point of view, nothing has changed compared to the morning forecast. The pound fell to a major support level of 1.2807 after the release of data on UK consumer credit growth, which declined. However, the bulls managed to hold this area, which led to renewed demand for the pair. The main task of buyers is to return to the resistance of 1.2870 and its breakdown, which will be a signal for an additional opening of long positions capable of updating the highs of 1.2943 and 1.3012, where I recommend taking the profits. If the pressure on the pound returns in the second half of the day, only the next formation of a false breakdown in the support area of 1.2807 will be a signal to open long positions. Otherwise, it is best to buy GBP/USD on a rebound from the low of 1.2735 or even lower, in the area of 1.2664.

To open short positions on GBP/USD, you need:

Bears successfully returned to the support of 1.2807, but once again failed to break below this level after the news that the Labor Party is ready to support the general election in the UK, the date of which will be December 11, 2019. Only the breakthrough of the minimum of 1.2807 will increase the pressure on the pound, which will collapse it to the support area of 1.2735 and 1.2664, where I recommend taking the profits. However, the primary goal of the bears now remains to keep the pair below the resistance of 1.2870, which the bulls will try to regain in the second half of the day. In the case of a breakthrough in this range, it is best to consider short positions in GBP/USD from larger highs around 1.2943 and 1.3012.

Indicator signals:

Moving Averages

Trading is conducted around 30 and 50 daily averages, which indicates the lateral nature of the market.

Bollinger Bands

A break of the upper border of the indicator in the area of 1.2870 will lead to a new wave of growth for the pair.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20