Yesterday is extremely difficult to call even a light workout before today. At least since it was much less eventful than what awaits us today. The data itself was not so important. So it is not surprising that at the end of the day both the single European currency and the pound, in fact, remained virtually unchanged. Another thing is that market participants clearly wanted to warm up at least a little, which was reflected in the fluctuations of quotes up and down.

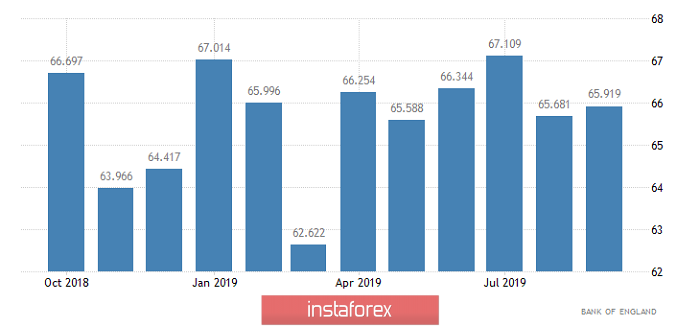

The reason for such fluctuations was various macroeconomic data, which, as usual, did not turn out as expected. In particular, Nationwide data were supposed to show the constant growth in housing prices, but in fact they showed an acceleration from 0.2% to 0.4%. But before everyone could rejoice at such wonderful news, the data on consumer lending came out, showing that in September its volume amounted to 828 million pounds against 969 million pounds in August. There is a clear decline in consumer lending, which should have a negative impact on consumer activity. However, there are improvements in the lending market regarding a rather important segment of the UK economy. The fact is that the number of approved mortgage applications has increased from 65,681 to 65,919. But it should be noted that the approved application does not mean that borrowers will take advantage of this opportunity. After all, banks can approve the application, but at a rate that does not suit the potential borrower. So these same approved applications will not necessarily turn into loans already issued.

Number of approved mortgage applications (UK):

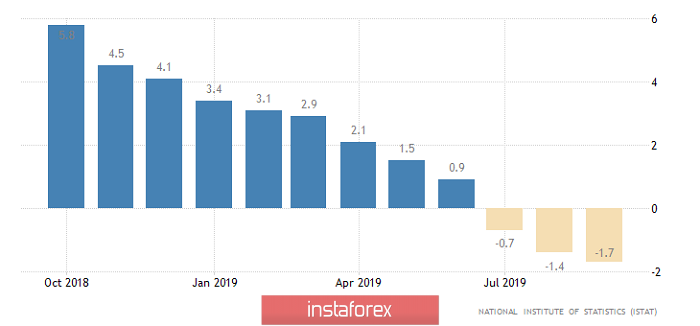

Meanwhile, the continent was not bored either. For example, Spain was happy because the growth rate of retail sales did not remain unchanged, but instead it accelerated from 3.3% to 3.4%. But on the neighboring peninsula, a little thoughtful, as producer prices in Italy continue to decline. The rates of their decline intensified from -1.4% to -1.7%. At the same time, data from Italy have a slightly greater weight, since this is the third economy of the euro area, while Spain is only the fourth. Nevertheless, data on retail sales give hope that inflation in Europe may grow even a little. That's just the steady dynamics of producer prices in Italy causes considerable concern.

Producer Prices (Italy):

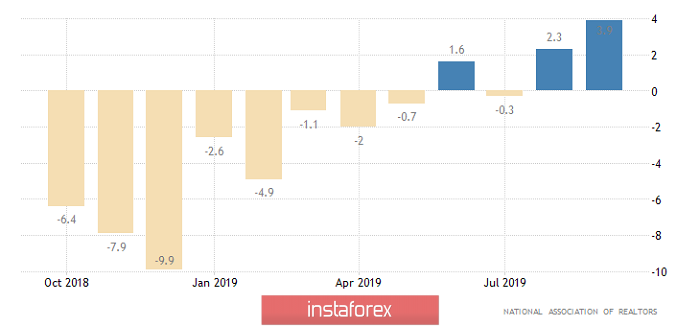

Macroeconomic statistics in the United States generally turned out to be completely different than expected. It was expected that the S&P/CaseShiller data will show an acceleration in the growth rate of housing prices from 2.0% to 2.1%, but they turned out to be unchanged. But the data on unfinished housing sales transactions was pleasing, the growth rate of which increased from 2.5% to 3.9%, instead of falling to 1.4%. This indicates a high growth potential of activity in the real estate market over the next month.

