The long-awaited day has come. With all confidence, we can say that you will not be bored today. And the matter is not only in the meeting of the Federal Committee for Operations on the Open Market, but the results of which will be known late in the evening. After all, before that, preliminary data on the United States GDP for the third quarter will be published. However, all this news can contribute to an almost panic weakening of the dollar. But first things first.

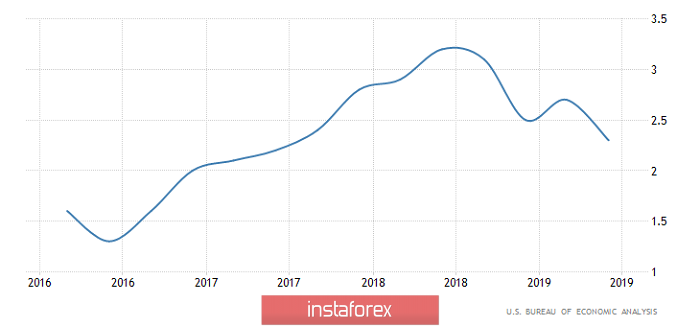

Recently, many tears have been expressed regarding the approach of a recession in the US economy, and today's data on GDP for the third quarter may contribute to the growth of another hysteria in this regard. The fact is that the first estimate of GDP for the third quarter may show a further slowdown in economic growth. It is forecasted that GDP growth rates, for the first time since 2016, will fall below 2.0%. Naturally, this will be perceived solely as another proof that the recession is inevitably approaching, and urgent measures are needed to somehow rectify the situation.

GDP (United States):

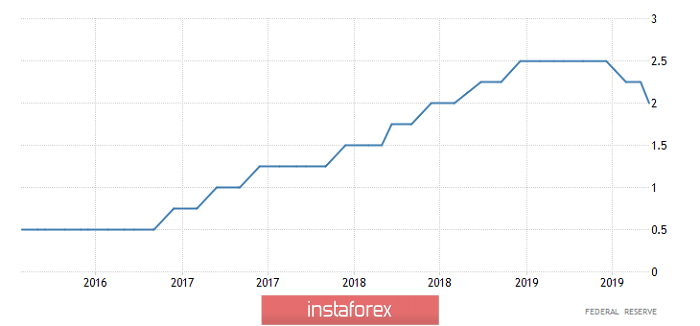

It is generally accepted that only the Federal Reserve System has the opportunity to avert the threat and prevent the onset of a recession. At the same time, the only instrument considered is the refinancing rate, which must be reduced to avoid a recession. Thus, it is not surprising that for several months in a row, the Federal Reserve System has been under serious information pressure when all kinds of media almost on a daily basis relay calls of commercial banks and other financial institutions to actively mitigate the parameters of monetary politicians. And it works, because it is precisely this pressure that has caused the recent reduction in the refinancing rate from 2.25% to 2.00%. However, Jerome Powell stated that the Federal Reserve does not see any signs of an approaching recession. Thus, making it clear that there will be no more exemptions. In addition, there are practically no one doubts that the refinancing rate will be reduced once again today. This time from 2.00% to 1.75%. Such a rapid easing of the parameters of monetary policy will finally convince everyone that there will be a recession, and the Federal Reserve is simply trying to calm everyone down, saying that it does not see signs of its approaching. So do not be surprised if the dollar comes under pressure today.

Fed Refinancing Rate (United States):

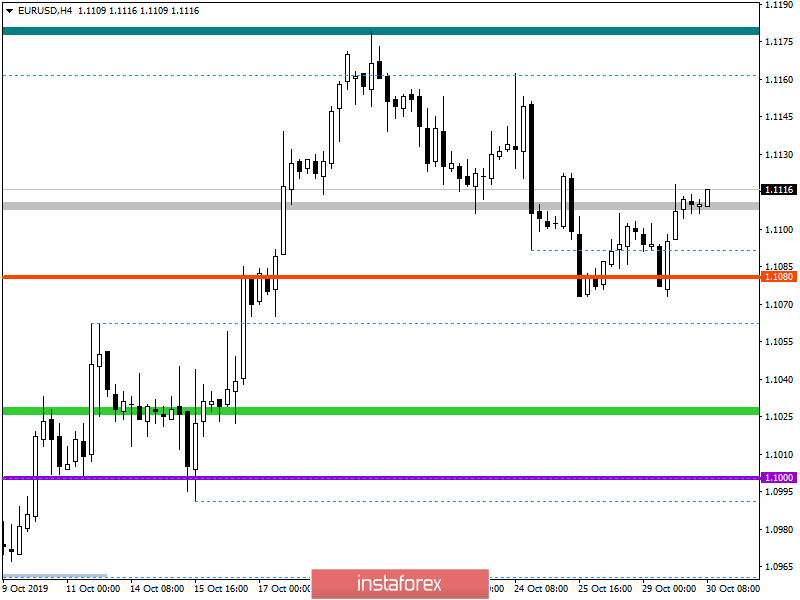

The EUR / USD pair naturally finds a foothold in the face of the level of 1.1080, where the same point is being worked out for the second time in a row. In fact, we see an attempt to restore the initial movement, but the mood set on an inertial course does not allow us to fully return short positions to the market, as a result of low-volatility fluctuations, with a drop of ambiguity. In terms of a general review of the trading chart, we see an attempt to restore a relatively oblong correction, but so far, the success has led us to the first degree [1,1080] only, which is not yet a complete move. Thus, another scrapping of short positions is still possible, in terms of pulling quotes into a long side channel, relative to key coordinates.

It is likely to assume that if the price is fixed higher than 1.1125, the existing fluctuation within the level of 1.1080 will stop attracting the quotation locally and we will return to the previously formed peaks of 1.1050 / 1.11080 again.

Concretizing all of the above into trading signals:

- We consider long positions, in the case of price fixing higher than 1.1125, with the prospect of a move to 1.1050 / 1.11080.

- We consider short positions, only in terms of a full-fledged move, thereby fixing the price is necessary lower than 1.1170.

From the point of view of a comprehensive indicator analysis, we see that the indicators relative to all the main time intervals have taken an upward position, which reflects the current market interest in some way.