4-hour timeframe

Technical data:

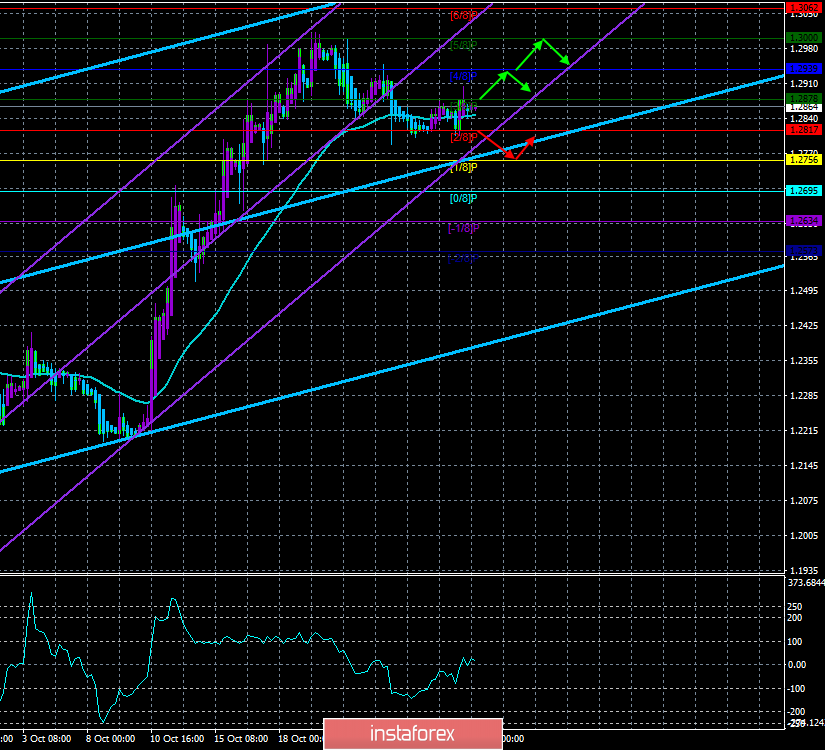

The upper channel of linear regression: direction – up.

The lower channel of linear regression: direction – up.

The moving average (20; smoothed) – sideways.

CCI: 13.6306

The British currency has stopped responding to any events relating to Brexit. If earlier any message, even not too important, could lead to the collapse of the pound, and any rumor or unconfirmed news to send the pound to 100-200 points up, now it seems that traders are tired of working out the information, which has no practical value. Market participants have been trading the pound/dollar pair for three years, trying to guess how Brexit will end, what the UK will expect after Brexit, what terms of the agreement will be between London and Brussels, and so on. But in fact, Great Britain remains in the European Union, Parliament can not agree on an exit with a "deal", or an exit without a "deal" and the whole process is stuck in a swamp. Only every three months is the Brexit date extended.

The holding of early parliamentary elections is another attempt by the British government and the opposition to get the country out of the political crisis, and Brexit out of the "dead-end". The two most anticipated outcomes of this election are:

1) The positions of conservatives are improving, and this is significant.

2) The positions of conservatives remain unchanged or worsen.

With the first option, Brexit can be considered officially completed, since Boris Johnson will receive a full carte blanche and the opposition will not be able to stop him unless the Conservative Party loses all its allies out of the blue, which will go to the support of the Laborites. If the conservatives do not improve their positions, then the battle for Brexit will continue, and no one will predict how long it will last. We said yesterday that Labor may try to make changes to the electoral process to attract additional votes for themselves among categories of the population that Brexit does not support. Conservatives will count on the fact that most of the British people are tired of living in limbo and they will vote for the party of Boris Johnson. According to the ratings of the two main parties of the Kingdom at the moment, conservatives lead by a margin of about 10%. However, this gap does not mean anything. Any sociological studies and surveys are conducted on 2-3 thousand people and cannot reflect real numbers. Moreover, all 650 deputies in the House of Commons are elected in single-mandate constituencies. That is, the party's rating has nothing to do with how many districts the conservatives will win. For example, in 2015, the Conservatives gathered 37% of the vote but received 330 seats (out of 650) in the Lower House, which gave them an absolute majority, which Boris Johnson will now seek.

Thus, the minimum task for Boris Johnson is to collect at least 320 seats. 5-10 votes on any bill can be obtained at the expense of allied parties and deputies. Ideally, more than 325. Then the conservatives will have an absolute majority and will be able to accept any proposal by Boris Johnson, without paying any attention to the Labor. So now it all comes down to December 12, and until that day the pound, like the rest of the UK, will remain in limbo. Today's meeting of the Fed should have an impact on the pound/dollar pair, which in recent days has frankly become quiet.

The technical picture of the pair implies at the moment the resumption of the upward trend, but the volatility in recent days has decreased sharply, the trend movement has gone to "no", and the results of the Fed meeting and Powell's speech cannot be predicted by anyone. Thus, in the evening, the pair can turn in any direction and get a new impulse to move by 200-300 points.

Nearest support levels:

S1 – 1.2817

S2 – 1.2756

S3 – 1.2695

Nearest resistance levels:

R1 – 1.2878

R2 – 1.2939

R3 – 1.3000

Trading recommendations:

The GBP/USD currency pair continues to move sideways amid the lack of macroeconomic statistics. Thus, traders are now advised to wait for the consolidation below the Murray level of "2/8" to be able to re-consider short positions. Or fixing above the Murray level of "3/8" to become relevant purchases of the British currency with targets of 1.2939 and 1.3000. At the same time, the volatility of the pair remains reduced, which should be taken into account when opening any positions.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustrations:

The upper channel of linear regression – the blue line of the unidirectional movement.

The lower channel of linear regression – the purple line of the unidirectional movement.

CCI – the blue line in the regression window of the indicator.

The moving average (20; smoothed) – the blue line on the price chart.

Support and resistance – red horizontal lines.

Heiken Ashi – an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.