Pending Home Sales (United States):

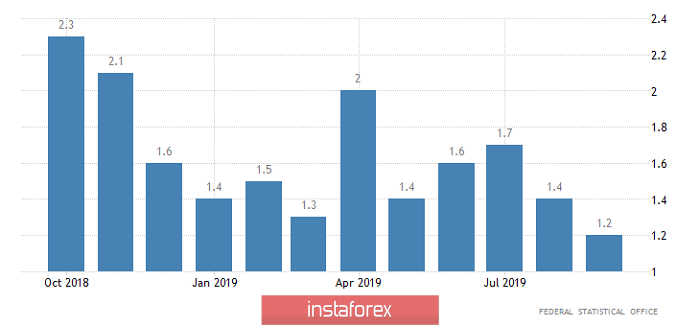

Today, a whole bunch of macroeconomic data was expected, as well as the results of the meeting of the Federal Open Market Committee. The only thing today is no news from the UK. At least economic in nature. British politicians can throw out another trick with Brexit and again turn everything upside down. However, this process is completely unpredictable, so we will proceed from what we have. Meanwhile, Spain has already released inflation data, the nature of which coincided with yesterday's data on retail sales, and the price growth rate remained unchanged. Its slowdown was predicted from 0.1% to 0.0%. The unemployment rate in Germany remained unchanged, which, of course, is more important than inflation in Spain. However, much more important is what happens to inflation in Germany itself, where, as expected, it can slow down from 1.2% to 1.1%. This will definitely be an extremely negative factor.

Inflation (Germany):

Nevertheless, all this pales against the backdrop of what will happen in the United States today. And it's not only about the FOMC meeting, since before the announcement of its results there is still a lot of interesting things. It all starts with ADP data on employment, which should increase by 120 thousand against 135 thousand in the previous month. That is, there is a slowdown in employment growth, which frightens many market participants ahead of the publication of a report by the United States Department of Labor. But the bad news is just beginning, as the first estimate of GDP for the third quarter may show a further slowdown in economic growth. Moreover, for the first time since 2016, growth rates may drop below 2.0%, which will convince even more that the recession is about to begin in the US economy. Well, the results of the meeting of the FOMC meeting will finally finish off the dollar, because almost certainly the refinancing rate will be reduced from 2.00% to 1.75%. It is worth noting that the last time Jerome Powell convinced everyone that the Federal Reserve did not see any signs of an approaching recession. Although the refinancing rate is still reduced. It turns out that, reassuring everyone that there is no threat to economic growth, the Fed reduces the refinancing rate for two consecutive meetings. After this, no words of the Fed representatives will matter, since market participants will be certain that the regulator is only trying to calm everyone down to prevent panic. Since the recession is not just inevitable, it is already beginning, and its scale will be simply terrifying. After all, it is rather difficult to explain such a rapid easing of monetary policy parameters with something else. Unless you agree with the statement that this is the weakness of the Fed against the pressure exerted on it by the financial sector.

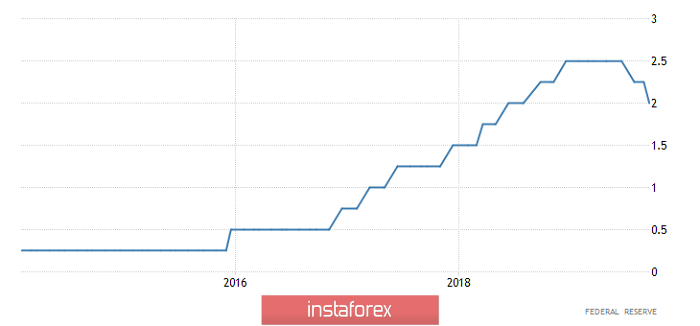

Refinancing Rate (United States):

I must admit that amid the news that will come from the United States, the level of inflation in Germany is not at all interesting to anyone. At least today. So no matter how much it falls there today, the single European currency will still grow, and the reference point is 1.1175. Although rather this is the first stop for a smoke break.

British politicians will have to throw out a really extravagant distraction to change this attitude. But one gets the feeling that they are still trying to figure out the mess that they have brewed themselves. So do not wait for the intervention of the British political class. Consequently, the pound has good chances to grow to 1.3000.