Today, the focus of the markets is the Fed's final monetary policy decision. This event is estimated by investors as important and largely determining the dynamics of markets in the near future.

It is assumed, according to the dynamics of futures on rates on federal funds, that the US regulator will lower its key interest rate by 0.25% to the range of 1.50-1.75% today. This event is rated with a probability of 97.8%.

However, the fact of the decision to lower the cost of borrowing will not be important if, of course, the bank suddenly refuses to do so, but its further plans for interest rates and monetary policy in general. In addition, there is an opinion that by lowering the rates, the regulator in the person of its leader J. Powell will make it clear that he will pause in order to evaluate the actions taken earlier and today on the national economy in a certain time period. This will be an important decision, since the very fact of lowering rates has already been taken into account in quotations and it is unlikely that there will be any noticeable reaction to this. But the decision that the Fed will stop the process of reducing rates will, as it seems to us, be vigorously accepted by the markets.

If such a scenario is implemented, then a local dollar rate reversal on global markets should be expected, which is believed to receive support. Earlier, we also covered another reason for a pause in lowering interest rates - this is a high probability of a new trade agreement between the United States and China at the APEC summit in Chile on November 16-17. It can be recalled that it was the declaration of a trade war between Washington and Beijing that became the catalyst for slowing down the growth of the American economy and in many ways, the reason was not only for the fed to stop raising interest rates this year, as it planned, but also to begin their smooth decline.

We believe that the achievement of a trade agreement may be the reason for stopping the reduction of rates, which means that the proposed cycle of easing monetary policy will be stopped. This will become the basis for the growth of a fall in negative sentiment in the markets, a decline in the demand for protective assets and, vice versa, its strengthening for risky ones. In this situation, we expect a further decline in gold prices and an appreciation of the US dollar.

It can be recalled that we can only expect this scenario if the Fed decides to stop reducing the cost of borrowing.

Forecast of the day:

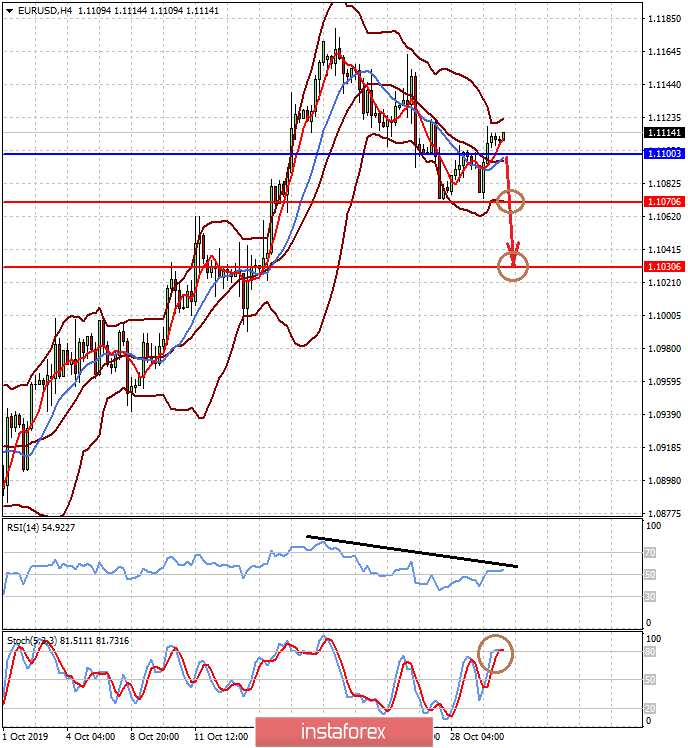

EUR/USD is trading above 1.1100 in anticipation of the Fed's final monetary policy decision. If the price drops below the level of 1.1100, it is likely that its price will continue first to 1.1070, and then to 1.1030.

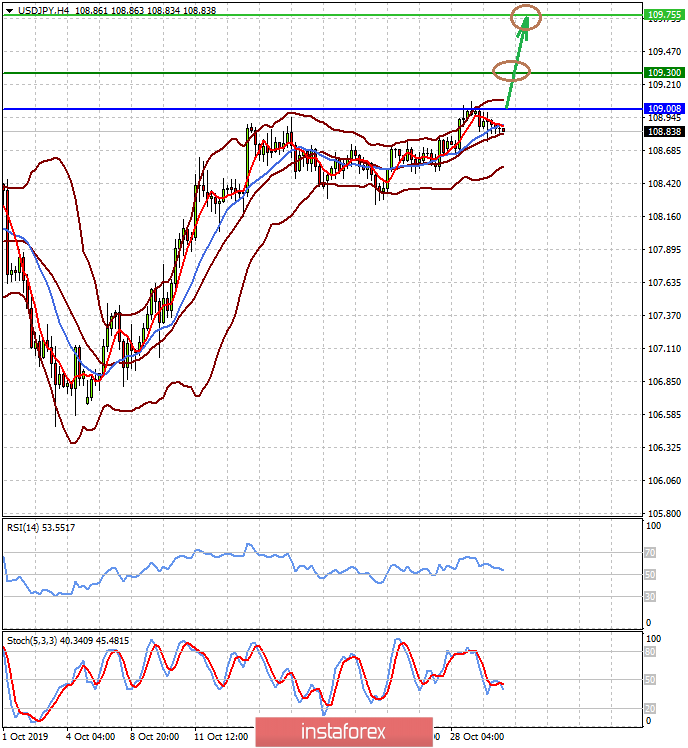

USD/JPY is trading below 109.00. Positive news for the dollar, namely the decision to stop the further reduction in rates, will lead to an increase in prices to 109.30 and 109.75 after breaking the level of 109.00.